Dog Breeding Business Insurance

Getting insurance for your dog breeding business is essential.

Dog breeding businesses need to be protected against things like claims of negligence, false advertising, and nuisance.

For example, a neighbor may file a nuisance claim against you for the noise of the dogs, or a client may claim that your dogs are not truly purebred.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Dog Breeding Business

General liability insurance is — generally speaking — one of the most important insurance policies for dog breeding businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Alongside general liability, there are several other insurance policies that dog breeding businesses commonly take advantage of to ensure they are adequately protected:

- Commercial property insurance

- Product liability insurance

- Commercial auto insurance

- Home-based business insurance

When considering which vendor to purchase these policies from, it is important to bear in mind the two general categories of insurance providers:

- Traditional brick-and-mortar insurers — Refers to firms that own tangible storefronts and employ insurance agents. Companies such as Nationwide and The Hartford are included in this category.

- Online insurers — Refers to firms that operate mostly online and so do not have storefront or insurance agents. Instead, they use their website and AI to offer highly personalized and reliable insurance to their customers. Companies such as Tivly and Ergo Next are included in this category.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

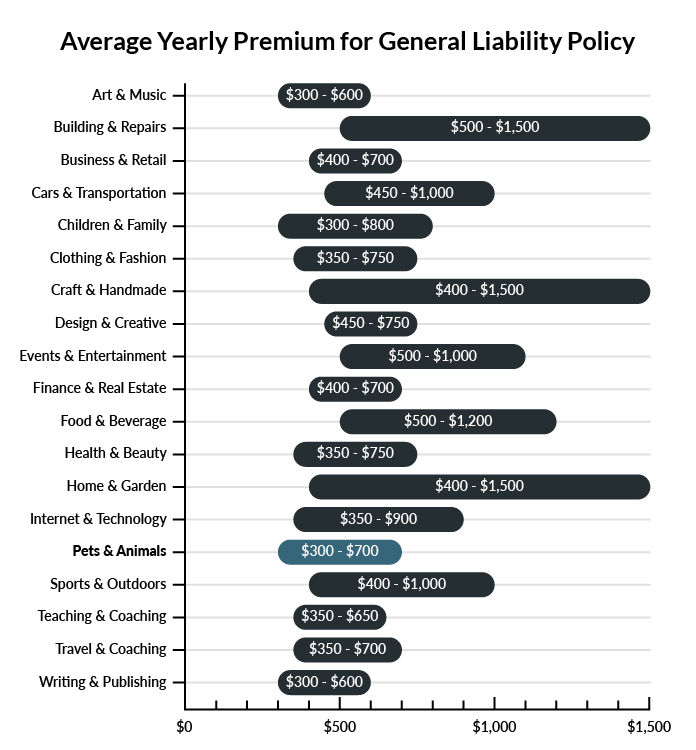

The average dog breeder in America spends between $300-$700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a dog breeding business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Dog Breeding Business

Example 1: A customer comes to meet a new litter of puppies to find the perfect one to take home. She fails to see a hole a dog dug in the yard and steps in it, breaking her ankle. General liability insurance would likely cover the cost of treating the injuries.

Example 2: One of the visitors to your property makes a sudden movement to pet one of your older dogs, startling the dog and leading to a dog bite injury. The visitor decides to take legal action, holding you liable for his injuries. Your general liability insurance policy would pay for the cost of your legal defense as well as any payout or settlement that is reached with the opposing party.

Example 3: The staircase leading down to your breeding area fails while a group of customers is walking down it. Several of them sustain injuries, including broken bones, and require medical care. The general liability insurance policy you carry would likely cover the cost of paying for the treatment of your customers’ injuries.

Other Types of Coverage Dog Breeding Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

Depending on the size of your dog breeding operation, you may have invested a significant amount in your equipment and supplies. Should your business suffer a serious incident, like a fire or a storm, and you were to lose your property, it would be difficult to replace out of pocket. A commercial property insurance policy helps to cover the costs of buying new equipment and supplies so that you can get back to doing business as quickly as possible.

Product Liability Insurance

There is always a risk that one or more of your customers will decide to take legal action against you—such as if a customer takes home a dog and the dog suffers from issues you are unaware of, such as extreme aggression. If the customer sues your business because of the dangerous behavior of the dog you sold, your product liability insurance will pay for your legal costs, including hiring an attorney to protect your interests and paying for a settlement if necessary.

Commercial Auto Insurance

If you have a vehicle, or more than one vehicle, that you use primarily for business purposes, you need a commercial auto insurance policy. Your commercial auto policy works much like your personal auto policy, providing protection against liability should you be involved in an accident. Not only will the policy pay for the repair or replacement costs for your vehicle, but it will also pay for treating your injuries or the injuries of others who were hurt in the accident.

Home-Based Business Insurance

If your dog breeding business is based out of your home, there is a chance that your homeowner’s insurance will not protect you in the event of accidents resulting from business activities. It is important to contact your homeowner’s insurance provider to determine what your current policy does cover in regards to your business. You should be able to get a home-based business insurance policy as part of a business owner’s policy or possibly as an extension to your current homeowner’s insurance policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your dog breeding business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Dog Breeding Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. Given the risks your dog breeding business will be exposed to from day one, obtaining appropriate business insurance prior to commencing operations is essential for its long-term success.

Additionally, depending on your circumstances, your business may be legally obligated to carry specific insurance policies (e.g., commercial auto).

Not necessarily. Certain exceptions may be written directly into your dog breeding business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.