Flea Market Business Insurance

Getting insurance for your flea market is essential.

To ensure the safety of flea markets beset by the various risks that come with the territory, obtaining insurance is crucial. With insurance, your flea market can be protected against property damage and also receive liability coverage for bodily injury and monetary loss.

For example, a tenant of your flea market is assaulted by a customer. He blames you for lack of security and sues. You’ll be happy to know that there is insurance to cover such a development.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Flea Market Business

General liability insurance is — generally speaking — one of the most important insurance policies for flea markets.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance can cover a wide range of risks, it may not be adequate to cover all of the potential risks that your flea market may face. In order to ensure comprehensive coverage, it may be necessary to obtain specialized policies that are specifically designed to address these unique risks. These specialized policies may offer additional protection, such as:

- Commercial property coverage: A policy of this type will cover damage to any property you own, such as tents, coverings, counters and other fixtures.

- Commercial auto insurance: This is a legal requirement that makes good sense. It will make certain any vehicles you operate are protected by ensuring that funds are available for repairs and by providing compensation to accident victims, should the need arise.

- Inland Marine Insurance: This is a form of property insurance that covers property not tied to a fixed location and that is not covered by a standard commercial property policy. Despite the name, inland marine insurance has nothing to do with having a boat onshore.

When acquiring your business coverage, you will generally be able to choose between the following two types of insurers:

- Traditional brick and mortar insurers: Traditional insurers, such as Travelers Group, may still rely on paper-based processes and require customers to visit a physical office to file a claim. This can increase premiums.

- Online insurers: Insurtechs, like Lemonade and Ergo Next, operate in a digital environment. This reduces overhead and lends to better policy matches for business owners. They often offer digital claims processing, which makes the process quicker and more efficient. This efficiency and low overhead leads to lower premiums and higher customer satisfaction, on average.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

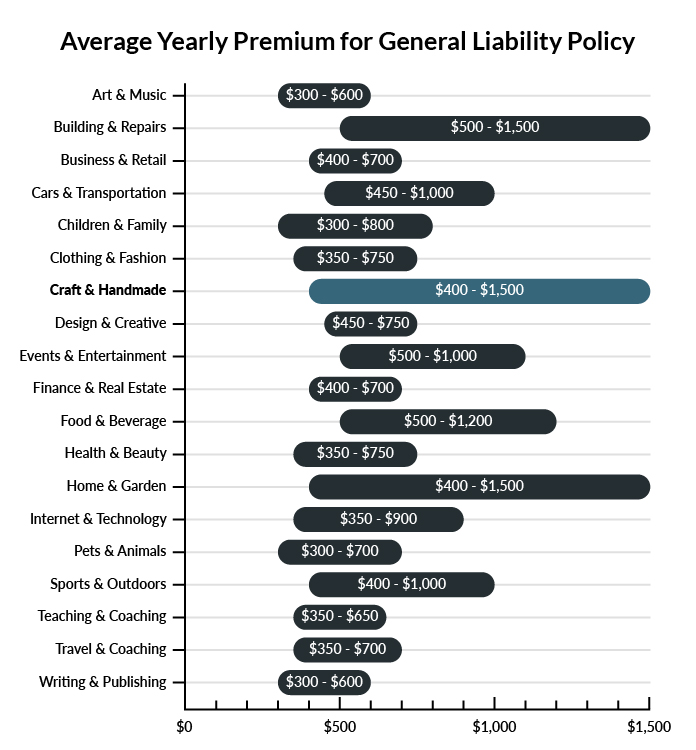

The average flea market in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a flea market business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Flea Market Business

Example 1: The “Wet Floor” sign in a recently mopped bathroom was knocked over by a visitor, so a woman entering the bathroom was not aware of the slippery floors. She slips and falls sustaining injuries, and she later files a lawsuit against you for damages. The general liability insurance policy you have will pay for your legal fees as well as the cost of a settlement if the case is decided out of court.

Example 2: One of your employees is transporting good across the parking lot when he fails to see the car of a flea market visitor. He barrels into the car with the handcart, causing significant damage. The general liability insurance policy you have covers damages to customer property, so you should be able to pay for repairs without needing to dip into your accounts.

Example 3: The advertising for your flea market appears to have caused losses at a nearby business, so they file a lawsuit against you. The fees for your legal defense will be covered by your general liability insurance policy, up to your policy limits.

Other Types of Coverage Flea Market Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

The equipment and supplies you need to keep your flea market running may be damaged by unexpected events such as a fire or storm. The cost of replacing all of your commercial property may be significant. With a commercial property insurance policy, you have coverage that will help to cover these costs. You can get new equipment, supplies, and products with your insurance money so you can start doing business again with minimal downtime.

Workers’ Compensation Insurance

Most states require that employers carry workers’ compensation insurance, although the exact requirements can vary by state. By getting a workers’ comp policy, you can meet your legal obligations as well as ensure that your employees are protected should they become injured due to job-related activities. The policy will pay for medical care to treat such injuries and for lost wages for employees who cannot work due to work-related injuries, up to your policy limits.

Commercial Umbrella Insurance

An umbrella policy is designed to pay for damages and expenses after the limits of your general liability insurance policy are reached. If you do not have an umbrella policy, you will be forced to find another way to pay—but if you do have an umbrella policy, you can rely on it to cover the costs up to the limits of the policy.

Commercial Auto Insurance

A commercial auto insurance policy is necessary for any vehicle that you use primarily for your business. A truck for transporting goods to the flea market, for instance, should have a commercial auto policy. That way, if you or an employee is involved in an accident with the company truck, you will have coverage to pay for medical bills and property damage.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your flea market business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Flea Market Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

It is crucial to purchase business insurance prior to opening your shop. Failing to obtain coverage from the very beginning can pose a significant threat to your business, not just from unfavorable dangers, but also from potential legal violations.

Certain types of insurance, such as workers’ compensation and commercial auto insurance, are required by law. In addition, your business may need insurance coverage to guard against specific risks, such as property damage and customer injuries.

Not necessarily. Certain exceptions may be written directly into your flea market business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.