Jam Business Insurance

Getting insurance for your jam business is essential.

Jam businesses need to be protected against things like personal injuries, negligence claims, and trademark infringement disputes.

For example, someone could claim that your jam wasn’t stored properly and gave them food poisoning, or that your company’s logo copied theirs.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Jam Business

General liability insurance is — generally speaking — one of the most important insurance policies for jam stores.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Jam stores should consider supplementing the protection offered by general liability with some of the following policies:

- Commercial property insurance for your jam store and any equipment you use, such as mixers and refrigerators

- Business interruption insurance to cover any loss that results from having to close your store

- Workers’ compensation insurance for your employees

- Commercial umbrella insurance to cover any damages that exceed the limits of some of your other policies

- Commercial auto insurance if you use any vehicles

Insurers are typically categorized into two broad groups, so learn the difference to help you determine which is best for your jam store. the two groups are:

- Traditional brick-and-mortar insurers

- Online insurers

Smaller businesses and new entities tend to prefer working with online insurers because they offer great rates for reliable and customized insurance.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

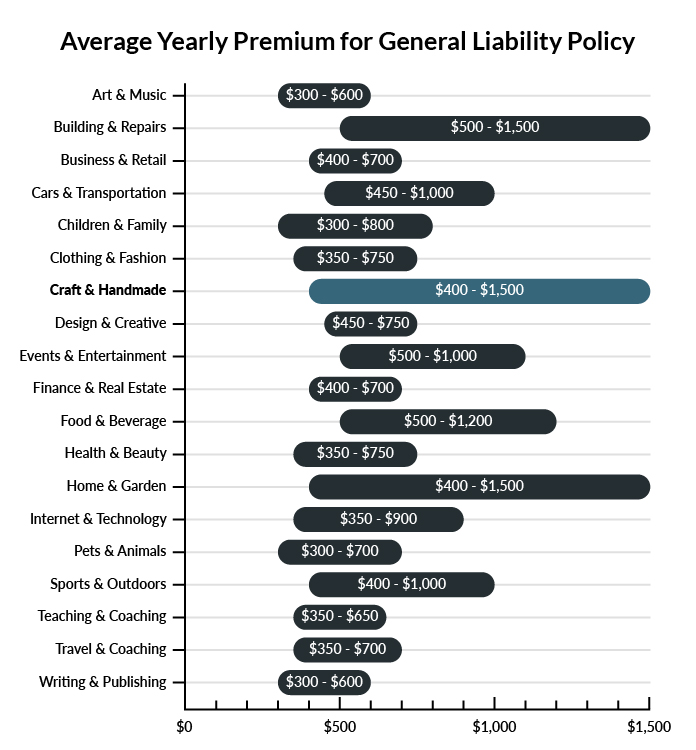

The average jam makers in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a jam business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Jam Business

Example 1: As part of your business plan, you teach jam making classes to the community. During one of the classes, one of the students is badly burned, resulting in a trip to the hospital and over $10,000 in medical bills. A general liability policy should cover the students medical bills and any potential legal expenses.

Example 2: You receive notification that your business’s label is very similar to another company’s and is protected under copyright. The business that claims ownership is suing for copyright infringement. General liability insurance would cover your legal fees and any payout that is awarded as a result of this lawsuit.

Example 3: While selling your products at a local farmer’s market, a customer bumps a display, causing it to fall on another customer. The customer injures her arm and is unable to work for several weeks. General liability insurance should pay all medical costs, required follow-up rehabilitation care, and any legal payout associated with the injury.

Other Types of Coverage Jam Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Product Liability Insurance

Product liability insurance is important for any business that creates a product and sells it to the general public. Whenever working with food, there is a possibility that a customer could get sick, causing them to miss work or incur medical bills. Product liability insurance covers damages caused by the product you sell.

Product liability insurance is tailored to the specifics of your business and the products you sell.

Home-Based Business Insurance

Many jam making businesses start out as a home-based operation, with all equipment and product stored in the owner’s primary residence. If an accident occurs as a result of business activities or the home suffers a loss, many business owners find they are uninsured or underinsured for these losses. Home-based business insurance fills in those gaps, protecting against losses a standard homeowner’s policy excludes.

Home-based business insurance is typically purchased as a part of a business owner’s policy (BOP). For an additional premium, some homeowner’s insurance policies offer this coverage as a rider (extension of coverage).

Commercial Auto Insurance

If your business offers delivery services, you will need to carry the state-mandated levels of commercial auto insurance on each of the vehicles in your fleet. A commercial auto insurance policy covers business-owned automobiles driven on public roadways. Commercial auto insurance is often purchased as part of a BOP.

Workers’ Compensation Insurance

If you employ workers in your jam making business, you are likely required by state law to carry workers’ compensation insurance. Workers’ compensation covers employee medical bills should and employee sustain injuries while working. While typically not a requirement, many business owners opt to include themselves on their workers’ compensation policy.

Workers’ compensation is generally purchased as a standalone policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your jam business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Jam Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. You need to purchase business insurance before your jam store faces any potential financial liabilities. Otherwise, you could be on the hook for a huge amount of money that will threaten your company’s financial future.

In addition, many states require some forms of business insurance to operate legally, such as workers’ compensation if you have employees and commercial auto if you use company vehicles.

Not necessarily. Certain exceptions may be written directly into your jam business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.