Locksmith Business Insurance

Getting insurance for your locksmith business is essential.

Locksmith businesses may encounter various challenging situations during their operations.

Insurance can provide protection to locksmith businesses against a range of risks, such as property damage, personal injury, and financial loss.

For a locksmith business, claims can arise from things like an employee injuring himself or damaging a customer’s property in the process of installing a lock.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Locksmith Business

General liability insurance is — generally speaking — one of the most important insurance policies for locksmith businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance will protect your locksmith business from a wide range of risks, there are insurance policies especially designed for specific risks. Such specialized policies include:

- Commercial property coverage: This type of insurance protects the physical assets of a business, such as the building, equipment, and inventory, from damage or loss due to theft, fire, or natural disasters.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this type of insurance provides protection against claims of negligence or mistakes made by a locksmith that may result in financial losses for the client.

- Commercial Auto Insurance: If, as is likely, you use a vehicle for business purposes, such as making service calls or transporting equipment and supplies, this insurance can provide coverage for accidents, property damage, and liability claims that may arise while driving.

Whenever you come to the point of purchasing coverage, you will generally be able to choose between the following two types of insurers:

- Traditional brick and mortar insurers: These insurers rely on human intermediaries to market and distribute their products. Consequently, processes tend to take a relatively long time. Overhead is increased, and subsequently, so are premiums.

- Online insurers: Insurtechs have a faster and more convenient application process. They use advanced technology, such as AI and machine learning, to simplify and streamline the application process, making it quicker and easier for customers to get insured. Streamlined processes and low overhead lead to less expensive policies.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

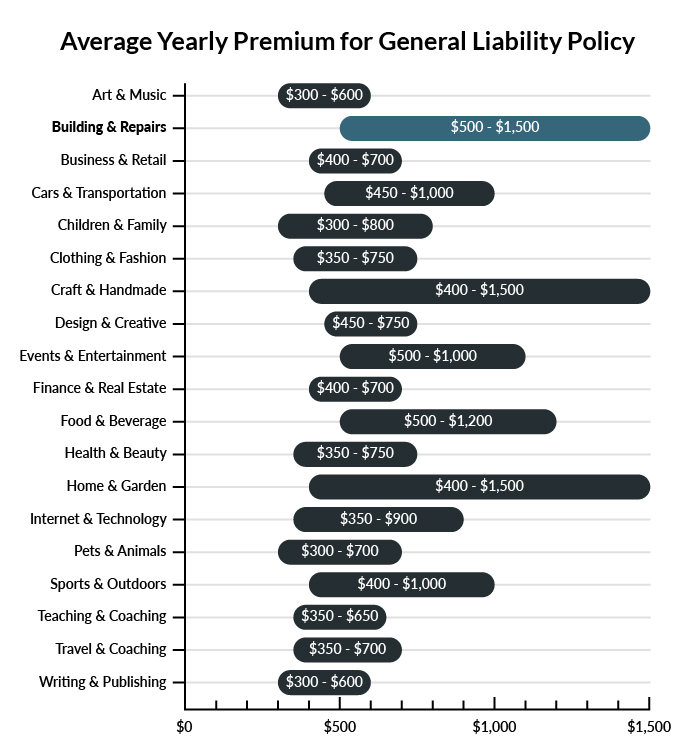

On average, locksmiths in America spend between $500 – $1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a locksmith business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Locksmith Business

Example 1: A customer is in your showroom looking at new locks for their home when he trips over a cord and falls into a display unit. He breaks his wrist in the fall and hits his head as well. Your general liability insurance policy will likely cover his medical costs and your legal fees if there is a lawsuit.

Example 2: You rent out basic tools to help customers who want to install their own locks. As an employee is demonstrating how to use a drill, she accidentally slips and sends the drill bit into your customer’s hand, seriously injuring them. General liability coverage will likely pay for their medical bills if you file a claim.

Example 3: While transferring a heavy inventory item from your storage unit onto the sales floor, an employee loses control of his dolly. It hits a customer’s brand-new luxury vehicle and causes extensive damage to the passenger door. Your general liability insurance policy will likely pay for any necessary repairs.

Other Types of Coverage Locksmith Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Auto Insurance

Making house calls is a huge part of your business and requires that you spend a good deal of time on the road. While you may use a personal vehicle for some job duties, your personal car insurance policy will not provide protection if you’re involved in a work-related accident. Commercial auto insurance is the best way to make sure that your company cars and employees are covered in the event of an accident.

Workers’ Compensation Insurance

Workers’ compensation insurance is a required coverage in most states for businesses that have employees. If one of your employees is injured while on the job, this coverage will help to cover their medical bills. Additionally, if they can’t return to work right away, they may be able to receive disability benefits.

Commercial Property Insurance

Maintaining a full inventory is important to your business. Additionally, your specialized equipment, tools, computer system, and office furniture make it possible to keep up with the demand of your customers. If any of these items are damaged in a fire or other accident, you will likely need to replace them as soon as possible. Commercial property insurance will cover the cost to repair or replace these essential business items.

Commercial Umbrella Insurance

If your primary insurance limits are exhausted by an accident claim or a lawsuit and you don’t have a backup plan, you could then be responsible for covering any remaining fees on your own. Commercial umbrella insurance is designed to step up in these situations to go beyond your primary policy limits and protect your business.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your locksmith business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Locksmith Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Unquestionably, your locksmith business will be able to significantly improve its ability to handle operational challenges by obtaining business insurance coverage.

Insurance will provide protection from a number of hazards, including property damage, accidental bodily injury, and financial loss. Additionally, owners and employers are legally obligated to possess certain types of insurance policies.

Not necessarily. Certain exceptions may be written directly into your locksmith business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.