Daycare Business Insurance

Getting insurance for your daycare business is essential.

To ensure the safety and success of daycare businesses, it is essential to protect them from the inherent risks of their operations, for which purpose insurance is crucial. By obtaining insurance, daycare businesses can prevent themselves from property damage and protect against liability for bodily injury or pecuniary loss.

For example, a parent may sue your daycare business alleging negligence in the care of her child. If such an unhappy event occurred, rest assured there is insurance to cover the issue.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Daycare Business

General liability insurance is — generally speaking — one of the most important insurance policies for daycare businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Regardless, your daycare business may also need protection from other risks. Three common risks that many daycare businesses are exposed to and the policies that cover them are:

- Commercial property coverage: Will reimburse you for the cost of replacing damaged property, which could be anything from playground equipment to stolen supplies.

- Commercial auto insurance: This is a legal requirement that makes good sense. Auto insurance makes sure that funds are available for repairs and for providing compensation to accident victims.

- Business income coverage: This is coverage that reimburses you for loss of income that results from an interruption of business. If, for example, your business has to shut up shop for a while because some adverse event, such as the closure of the road that leads to your establishment, has occurred the insurer will cover the loss of income sustained.

Companies providing insurance services fall into two brackets: traditional insurers and online insurers:

- Traditional brick and mortar insurers: These providers may not be as quickly responsive as their more modern counterparts, since their methods have not have changed to take advantage of the latest technologies. This can result in higher premiums and policies that are less geared to specific businesses.

- Online insurers: Insurtechs, like Clearcover and Ergo Next, can often provide quotes and coverage much more quickly and at a lower cost than traditional insurers. This is because they use technology to automate many of the processes that were customarily done manually.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

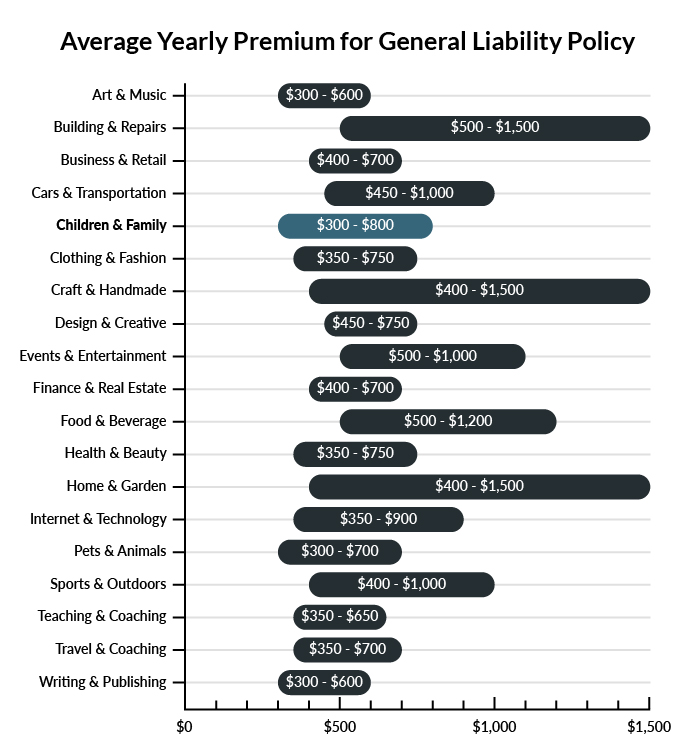

The average daycare in America spends between $300-$800 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a daycare business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Daycare Business

Example 1: After a parent drops their child off at daycare, the child becomes upset and runs into some glass doors with a toy in their hand. The impact causes the glass to shatter and leaves the child cut badly enough to receive stitches. General liability coverage will likely cover any damages involved in a lawsuit.

Example 2: A new family is touring your daycare after hours, and one of the parents slips and falls on the freshly cleaned floors. With general liability insurance, you can protect your business and pay for any damages if you are sued.

Example 3: During outdoor recess, a toddler manages to climb to the top of the jungle gym unnoticed by a caregiver. While playing, they fall from the top of the structure and break an arm. Your general liability insurance will likely cover their associated medical bills and any other damages.

Other Types of Coverage Daycare Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Auto Insurance

Your personal car insurance will not cover any accidents or situations where a work vehicle causes property damage to another car on the road. Commercial auto insurance is necessary for any cars that are used for business purposes.

Workers’ Compensation Insurance

If one of your employees becomes injured or ill on the job, workers’ compensation insurance can help to cover their medical bills and lost wages. This type of insurance is required in most states for any business that employs part-time or full-time workers.

Home-Based Business Insurance

If you operate your daycare from your home, your homeowner’s insurance policy may not cover accidents that are related to your business. This type of policy can be tailored to meet your specific needs and provides an extra layer of protection for your home in the event of an accident or lawsuit.

Commercial Umbrella Liability Insurance

Operating a business involving the care of small children comes with a variety of different risks, and the liability expenses associated with a lawsuit could very well exhaust your primary policy limits. With the help of commercial umbrella liability coverage, you can rest easy knowing you have an extra layer of protection in the event that the damages associated with a lawsuit exceed the limits of your primary policies.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your daycare business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Daycare Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

It is essential to buy business insurance before launching your business. Failure to obtain coverage from the first day can put your enterprise in danger, both from unforeseen events and legal noncompliance.

Legal regulations mandate certain insurance types, like workers’ compensation and commercial auto insurance. Additionally, your business may require other forms of insurance to safeguard against specific risks, like property damage and customer injuries.

Not necessarily. Certain exceptions may be written directly into your daycare business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.