Financial Consulting Firm Business Insurance

Getting insurance for your financial consultancy is essential.

By securing insurance, financial consultancies can fortify themselves against perils and ensure their operations continue without interruption.

For example, a client may initiate legal action against you and your financial consultancy claiming that you negligently represented certain high-risk investments had a low degree of risk. Fortunately, there would be insurance to cover such an eventuality.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Financial Consulting Firm

General liability insurance is — generally speaking — one of the most important insurance policies for financial consultancies.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

However, your financial consultancy may face other hazards that are not covered by a general liability policy. Here are three types of insurance to guard against those adverse occurrences:

- Professional liability insurance: This type of insurance provides protection for allegations of professional negligence or failure to provide proper advice or service. In the event of a lawsuit, legal fees and damages will be covered.

- Cyber liability insurance: As a financial consultancy, you will likely have access to sensitive client information, such as financial records and personal identification data. Cyber liability insurance protects against cyberattacks, data breaches, and other cyber-related incidents that could result in financial loss or damage to your reputation.

- Business income coverage: This type of insurance provides financial protection in case of a significant business interruption, such as a natural disaster or a major power outage. It covers expenses such as lost income, relocation costs, and extra expenses incurred during the recovery period.

Business insurance is presently offered by two types of providers:

- Traditional brick and mortar insurers: Traditional insurers may be more risk-averse and less likely to embrace new methods and technologies. This can lead to higher premiums and reduced customer satisfaction.

- Online insurers: Insurtechs, such as GoHealth and Ergo Next, are generally more innovative than traditional insurers. They are more likely to experiment with new technologies and business models, which can lead to new products and services that benefit customers in several ways, including lower premiums.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

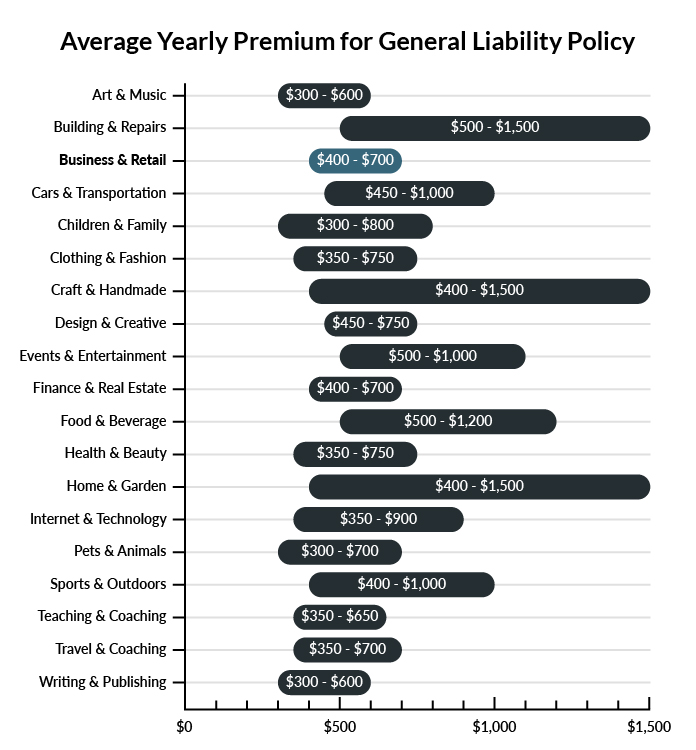

On average, financial consultants in America spend between $400 – $700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a financial consulting firm to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Financial Consulting Firm

Example 1: A client stops into your office for a meeting and trips and falls over a garbage can that was left in the middle of an aisle, breaking his wrist. General liability insurance would likely cover the medical claims of the injury.

Example 2: While advising a client of their financial opportunities, one of your employees makes a mistake while explaining an annuity clause. General liability may be able to help cover the expenses should the client demand compensation for any ensuing losses.

Example 3: A client decides that your marketing campaign is dishonest or otherwise fraudulent. General liability will help cover the cost of fighting this claim in court, as well as pay any potential settlement costs.

Other Types of Coverage Financial Consulting Firms Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

Property insurance covers the physical grounds, the structure of the building, and the contents within. Financial consultants typically have a variety of expensive computer equipment, and this insurance can help cover the cost of replacing or repairing it if it is damaged in a covered event like a fire or storm.

Professional Liability Insurance

Financial consultants have an extremely sensitive job, considering they give advice about a very personal matter. Professional liability insurance is available to help cover legal costs in case a client feels that the advice they were given caused them harm, whether it’s a result of negligence or an unexpected swing.

Commercial Umbrella Insurance

Commercial umbrella insurance for a financial consultant firm may not be mandatory, but it is highly recommended. Umbrella insurance provides the additional financial resources needed to defend yourself against major legal claims when your general liability policy’s limits are reached.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your financial consulting firm:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Financial Consulting Firm Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Most certainly. Setting up a financial consultancy is a complicated affair that involves compliance with state and federal laws. As such, it is imperative to be prepared for the unexpected by having professional liability insurance, for example.

Not necessarily. Certain exceptions may be written directly into your financial consulting firm insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.