Ghostwriter Business Insurance

Getting insurance for your ghostwriting business is essential.

Ghostwriting businesses need to be protected against claims involving things that could foreseeably occur and cause them serious financial damage, such as libel, defamation, or breach of contract claims.

You will also want to protect yourself from any liability that arises as a result of employment law disputes, such as wrongful termination allegations.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Ghostwriting Business

General liability insurance is — generally speaking — one of the most important insurance policies for a ghostwriting business.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Having said that, each business is unique, and there’s a chance that you will need to purchase additional policies in order to cover all foreseeable risks.

A few policies that we believe are worth considering include:

- Commercial property coverage: This policy will cover the costs associated with repairing or replacing your property (e.g., work computers, office furniture, etc.) if it is damaged or stolen.

- Data breach coverage: This will cover you from data breach claims, which can give rise to exorbitantly high damages when relating to personal information leaks.

- Intellectual property coverage: This will cover your costs if another company or client claims that you or one of your ghostwriters infringed on a copyrighted or trademarked piece of content.

You will also need to decide what type of business insurer you will work with; there are generally two options available for small businesses:

- Online insurers: These use technology in order to offer personalized quotes without an insurance agent. Due to the lower overhead involved, they generally offer good value-for-money.

- Traditional brick-and-mortar insurers: These have been operating for several decades, and have held a consistent track record when it comes to their claims procedures and financial strength.

We typically recommend going with the first option as a small business owner, as it can help you stay as price-efficient as possible when starting out.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

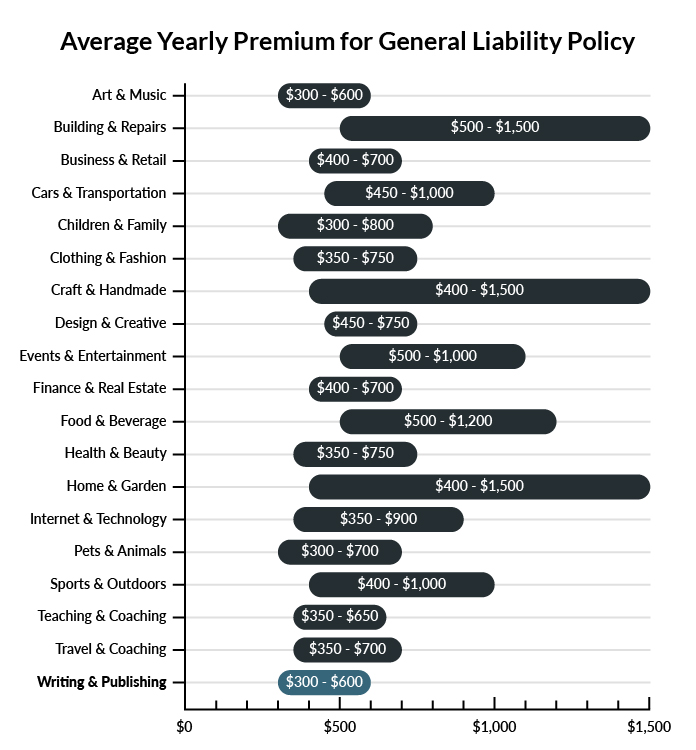

On average, ghostwriting businesses in America spend between $300-$600 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a ghostwriter to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Ghostwriter

Example 1: While waiting in your lobby for a consultation, a customer reaches for a book on a high shelf, accidentally pulls the shelf down onto herself, and decides to sue your company for damages. General liability insurance would pay for your legal defense and any required settlement.

Example 2: You author a blog to attract new clients and help other ghostwriters break into the business. After reading one of your blog posts, a competitor accuses you of libeling her business. While you disagree with the accusation, you want to secure legal representation. General liability insurance would cover your legal fees and any required settlement.

Example 3: A local competitor threatens to sue, claiming your new logo is too similar to his own. General liability insurance would pay for your legal fees and any required settlement in the event of a lawsuit.

Other Types of Coverage Ghostwriters Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

While you strive to create content that satisfies your clients, there’s always a chance someone might claim your work or advice caused them harm. If a client sues your business, claiming you made a mistake or failed to perform, professional liability insurance would cover your legal fees and any required settlement.

Commercial Property Insurance

You made a major investment in the equipment, office supplies, and real estate necessary to establish your business. In the event of a fire, theft, or natural disaster, commercial property insurance would cover the cost of repairing or replacing your business-related property. This includes structural damage to your building and the business materials you store there.

Workers’ Compensation Insurance

Most states require businesses to carry workers’ compensation insurance for their part-time and full-time employees. This coverage protects your employees if they become injured at work or fall ill after a work-related accident. It not only covers an employee’s medical bills and lost wages if they need time to recover, but also any disability or death benefits stemming from a workplace accident.

Commercial Umbrella Insurance

While your general liability insurance policy covers most claims, some accidents or lawsuits may be so catastrophic that they threaten to exhaust the limits of your primary coverage. Commercial umbrella insurance protects you from paying out-of-pocket for any legal fees and awarded damages that exceed your primary policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your ghostwriting business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Ghostwriter Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. Since you cannot accurately know exactly when you will need business insurance, it’s generally recommended that you get it before you interact with your first client.

If you hire additional ghostwriters, insurance may also be a legal requirement (e.g., workers’ compensation), depending on which state you operate in.

Not necessarily. Certain exceptions may be written directly into your ghostwriter insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.