Hospice Business Insurance

Getting business insurance for a hospice center is essential.

Hospice centers are exposed to a variety of risks during operation which, if they materialize, may have a detrimental effect on the business. That prospect makes insurance imperative.

Insurance can protect a hospice from a variety of risks, including liability for physical injury, damage to property, and financial loss.

We’ll help you find the most personalized and affordable coverage for your business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for Hospice Centers

General liability insurance is — generally speaking — one of the most important insurance policies for hospice centers.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance provides coverage for a variety of risks, it may not be sufficient to cover all the risks that your business may face. For instance, some risks may require coverage from specialized policies, such as those that offer:

- Professional Liability Insurance: This type of insurance is designed to protect hospice workers and volunteers from claims of negligence, errors, or omissions in the course of providing professional services.

- Workers’ Compensation Insurance: Hospices may require workers’ compensation insurance to cover medical expenses and lost wages in the event of an employee’s job-related injury or illness.

- Cyber Liability Insurance: In today’s digital age, hospices may also require cyber liability insurance to protect against cyber attacks, data breaches, and other cyber risks. This type of insurance can cover the costs of legal fees, notification of affected parties, credit monitoring, and other expenses related to a data breach or cyber attack.

When thinking about insurance, your options will generally be between the following two types of insurers:

- Traditional brick and mortar insurers: These insurers, like Allstate and Farmers, may still be doing things the way they have been for decades. As a result, premiums tend to be higher.

- Online insurers: Insurtechs, like Zipari and Ergo Next, often provide a better digital experience, with online platforms that allow customers to purchase and manage policies, file claims, and get support. Overhead is much lower for online insurers and this is reflected in premiums.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

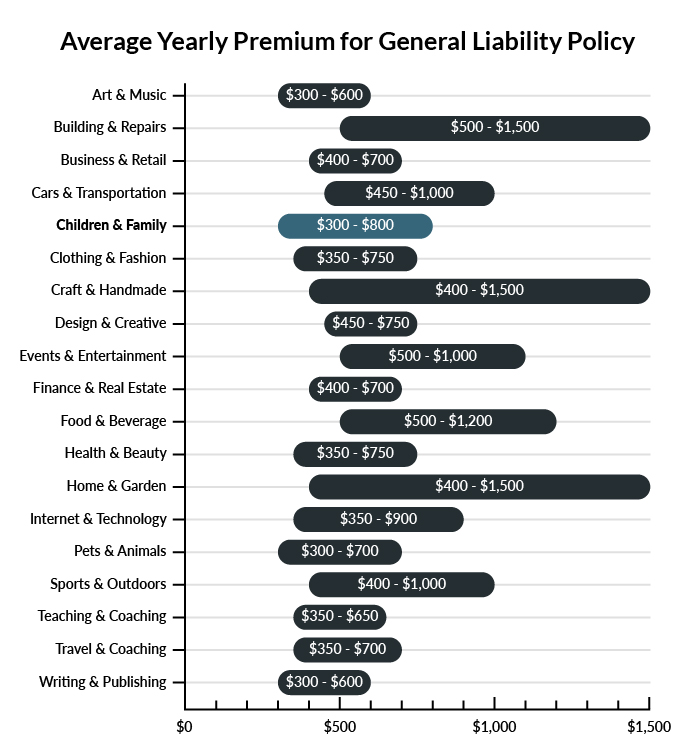

The average hospice company in America spends between $300-$800 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a hospice business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Hospice Business

Example 1: While visiting a resident, a family member slips on some ice in the parking lot and falls. They fracture their wrist and hit their head on the icy pavement. General liability insurance would likely cover the injuries sustained during the fall.

Example 2: A patient uses the restroom on their own and trips over the wastebasket. Their fall results in multiple abrasions that need to be treated as well as other injuries. General liability insurance would likely provide protection against lawsuits arising from the incident.

Example 3: An employee carelessly claims your hospice facility is the “top” facility in the area on social media. They have no evidence to back up the statement, and another facility files a lawsuit over the claim. General liability insurance would probably cover the resulting legal fees.

Other Types of Coverage Hospice Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

Hospice facilities need commercial property insurance for their buildings and equipment. Property insurance also covers supplies and inventory kept at a facility.

When selecting commercial property coverage, don’t consider only the value of your facility’s building. Make sure you also get enough protection for the full value of the facility’s medical equipment, which is likely tens of thousands of dollars or more.

Commercial property insurance is included in most business owner’s policies (BOPs).

Professional Liability Insurance

Businesses that provide medical care for patients can face expensive malpractice lawsuits if one of their employees makes a significant mistake in a patient’s care. Professional liability insurance protects against error-related lawsuits like malpractice suits.

Many people provide medical care to patients at hospice facilities. Check to see that your facility’s policy covers everyone who provides care, including all technicians, aides, nurses, and physicians.

Professional liability insurance is included in some package policies and is available by itself.

Workers’ Compensation Insurance

Businesses that employ workers are usually required by state law to provide workers’ compensation insurance for their employees. This insurance covers work-related injuries.

Data Breach Insurance

Keeping electronic medical records is required by law, but it leaves businesses exposed to potential online security risks. Data breach insurance protects against system intrusions and non-criminal data breaches.

Data breach insurance is included in some package policies and is available by itself.

Commercial Auto Insurance

If your hospice facility uses a company-owned bus or van to transport patients, the vehicle must be insured with commercial auto insurance. State laws require that all vehicles driven on public roads be insured.

Commercial auto insurance is included in some package policies and is available by itself.

Commercial Umbrella Insurance

Malpractice lawsuits and other liability claims can involve expensive legal fees and settlements. Commercial umbrella insurance offers extra liability protection for expensive lawsuits.

Commercial umbrella insurance is included in some package policies and is available by itself.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your hospice business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Hospice Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

It’s certainly prudent to establish business insurance coverage at the earliest opportunity. A significant number of the hazards that arise during business operations may possibly occur before the actual commencement of trading. Additionally, certain categories of protection are mandatory by law, despite the fact that you may not have initiated your business yet.

Not necessarily. Certain exceptions may be written directly into your hospice business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.