Life Coaching Business Insurance

Getting insurance for your life coaching business is essential.

Life coaching businesses need to be protected against things like claims arising from employment disputes, contractual breaches, and professional negligence.

For example, a client could sue you for emotional distress, claiming that you gave them bad advice that caused them pain and suffering.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Life Coaching Business

General liability insurance is — generally speaking — one of the most important insurance policies for life coaching businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Since your life coaching business will face many risks and potential financial liabilities, consider some additional policies that will bolster your protection, including:

- Professional liability insurance to protect you from claims of professional negligence.

- Commercial auto insurance if you use a vehicle to get to clients’ homes.

- Commercial umbrella insurance to extend the limits of your other insurance policies.

- Workers’ compensation insurance for any employees you hire if they experience an on-the-job injury or illness and need time off or have medical bills.

There are two principal types of insurance providers for you to be aware of when shopping for your coverage:

- Traditional brick-and-mortar insurers

- Online insurers

For new and small businesses, online-based insurers (e.g., Tivly and Ergo Next) are typically the best choice because they provide reliable insurance at reasonable prices.

While traditional insurance providers like Nationwide and Allstate are larger and often better known, their policies are usually more expensive because they use agents to sell insurance. By contrast, online providers use AI to sell policies on their websites.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

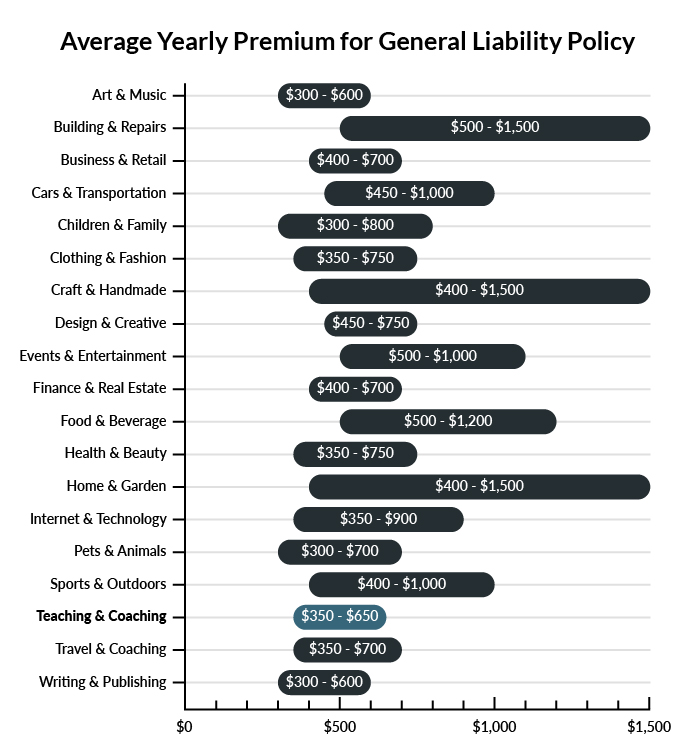

The average life coach in America spends between $350-$650 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a life coaching business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Life Coaching Business

Example 1: A client visiting your office trips on the steps while entering and suffers a bad fall. General liability insurance would likely cover any injuries they sustained.

Example 2: You’re unable to deliver on promises made in marketing materials, and a client sues for false advertising. General liability insurance would likely cover the lawsuit.

Example 3: General liability insurance may be required to reserve spaces at tradeshows or for teaching classes.

Other Types of Coverage Life Coaching Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

Professional liability insurance helps protect workers who give advice as part of their job. This insurance covers lawsuits that clients might file if they find advice misguided or faulty.

As a life coach, your entire business centers around the expertise you have and advice you give. You likely make big promises, and big promises often come with big potential liabilities. Make sure the professional liability insurance you select has broad coverage definitions and high limits so that you’re well protected.

Professional liability insurance can be purchased by itself or with other coverage in a package policy.

Home-Based Business Insurance

Many life coaches have a home office and therefore need home-based business insurance. This is an insurance that fills in gaps left by homeowner’s insurance policies, which frequently don’t cover accidents related to business activities.

Home-based business insurance is sometimes available through a business owner’s policy (BOP) or as an endorsement on a homeowner’s insurance policy.

Data Breach Insurance

Assuming you offer some life coaching services online (even if only to email clients occasionally), data breach insurance is an important protection to consider. Should confidential information about clients be leaked, the resulting consequences could be significant and potential lawsuits might be expensive. This insurance covers many types of possible data breaches and associated legal fees.

Data breach insurance can be purchased by itself or with other coverage in a package policy.

Commercial Property Insurance

If you own an office space or meeting area, your business should have commercial property insurance. Property coverage typically insures buildings, other commercial spaces, and equipment that businesses own.

Commercial property insurance can be acquired with other coverage in a BOP.

Commercial Auto Insurance

If you use a vehicle for work-related driving, regardless of whether it’s registered as a personal or commercial vehicle, you should have some form of commercial auto insurance. Vehicles driven on public roads need to be insured, and those that are used for business typically require commercial coverage.

Commercial auto insurance can be purchased by itself or with other coverage in a package policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your life coaching business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Life Coaching Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

To protect your life coaching business from the many possible liabilities it will face, early acquisition of business insurance is essential. As with all insurance, purchasing business insurance retroactively won’t work.

Since you will be operating out of a vehicle, you will likely even be required to purchase a commercial auto policy to operate legally in your state.

Not necessarily. Certain exceptions may be written directly into your life coaching business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.