Day Spa Business Insurance

Getting insurance for your day spa is essential.

It is imperative that day spas be protected from the many perils that are part-and-parcel of doing business. That’s why they need insurance. Insurance can shield the business from damage to property, as well as cover it for liability for bodily injury or financial loss.

For example, a visitor to your spa may allege she was injured by the negligent actions of a massage therapist and sues. Fortunately, there is insurance that offers protection from such an occurrence.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Day Spa

General liability insurance is — generally speaking — one of the most important insurance policies for day spas.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance provides coverage for numerous risks, it may not be sufficient to cover all the risks that your business faces. To address these additional risks, special policies such as those that offer specific protections may be necessary:

- Commercial property coverage: A policy of this type could cover damage to any property you own, such as equipment and furniture, as well as the business premises, even if you are renting.

- Commercial auto insurance: Coverage may include the risk of damage through collision or comprehensive coverage that protects against both collision and non-collision risks, such as a rock smashing your vehicle windshield.

- Business income coverage: Business interruption insurance will help an owner recoup losses incurred from having had to close the business because of a natural disaster. This insurance will also be available to cover man made calamities that cause you to close shop.

Two types of insurers are currently available to businesses:

- Traditional brick and mortar insurers: Traditional insurers have greater market share; they still dominate the market, but their costs are generally higher than online insurers.

- Online insurers: Insurtechs, such as Cover Genius and Ergo Next, are rapidly gaining ground. Insurtechs are able to attract younger customers who prefer digital experiences, and they are disrupting the traditional insurance market and taking market share away from the veterans by offering fine tuned policies and lower premiums.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

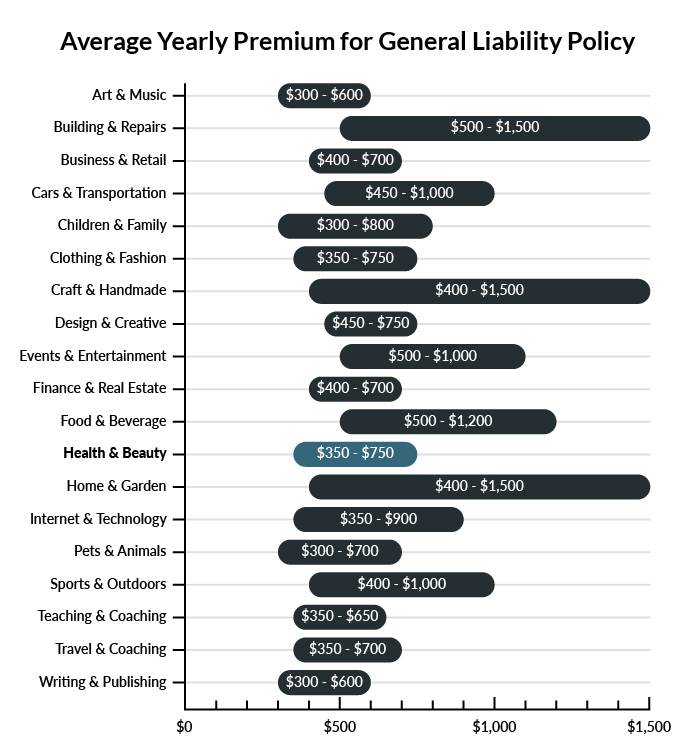

On average, day spas in America spend between $350 – $750 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a day spa to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Day Spa

Example 1: A customer is complaining of abnormal irritation and splotching from sun exposure following a spa skin treatment. A general liability policy should cover any medical expenses or litigation.

Example 2: During a hair coloring appointment, the customer suffers chemical burns from one of the products. Your general liability insurance should provide coverage for medical bills and/or legal fees.

Example 3: A customer is threatening a lawsuit after complaining of intense pain and discomfort following a massage visit. General liability insurance will cover costs incurred because of the suit as well as the customer’s medical expenses.

Other Types of Coverage Day Spas Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional liability insurance

Day spas offer a variety of services, requiring skilled technicians to treat customers based on their individual needs. Professional liability insurance, also known as Errors & Omissions (E&O), is designed to protect professionals against liability claims. If a customer doesn’t receive the desired outcome or promised results, this may trigger a covered professional liability claim.

Workers’ Compensation Insurance

Your state will likely require the business to carry workers’ compensation for each employee. It covers work-related accidents and illnesses, along with resulting medical bills, lost wages, and any resulting settlements.

Workers’ compensation is purchased as a standalone policy.

Commercial Property Insurance

In addition to the extensive investment day spas make in equipment, furnishings, and tools, most facilities require extensive build-outs to get them up to code. A commercial property insurance policy covers this investment in the event of a covered loss.

Commercial property insurance is generally purchased as part of a business owner’s policy (BOP).

Business Interruption Insurance

Many BOPs offer business interruption insurance as part of the insurance package. If the business suffers a major loss in an event such as a fire, business interruption insurance will help cover lost revenue while you rebuild. In addition to making up a percentage of lost profits, it can cover fixed costs and additional expenses incurred when/if the business operates at a temporary location.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your day spa:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Day Spa Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Acquiring business insurance prior to starting your business is crucial. Failing to have coverage from the onset may not only expose your business to unforeseen hazards, but it could also lead to legal infringements.

Certain forms of insurance, such as commercial auto insurance and workers’ compensation, are mandatory by law. Additionally, your business may necessitate insurance to safeguard against specific risks such as property damage and personal injury to customers.

Not necessarily. Certain exceptions may be written directly into your day spa insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.