Kennel Business Insurance

Getting insurance for your kennel business is essential.

Kennel businesses need to be protected against claims arising from things like negligence, fraud, and animal injuries.

For example, a customer’s pet is injured while in your kennel business’s care, or a pet in your care escapes and causes damage to a neighbor’s property.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Kennel Business

General liability insurance is — generally speaking — one of the most important insurance policies for kennel businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Due to the unique set of risks faced by kennel businesses, many decide to enlist the help of several supplementary insurance policies, such as:

- Commercial property insurance: Protects your kennel business in the event that its property is damaged by covered events (e.g., fires and natural disasters).

- Commercial auto insurance: If your kennel business offers dog walking or transportation services, it will need this policy to ensure its commercial vehicles are covered if ever involved in an accident.

- Home-based business insurance: Many kennel businesses choose to work from home to save costs on rent. This policy is needed to protect your business as standard home insurance policies may not cover commercial damages.

Your kennel business can acquire coverage from an insurance provider. There are two principal types to pay attention to:

- Traditional brick-and-mortar insurers

- Online insurers

It is common for small businesses to prefer online insurers as they sell their policies at budget prices, yet the quality and accuracy of their insurance remain very high.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

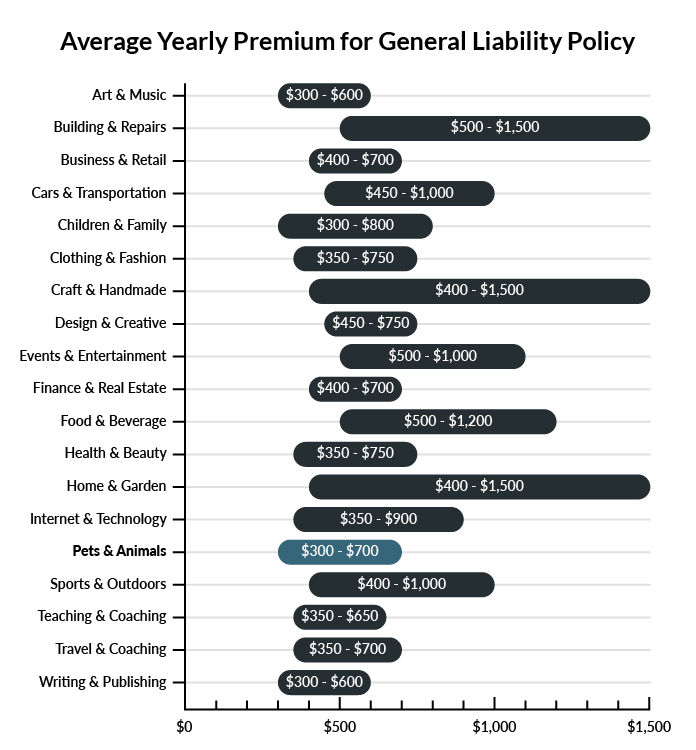

The average kennel in America spends between $300-$700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a kennel business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Kennel Business

Example 1: A dog in your care eats the wrong food and suffers an allergic reaction and asphyxiates while employees are busy managing other pets. The dog’s owner sues your business for damages, including the loss of an expensive breed and psychological shock. If found liable, general liability insurance would likely be able to help cover these losses as ordered by a court or settled upon privately.

Example 2: While a kennel area is being cleaned, its resident dog is placed temporarily in another dog’s caged area. The dogs seem friendly at first, but suddenly begin fighting. One of the dogs comes away with significant injuries, requiring immediate medical attention. If found liable, your business could probably be covered by general liability insurance for medical damages owed or a settlement with the injured dog’s owner.

Example 3: A dog is so excited by its owner’s return that it behaves rambunctiously in the passenger seat as they drive away from your kennel. In your parking lot, the owner’s vision is blocked when the dog jumps into her lap, causing her to collide with a passing vehicle. If found liable for any vehicle damages or occupant injuries, general liability insurance would likely assist your business in covering some of the payments mandated or settlements reached.

Other Types of Coverage Kennel Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

A kennel is full of equipment for animal care, including food, animal soaps, toys, mobile kennel containers, and more. While the chief concern in cases of destructive fires or violent weather would be the safety of the animals, your business should still be protected against disastrous damages to its property. Particularly if you own the commercial real estate on which your business operates, this is a policy that will prove invaluable for businesses trying to recoup significant losses. Commercial property insurance helps cover the costs of replacing/repairing inventory, equipment, real estate, and more in the event of unexpected damage.

Commercial Umbrella Insurance

For a business that operates on commercial property and cares for the beloved furry friends of its trusting clientele, commercial umbrella insurance is an important policy to take out. A kennel stands to lose quite a bit when disaster strikes. Between replacement costs and damage compensation for injured/deceased animals in their care, a kennel could find itself in serious trouble when the cost of the coverage is simply too high for normal insurance policies.

Commercial umbrella insurance exists to cover those gaps beyond existing policies, ensuring that your kennel business doesn’t find itself crippled by an extreme and unpredictable loss.

Commercial Auto Insurance

Some kennels are more involved, taking pets for little trips or events to keep them happy and exercised. If your kennel business wants to include dog-walking or park play in its offered services, you’ll need commercial vehicles. This insurance policy will cover automotive damages incurred when your pet van or similar automobile is damaged on the road.

Home-Based Business Insurance

If your kennel business is run from home, it’s a great way to save on the costs of renting/acquiring a place of business, especially for a business like this one with such specific needs for its operating grounds. However, when running a business from home, your normal home insurance policies may not cover accident damages related to your business. Home-based business insurance is designed with this in mind, and it is often available through a business owner’s policy or as a rider extension for existing homeowner insurance.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your kennel business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Kennel Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

A kennel business faces a unique set of risks from the first day of its operation that necessitates business insurance in advance. Failure to do so will open it up to financial threats very early on.

Be aware that due to this business’s nature, certain policies (such as commercial auto insurance) could be required by law.

Not necessarily. Certain exceptions may be written directly into your kennel business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.