House Sitting Business Insurance

Getting insurance for your house sitting business is essential.

Insurance coverage can shield a business from potential financial losses, property damages, and harm to individuals.

For example, you may inadvertently cause damage to a homeowner’s valuable furniture. In such a situation, the homeowner would expect to be compensated. Fortunately, insurance can provide the funds to do so.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a House Sitting Business

General liability insurance is — generally speaking — one of the most important insurance policies for house sitting businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance can cover a wide range of risks, it may not be adequate to cover all of the potential risks that your business may face. In order to ensure comprehensive coverage, it may be necessary to obtain specialized policies that are specifically designed to address these unique risks. These specialized policies may offer additional protection, such as:

- Commercial property coverage: Property insurance provides coverage for the physical property of a house sitting business. This includes office equipment, if any, as well as tools, and supplies. This insurance protects against damage, theft, or loss due to natural disasters such as fire or flood.

- Errors and omissions (E&O) insurance: These policies provide coverage in case a house sitting business is sued for professional negligence, errors, or mistakes that result in financial losses to their clients.

- Workers’ Compensation Insurance: In many states, if a house sitting business has employees, workers’ compensation insurance would be required by law. This insurance provides benefits to employees who are injured or become ill due to job-related activities, such as cleaning or maintenance of a client’s home.

When searching for an insurance company, it’s important to keep in mind that there are two main types to choose from, traditional brick-and-mortar insurers such as Nationwide or Allstate, and online insurers such as Ergo Next or Tivly.

The advantages and disadvantages of each will depend on your specific circumstances. However, if you’re a small business owner looking for affordable and high-quality insurance, it’s generally recommended to opt for an online-based insurer.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

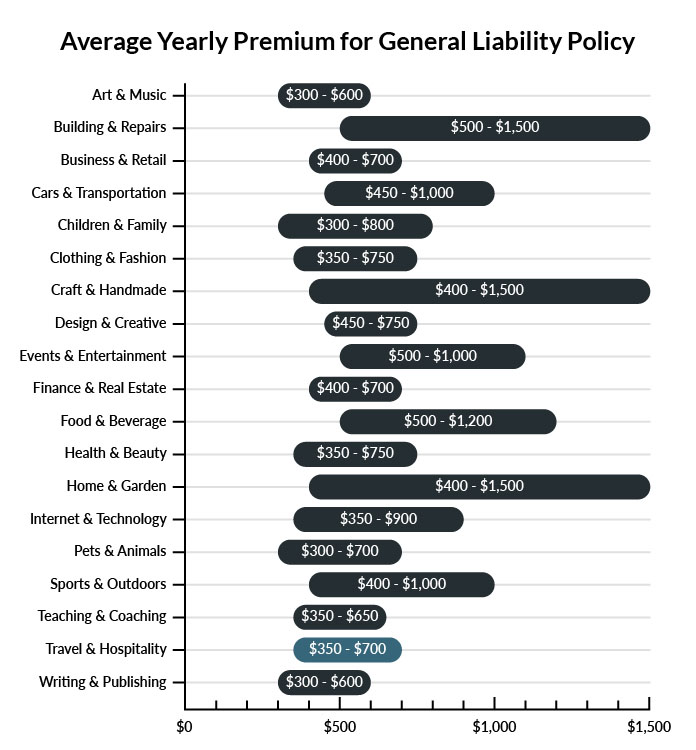

On average, house sitters in America spend between $350 – $700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a house sitting business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a House Sitting Business

Example 1: As part of your house sitting duties, you’re responsible for ensuring the water level on their pool remains at a certain level. You forget for a few days, and the pump breaks due to low water levels. The client is asking you for financial compensation to replace the water pump. General liability insurance will pay for the replacement, as well as your legal fees if the customer decides to sue.

Example 2: You spill a glass of wine on the client’s new couch and they are suing you for the replacement cost. Your general liability policy should cover your attorney’s fees and the compensation claim.

Example 3: You have decided to expand your business and are seeking a loan to get you started. As part of the terms of the loan, the bank requires evidence of at least $1 million in liability. General liability insurance ensures you meet that requirement.

Other Types of Coverage House Sitting Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Workers Compensation Insurance

State law requires that business owners carry workers compensation insurance on all payrolled employees. In the event of an on-the-job injury or illness, it pays their medical bills and lost wages while out of work. If the incident leads to a lawsuit, the policy would also cover the business owner’s legal fees.

You can purchase workers compensation insurance as a standalone policy.

Commercial Property Insurance

In the event of a covered loss, commercial property insurance pays to repair or replace business-owned property, including the building and its contents. To ensure protect business asset protection, this coverage should be part of every company’s insurance portfolio.

Commercial property insurance is generally purchased as part of a business owners’ policy (BOP).

Business Interruption insurance

If you are like most entrepreneurs, you rely on consistent revenue to keep the business running. But, what if you experienced a loss that closed your doors for an extended period of time? Business interruption insurance helps protect the company during the shutdown, offering a percentage of the revenue lost.

This insurance is generally offered as part of a business owners’ policy (BOP) package.

Commercial Umbrella Liability Insurance

House sitting offers a very personal service. With employees entering the clients’ homes on a regular basis, it only makes sense to have as much protection as possible, particularly when it comes to liability risks. A commercial umbrella policy provides an additional layer of liability coverage, above and beyond the limits of the underlying general liability policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your house sitting business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

House Sitting Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

In general, yes. Certain types of insurance are mandated by state law. Moreover, enterprises may face various risks, including property damage, financial loss, and personal injury, even before commencing their business activities. So right from the very start, business insurance is crucial.

Not necessarily. Certain exceptions may be written directly into your house sitting business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.