Interior Design Business Insurance

Getting insurance for your interior design businesses is essential.

Interior design businesses need to be protected against things like claims of product liability, breach of contract, and employment-related disputes.

For example, you could damage someone’s home while redecorating it or purchase faulty furniture for the client that leads to injury.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for an Interior Design

General liability insurance is — generally speaking — one of the most important insurance policies for interior design businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Although general liability provides excellent overall coverage, your interior design business will face a number of risks that this type of insurance doesn’t cover. Some additional policies to consider include:

- Commercial property insurance for your computers, printers, and other equipment needed to run your interior design business

- Workers’ compensation insurance for your employees if they get sick or become injured on the job

- Commercial auto insurance for any vehicles you use for business purposes

There are two main types of insurance providers that could be suitable to cover your interior design business:

- Traditional brick-and-mortar insurers — this includes long-standing companies like Nationwide or The Hartford

- Online insurers — this includes newer web-based companies like Tivly or Ergo Next

Online insurers are great for small businesses, as they provide the same high-quality coverage as traditional insurers but at a much lower fee.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

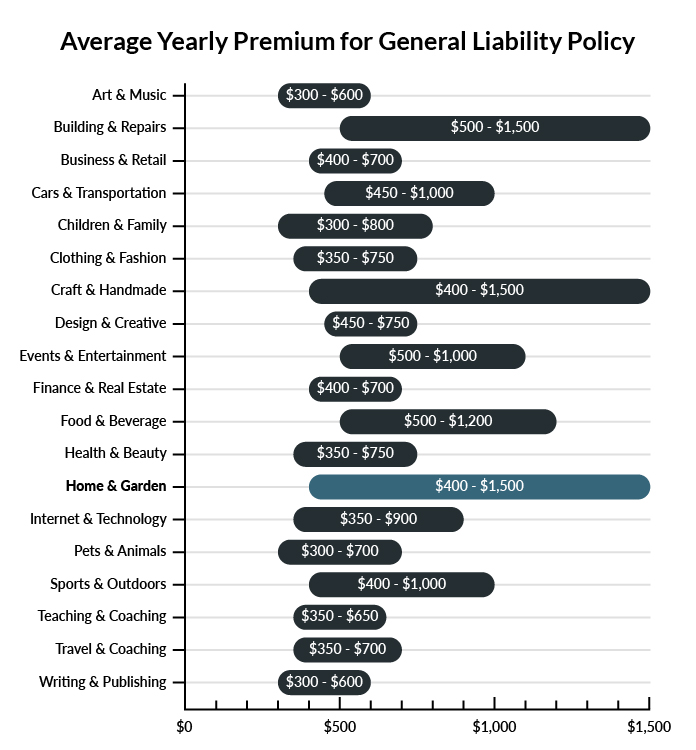

The average interior designer in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for an interior design to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for an Interior Design

Example 1: You install a heavy new dresser in your studio, screwing it into the wall for safety. The wall is not suited for maintaining that level of weight, and the dresser comes loose, tipping forward and landing on a visiting client. She has several broken bones and opts to sue. General liability insurance could probably help cover medical expenses ordered by the court or a settlement decided on by your business and the plaintiff.

Example 2: You are replacing an outdated light fixture in order to bring a new look to your client’s living room. However, as you do so, you accidentally produce a short in the electrical system, sparking a fire and badly damaging half of the home before firefighters can get it under control. The homeowner sues you for these pricy damages. General liability insurance would likely help your business cover court-ordered payments or a settlement.

Example 3: As you explore a client’s home gathering ideas, you back into an expensive statuette—a work of art purchased for several thousand dollars. The statuette cracks on the floor. If liable for these damages, general liability insurance could help your business cover anything owed from a lawsuit or a settlement.

Other Types of Coverage Interior Designs Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

As an interior designer, you will be responsible for advising clients on how to decorate their homes, bringing style and beauty to living spaces in need of an upgrade. If for any reason your advice is regarded by clients as a serious failure, or the sum total of your services is rejected by clients as sub-par, professional liability insurance can help cover damages owed.

If, for example, your floor measurements for the replacement flooring are grossly inaccurate, resulting in a highly unprofessional and unacceptable new floor, professional liability insurance can help to cover any damages you are found to owe.

Business Interruption Insurance

If your business is interrupted by an unpredictable disaster, such as a massive fire or a tornado, business interruption insurance can help cover the damages estimated due to loss of profit during company inactivity. Without this policy, a serious interruption can represent an extremely costly undertaking in the form of repairs and relocation. Business interruption policies can sometimes also assist in covering the costs of relocating your studio and paying for a temporary place of operation while permanent real estate is pursued.

Workers’ Compensation Insurance

By hiring talented interior design assistants and artists, you can substantially increase the reach of your business, developing a wider awareness of your services as well as drawing more revenue. If your interior design business is gearing up to expand beyond yourself, any part-time or full-time employees will legally require you to obtain workers’ compensation insurance.

This policy will cover accidental injuries sustained by your employees while on the job. It will also provide disability benefits related to work injuries, as well as death benefits for your workers’ families.

Data Breach Insurance

Your design studio may well keep its confidential client data in digital format, but with the storage of sensitive personal info comes the danger of theft. Data breaches may steal bank account info, home addresses, or other personal info that can be sold or used in order to profit at your clients’ expense—or even yours.

Protect your company from lawsuits resulting from data breaches. In the event your business is unable to protect sensitive user data, this policy can help cover damages owed from any lawsuits in which your business is found liable.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your interior design:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Interior Design Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. Obtaining business insurance before taking on your first client is one of the most important things you can do for your company’s long-term financial health.

You will be required to purchase commercial auto insurance if you have company vehicles or workers’ compensation insurance if you have employees, so keep that in mind as well and check your local laws.

Not necessarily. Certain exceptions may be written directly into your interior design insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.