Gift Wrapping Business Insurance

Getting insurance for your gift wrapping business is essential.

Gift wrapping businesses need to be protected against things like claims of contractual breach, product liability, and property damage.

For example, a customer’s gift is accidentally broken in the process of wrapping it, or a client is unsatisfied with your business’s work and claims you didn’t satisfy the contract.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Gift Wrapping Business

General liability insurance is — generally speaking — one of the most important insurance policies for gift wrapping businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

To ensure an exhaustive coverage plan, gift wrapping businesses often also opt for some of the following complementary policies:

- Workers’ compensation insurance

- Commercial property insurance

- Commercial auto insurance

- Commercial umbrella insurance

Vendors of insurance coverage for businesses typically come as one of two general types:

- Traditional brick-and-mortar insurers — For example, The Hartford, Nationwide, and Hiscox.

- Online insurers — For example, Tivly and Ergo Next.

While traditional insurers are more well-heard-of, online providers are the recommended route for new or small businesses because their business structure enables them to offer high-quality, personalized insurance far more cheaply. This is because they utilize technology like artificial intelligence to create quicker quotes.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

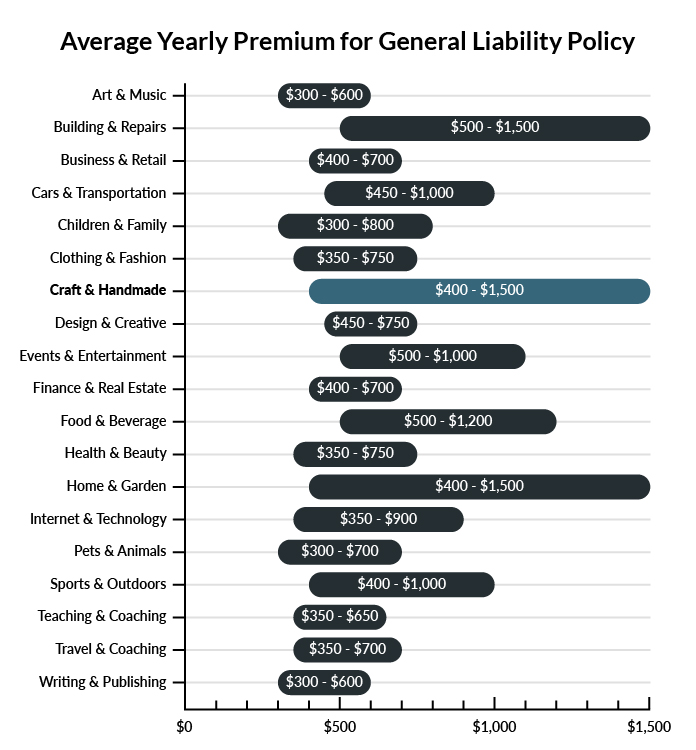

The average gift wrapping business in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a gift wrapping business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Gift Wrapping Business

Example 1: A customer is bringing in a stack of boxes for your team to wrap. She does not see a change in the level of the floor and trips, falling with all of her packages. Not only does she break her arm in the fall, but some of her expensive gifts as well. Your general liability insurance policy would likely cover the cost of her medical treatment and the replacement of her property.

Example 2: One of your employees is trying to keep up with the holiday rush. She overloads a handcart with packages to take from one part of the building to the other. In her hurry, she runs the hand cart into an obstacle and spills the packages onto the hard floor. The contents of multiple packages are smashed, including a number of expensive electronics. Your general liability insurance policy will likely cover the cost of replacing the property of your customers.

Example 3: The new logo you have purchased from a local artist is a hit with you, your employees, and your customers. Unfortunately, one of your competitors feels like the logo is too similar to her own logo, and she hires an attorney to sue your business over it. Your general liability insurance policy will pay for your legal fees in the event of a lawsuit against your company. It will also pay for any payouts or settlements if they are required.

Other Types of Coverage Gift Wrapping Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Workers’ Compensation Insurance

Most states require businesses with employees to carry workers’ compensation insurance. The policy that you carry for your employees will cover them should they become injured while performing job-related duties. For example, if an employee is climbing a ladder to access some wrapping materials on a high shelf and falls, workers’ comp would pay for the treatment of her injuries. It would also pay for some of the wages she loses while being unable to work.

Commercial Property Insurance

The various supplies and equipment you have purchased to make your gift wrapping business operational required a significant investment on your part. If an unexpected event like a fire were to destroy most or all of your supplies and equipment, it may be difficult to pay for replacements out of pocket. But with a commercial property insurance policy, you will not be forced to pay for it all on your own. Your policy will help to cover the costs of replacements, allowing you to get back to doing business sooner rather than later.

Commercial Auto Insurance

If you have one or more vehicles that you use primarily for business purposes, you need to have commercial auto insurance. Much like your personal auto insurance policy, commercial auto insurance provides financial protection for your commercial vehicles. In the event of an auto accident caused by you or one of your employees, your policy will help to cover the cost of repairing or replacing the vehicle and the vehicle of any other parties hit by your vehicle. It will also pay for medical treatments for injured parties.

Commercial Umbrella Insurance

An umbrella insurance policy is designed to pick up where a general liability insurance policy leaves off. Every general liability insurance policy has limits to what it pays out—once those limits are exceeded, the umbrella policy takes over to cover damages. Events that can exceed general liability insurance policies can include things like expensive lawsuits. Were your business to lose a lawsuit, the damages you were required to pay could exceed your general liability insurance policy. At that point, you could depend on your umbrella policy to take over.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your gift wrapping business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Gift Wrapping Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, business insurance is essential for your gift wrapping business — especially before it launches. Your business is going to be exposed to many risks that will threaten its financial security, particularly soon after starting up.

This doesn’t even include situations where certain business policies are a prerequisite for your gift wrapping business to operate legally.

Not necessarily. Certain exceptions may be written directly into your gift wrapping business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.