Flower Shop Business Insurance

Getting insurance for your flower shop is essential.

Flower shops need to be protected against things like claims of breach of contract, personal injury, and property damage.

For example, an employee gets into an accident during a flower delivery, or you accidentally use flowers in a client’s order that they’re knowingly allergic to.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Flower Shop Business

General liability insurance is — generally speaking — one of the most important insurance policies for flower shops.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

As a starting policy, general liability insurance is great. If you want to supplement it with some additional protection, some other useful policies for your flower shop include:

- Commercial property insurance — this covers all of your shop’s equipment and inventory as well as the physical building

- Business interruption insurance — this covers your shop’s losses in the event it needs to close due to something like property damage

- Home-based business insurance — if you run your shop from home, you will need coverage for any property damage or customer injuries that occur there

- Workers’ compensation insurance — this is (typically) required coverage for companies with employees

Deciding which insurance provider to choose for your business may seem like a difficult choice, but it is far simpler when they are divided into two categories:

- Traditional brick-and-mortar insurers

- Online insurers

While traditional insurers (e.g., The Hartford and Nationwide) have been around longer and are trusted establishments, online insurers (e.g., Tivly and Ergo Next) are the better option for small businesses. This is because online insurers offer these businesses access to high-quality insurance for a low price.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

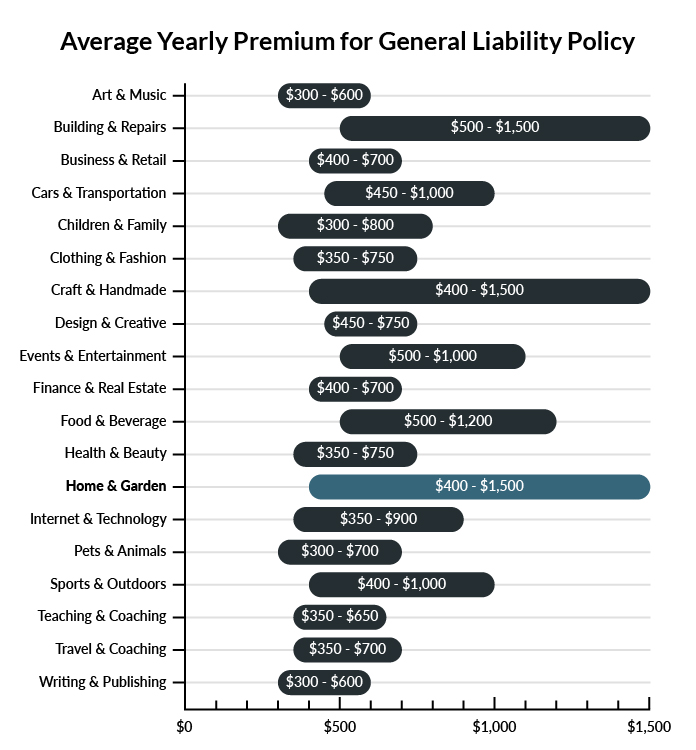

The average flower shop in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a flower shop business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Flower Shop Business

Example 1: A customer is admiring a potted flower when a venomous spider crawls out of the pot and bites them on the hand. The venom is non-lethal, but the wound later becomes infected. It is a rare occasion in which fairly serious medical intervention is required. If held liable, general liability insurance would probably help in covering court-mandated medical payments.

Example 2: A customer purchases a large plant in a big ceramic pot. He insists that he can carry it himself, but he trips over the door frame while moving backward, dropping the heavy pot and breaking his shin. If found liable, general liability insurance would likely provide coverage for a resulting settlement or medical payments owed through a court ruling.

Example 3: You show a customer one of your latest imports, a special exotic flower that has recently become popular in the U.S. The customer touches and smells the flower and suffers a severe allergic reaction. Rapid swelling causes her to asphyxiate before an ambulance can arrive and administer adrenaline. If her bereaved spouse took your business to court, your expenses would probably be covered by general liability insurance.

Other Types of Coverage Flower Shop Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

A flower shop may sell a variety of accessories, but its core inventory is a collection of flowers and other flora. Plant life requires attention, care, and even some cosmetic maintenance like pruning. Such delicate products are highly vulnerable to disasters like fire and violent weather. Keep your sensitive inventory covered with a commercial property policy. Owned real estate is also covered under this insurance, allowing many businesses to get back on track after destructive natural forces push them off course.

Business Interruption Insurance

Similar to commercial property insurance, the purpose of this policy is to provide coverage for businesses that have suffered serious setbacks due to factors like fire, tornadoes, or other disasters causing storefront destruction. Business interruption insurance can help cover estimated losses in revenue during a temporary shutdown as well as any relocation costs. This type of insurance is commonly offered as part of a business owner’s policy, and it can make the difference between permanently shutting down your flower shop and suffering what is ultimately a minor setback.

Home-Based Business Insurance

One of the advantages of a flower shop is that it can be run from home. You can use your own garden and/or greenhouse to grow a commercial collection of diverse flowers and other plant life. But as convenient and comfortable as it can be to run a business from home, homeowners’ insurance might not cover various business-related accidents or inventory damage. Home-based business insurance is your solution, delivering peace of mind as you run your flower business.

Workers’ Compensation Insurance

As businesses grow, they pick up more inventory, more locations, and more human resources. Whether you are starting off a business with multiple employees or taking a solo business to the next level, this is a policy you’ll need to keep your workers covered. In fact, any business with part-time or full-time employees is required by law to provide workers’ compensation insurance.

With this insurance, your employees and their families are covered in the event of work-related accidents and/or fatalities.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your flower shop business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Flower Shop Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. Before your flower shop commences its operations, it is essential that it’s protected by enough business insurance. This is because coverage will only be useful if it is purchased proactively.

For a flower shop, we recommend getting general liability insurance, as well as commercial property coverage.

Not necessarily. Certain exceptions may be written directly into your flower shop business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.