Cigar Shop Business Insurance

Getting insurance for your cigar shop is essential.

It’s important for cigar shops to have safeguards in place against potential operational risks that may result in financial losses or liability. Such risks may include property damage, financial loss, and potential third-party claims of negligence.

For example, burglars may damage fixtures and fittings in your business premises. Having insurance means you will be reimbursed for the cost of repairs or replacement.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Cigar Shop Business

General liability insurance is — generally speaking — one of the most important insurance policies for cigar shops.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance will protect your cigar shop from a wide range of risks, there are insurance policies especially designed for specific risks. Such policies are generally more cost effective than general liability insurance, since they assess the specific risk directly rather than apply an average risk rate. Such specialized policies include:

- Commercial property coverage: Insurance of this sort will provide funds to repair or replace damaged property, such as fixtures and fittings. Numerous causes of damage, including fire, flood, and burglary, are typically covered.

- Commercial auto insurance: May be of two kinds: collision policies and comprehensive policies. The former covers physical damage to individuals, including medical expenses and damage to property. The latter covers the risks covered in a collision policy, but also vehicle damage not caused by collision.

- Business income coverage: This policy will remunerate a business for loss of income resulting from an adverse event, such as a fire, which interrupts operations, as well as cover regular operating expenses, like wages, that must continue to be paid.

Today’s insurance market is made up of two types of insurer:

- Traditional brick and mortar insurers: These veterans of the insurance industry include insurers such as AIG, CNA Financial, and Colonial Life & Accident Insurance Company. They tend to rely on the vast amount of data they have collected over decades of operation to measure risk.

- Online insurers: These insurers, such as Ergo Next, employ digital technologies and vast amounts of current data to measure risk, reduce costs and improve delivery of their services. These insurtechs, as they are known, have taken the lead from their traditional counterparts in providing insurance services.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

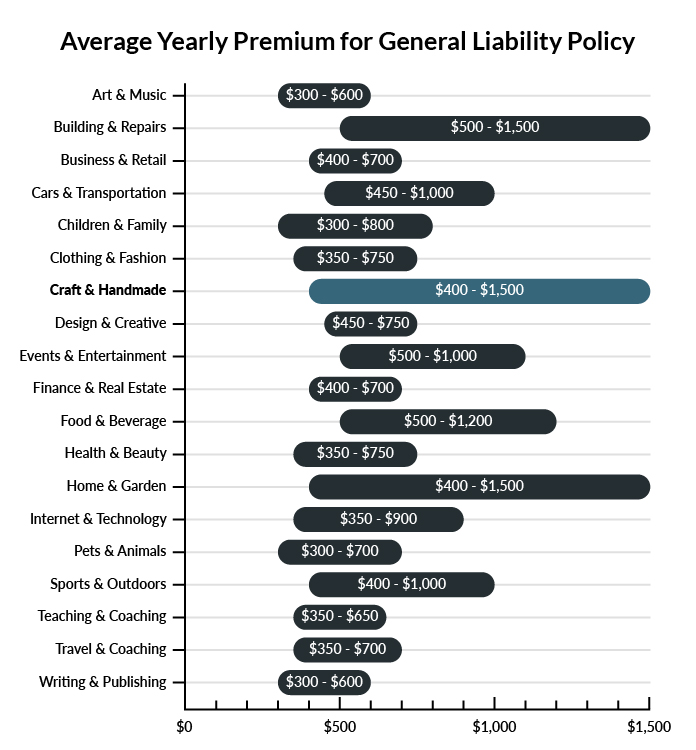

The average cigar shop in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a cigar shop business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Cigar Shop Business

Example 1: A customer walks into the restroom of your cigar shop and slips and falls on the tile floor, sustaining a broken arm. He wants your business to pay for his medical care to treat the injuries. Your general liability insurance policy will likely help you cover the cost of paying for medical treatment when a customer is injured at your business.

Example 2: One of your cigar shop employees is carrying a stack of boxes and is unable to see past the boxes without stretching his head around the stack. He quickly rounds a corner and runs into a customer. The impact knocks the customer over and he hits his head on the floor, sustaining a concussion. The customer files a lawsuit against your business, demanding damages. Your general liability insurance policy will pay for the cost of defending your business, including the cost of an attorney and any settlement you may wind up paying.

Example 3: A visitor to your cigar shop is walking across the parking lot when she slips on some ice and sustains serious injuries. Your general liability insurance will likely help to pay for treating her injuries. It will also pay for any legal costs if the visitor decides to take legal action.

Other Types of Coverage Cigar Shop Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Product Liability Insurance

As a seller of products, there is always the risk that one of your customers could file a lawsuit against your business claiming that one of your products caused him or her injury. For instance, if a lighter explodes in the face of a customer, he may decide that your business is responsible for his injuries. A product liability insurance policy will pay for your legal fees if you need to defend your business in court. It will also pay for any payouts or settlements in you settle the case out of court.

Commercial Property Insurance

In the event of a fire or other catastrophic event, your cigar and smoking supplies inventory could be destroyed. Replacing your inventory on your own could be costly, and it may not even be possible depending on its value. A commercial property insurance policy will cover the costs of replacing your inventory. That means you can purchase new stock and start selling cigars again, bringing in much-needed income.

Workers’ Compensation Insurance

The majority of states require businesses to carry workers’ comp insurance when they have employees. Workers’ comp insurance is a good idea for your business for a variety of reasons. If one of your employees is injured while performing a task related to his or her job, then workers’ comp insurance will pay for medical treatment. The policy will also help to cover the lost wages of the employee while he or she recovers.

Commercial Umbrella Insurance

There is always the possibility that the limits of your general liability insurance will be exceeded. This can happen if your company loses a serious lawsuit and is required to pay extensive damages. If your general liability insurance policy limits are exceeded, then you will be forced to pay the remaining amount yourself—unless you have commercial umbrella insurance. An umbrella policy will pick up where the general liability insurance leaves off.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your cigar shop business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Cigar Shop Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

It is crucial to purchase business insurance prior to opening your shop. Failing to obtain coverage from the very beginning can pose a significant threat to your business, not just from unforeseen dangers, but also from potential legal violations.

Certain types of insurance, such as workers’ compensation and commercial auto insurance, are mandatory by law. In addition, your business may require insurance coverage to guard against specific risks, such as property damage and customer injuries.

Not necessarily. Certain exceptions may be written directly into your cigar shop business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.