Haunted House Business Insurance

Getting insurance for your haunted house is essential.

Haunted houses need to be protected against claims arising from a variety of risks, especially personal injury lawsuits.

For example, a customer could fall and injure themselves in your haunted house, or they could sue for emotional distress because they were excessively frightened.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Haunted House Business

General liability insurance is — generally speaking — one of the most important insurance policies for haunted houses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Your haunted house might want to supplement its general liability insurance policy with other policies that cover specific situations, including:

- Workers’ compensation insurance: If your employees get sick or injured on the job, this will pay their medical bills and related expenses.

- Commercial auto insurance: If your employees drive company vehicles, you need this for coverage if they get into an accident.

- Commercial umbrella insurance: This covers extra expenses that general liability insurance doesn’t.

The establishments your haunted house can buy business insurance from are commonly divided into two groups:

- Traditional brick-and-mortar insurers — These insurers, including Hiscox, The Hartford, Nationwide, and other well-known companies, are generally reliable and have a lot of experience. However, they charge higher prices for a given type of coverage because of their high overhead, including employing agents to sell policies from physical offices.

- Online insurers — Online insurers such as Ergo Next and Tivly don’t have physical offices, at least not ones that customers visit to buy insurance. Instead, they sell insurance online using AI. This makes them faster and cheaper than traditional insurers, plus they often can personalize your coverage to a greater extent.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

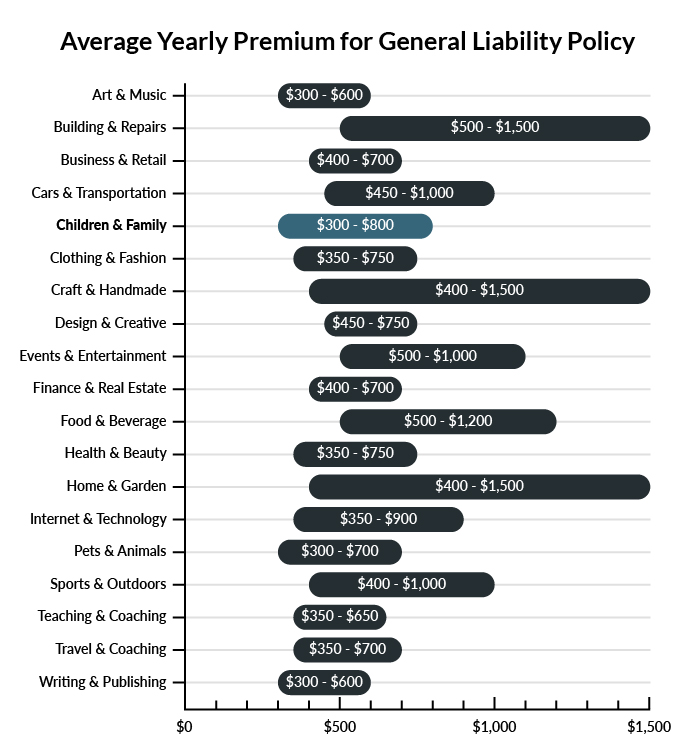

The average Haunted House in America spends between $300-$800 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a haunted house business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Haunted House Business

Example 1: A customer walking through a haunted attraction touches a live wire that wasn’t properly installed and suffers significant burns and electrical shock that require emergency medical attention. General liability insurance most likely would cover expenses related to the event, including medical fees and any legal suit filed against the business.

Example 2: As a touring visitor enters the haunted house, an employee reaches out to grab him, mistakenly touching the visitor and causing him to drop an expensive camera. General liability insurance may help cover the cost of the camera, depending on the value.

Example 3: A person walking through a haunted display has a stage prop fall on them. They fall and hit their head. While they don’t seem to have any medical emergency, the haunted house calls an ambulance to be on the safe side. Liability insurance helps cover losses related to any medical expenses and any lawsuits filed against the company.

Other Types of Coverage Haunted House Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Coverage

If you own the building the haunted house will operate in or the land you will set up the attraction on, having commercial property insurance is necessary. It aids in protecting the building itself as well as the attraction features from various types of risks. In a haunted house, each attraction, from the walls to props, are vital to the operation of the business. Minimizing damage to any equipment is also important.

Workers’ Compensation Insurance

Most haunted houses employ numerous individuals. Some are placed in dangerous situations where they can slip and fall or suffer another injury. Workers’ compensation covers on-the-job injuries and illnesses to employees and minimizes financial loss.

Commercial Umbrella Insurance

Damages from an incident can be significant. For example, a customer suffering a hit to the head after tripping on the floor in the dark could potentially lead to an expensive lawsuit and settlement. Commercial umbrella insurance may help to defray those costs. It extends the amount of liability coverage beyond what the general liability insurance plan offers. It applies only when the limit of the general liability policy is exceeded.

Commercial Auto Insurance

Some haunted houses also use vehicles as a part of the attraction. A haunted forest or farm, for example, may pull employees through a field. These vehicles, whether they are high-powered tractors or full trucks, are valuable investments for the company. Because they are being used as a part of the business operation, companies should consider covering them with commercial auto insurance. This helps protect the vehicle’s value if an accident occurs and minimizes general liability claims.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your haunted house business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Haunted House Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Purchasing adequate business insurance for your haunted house before opening is vital to protect your company from financial risks such as lawsuits. Your state also likely requires at least workers’ compensation insurance, as well as commercial auto insurance, if you drive a company vehicle.

Not necessarily. Certain exceptions may be written directly into your haunted house business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.