Lawn Care Business Insurance

Getting business insurance for your lawn care company is essential.

Lawn care businesses need to be protected against claims involving events like you or an employee accidentally damaging a customer’s property while working on their lawn, negligent acts that cause trip-related hazards, or generally subpar commercial landscaping.

Claims can also arise as a result of insurance disputes when it comes to repairing and/or replacing commercial equipment (e.g., lawn tractors, etc.).

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Lawn Care Business

General liability insurance is — generally speaking — one of the most important insurance policies for lawn care businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Having said that, the nature of a lawn care business means that some of its risks may not be covered with just a general liability policy.

This can mean that you may need to get additional coverage, such as:

- Contractors’ equipment coverage will cover the costs of paying for damaged or missing commercial equipment that belongs to contractors.

- Business income insurance will reimburse you for lost income that arises as a result of property damage (e.g., lawn mower, etc.).

- Commercial property insurance can allow you to easily repair or replace your lawn care business’s property (if need be).

When it comes to finding the right lawn care business insurance, you will generally have two options.

These are:

- Traditional insurance providers: Some of these providers have offices all over the US and have been operating for over a century. They are trustworthy and reliable, albeit generally more expensive than online insurers.

- Online insurers: These tend to offer more affordable and accurate coverage to small business owners. Online insurers use AI to find comprehensive policies and their digital only presence greatly reduces overhead costs. The savings are passed on to their customers.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

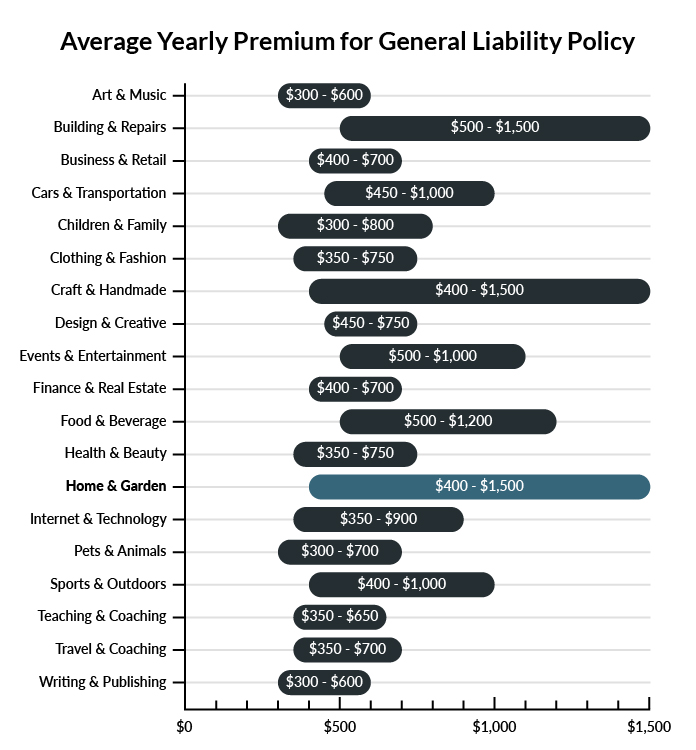

The average lawn care company in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a lawn care business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Lawn Care Business

Example 1: Your employees mix up the orders for two different jobs that day, spraying a client’s garden and lawn with pesticides that ultimately damage the property. General liability insurance would probably help cover the damages owed or settlement reached in the event your business is found liable.

Example 2: At your business’s storage warehouse, an employee brings his friend along to check out the equipment. The friend messes around with the machinery, leading to a serious injury. If found liable, your business would probably be covered for damages through general liability insurance.

Example 3: A customer offers the use of his riding lawn mower, which your employees accept. A worker climbs in and accidentally drives the mower into an expensive fountain, damaging it as well as the mower. General liability insurance would likely be able to assist in covering damages owed by your business if found liable.

Other Types of Coverage Lawn Care Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Auto Insurance

A lawn care business is necessarily mobile, and it usually owns a lot of equipment. This means you will almost certainly be using commercial vehicles to haul expensive tools and machinery to client homes and businesses. Insure your business’s vehicles and get covered for accidents on the road, protecting your operation from surprise automotive repair expenses and accident suits.

Professional Liability Insurance

A business that provides careful, expert services should always carry a policy like this. Professional liability insurance provides coverage in the event that your business is charged with negligence or similar failures pertaining to the conduction of its duties. If your care service mismanages someone’s lawn, they may sue for poor service/failed contractual obligations. Keep your company safe from potential customer dissatisfaction and the far-reaching financial consequences that it can entail.

Commcercial Property Insurance

Your lawn care business will definitely require a collection of professional tools and other equipment to do its job. Of course, if that property is damaged by things like fire or violent weather, you can find yourself in big trouble. Keep your company insured with a policy like this, and you can rest easy that any business equipment and owned real estate will be covered in the event of certain disasters.

Workers’ Compensation Insurance

A big lawn care business will require workers to manage the incoming business from clients across your area of operation. Full-time and part-time employees legally require compensation insurance to keep them covered for on-the-job accidents and similar incidents. In a case of personal workplace injury, employees will be provided disability and even death benefits by a workers’ compensation policy, helping to provide for both employees and their families in times of hardship.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your lawn care business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Lawn Care Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, you do.

Even though this will likely not be a legal requirement unless you immediately hire employees or purchase company vehicles, acquiring the right lawn care business insurance before your first trip to a jobsite can be pivotal.

This is because it will ensure that you adequately safeguard your business’s assets against foreseeable financial harm.

Not necessarily. Certain exceptions may be written directly into your lawn care business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.