Makeup Artist Business Insurance

Business insurance is essential for makeup artists.

In their daily operations, makeup artists face various potential risks.

For example, a client could develop permanent skin damage after an allergic reaction. If you should encounter such a situation, insurance will provide protection.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Makeup Artist Business

General liability insurance is — generally speaking — one of the most important insurance policies for makeup artists.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance can cover a broad range of risks, it may not provide coverage for all the potential risks faced by your business. In such cases, you may need to consider obtaining specialized policies that offer coverage for specific types of risks, such as:

- Commercial property coverage: This type of insurance covers the loss or damage of property owned by your business, such as your makeup kit, studio equipment, and inventory. It can help pay for repairs or replacement if your property is damaged or stolen.

- Professional Liability Insurance: Insurance like this protects you in the event a client alleges you made a mistake or were negligent while providing your services. It can cover legal fees and damages if you are sued.

- Business income coverage: This type of insurance can help cover your lost income if your business is unable to operate due to an unexpected event, such as a fire, natural disaster, or other covered peril. It can help cover rent, utilities, and other fixed expenses while you are unable to work.

Make sure to keep an eye out for the following two key types of insurers when shopping for business coverage:

- Traditional brick-and-mortar insurers — Firms with insurance agents and physical premises.

- Online insurers — Firms that utilize AI to offer quotes instead of insurance agents and are purely based online. These insurers tend to offer lower premiums due to lower overhead.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

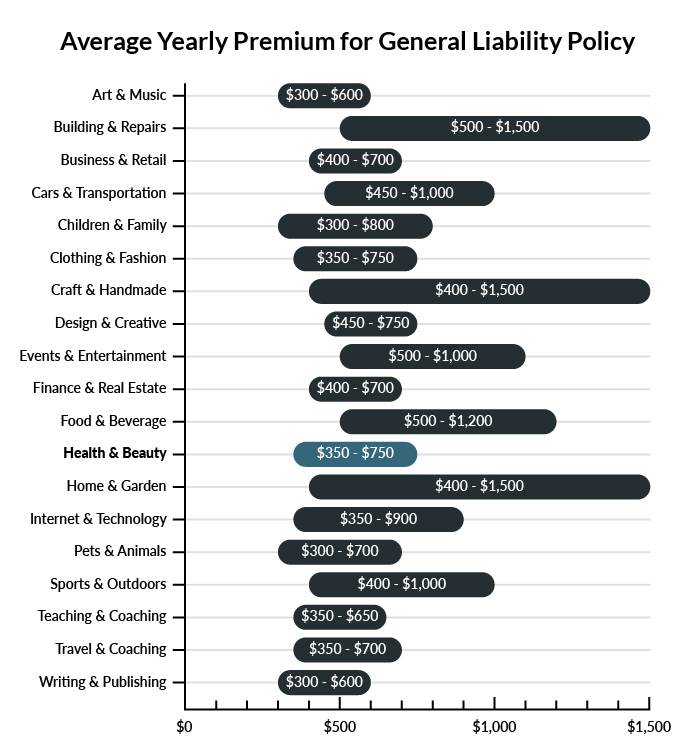

The average makeup artist business in America spends between $350 – $750 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a makeup artist business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Makeup Artist Business

Example 1: While discussing cosmetics with a client, you unknowingly recommend a mixture to which the client is allergic, triggering a reaction that requires some medical attention. If this incident went to court, general liability insurance would likely cover any medical expenses incurred by the client’s allergy treatments, as well as any settlements.

Example 2: Your business films an advertisement that is aired on TV. In the ad, a pair of actors play happy customers who refer to another local makeup artist’s business, at which point the ad shows an image of a clown. The other business learns of your ad and takes legal action against you, claiming that your ad’s clown image is a slanderous misrepresentation of their services. General liability insurance would probably cover your business in a resulting settlement or court-mandated payment.

Example 3: A busy employee drops an open bottle of conditioner, spilling it on the floor. As he runs to find a mop, an elderly customer walks over the spill and slips, sustaining a minor hip fracture. If your business were sued as a result, any hip injury compensation or settlement would likely be covered by general liability insurance.

Other Types of Coverage Makeup Artist Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

All varieties of makeup artists work with clients who look to them for recommendations and advice in the world of cosmetics. Clients may rely on their makeup artists to help them cultivate the right appearance for professional events or personal endeavors. Your business should be confident in its provided services, but if a client believes they have lost an important professional opportunity due to either your cosmetic advice or a professional error, you do not want to be held liable without a professional liability policy. This is a key policy to take out for any business that makes important recommendations or conducts sensitive personal modifications for its clientele.

Business Interruption Insurance

Ideally, a business can persist through the toughest of times. In reality, many successful businesses suffer temporary lulls or shutdowns due to possible disasters like fires, flooding, illness, or extended power outages. Depending on how your makeup artistry business operates, interruptions may leave you unable to access your crucial business supplies or prevent you from personally fulfilling scheduled sessions with clients.

If your business is interrupted for a significant amount of time, this policy can help to make up for estimated losses during the covered interruption. Business interruption insurance is frequently offered in business owners’ policies laid out by insurance companies.

Workers’ Compensation Insurance

If you manage a business with employees working under you, workers’ compensation insurance may become mandatory, depending on state requirements. However, no business is perfectly safe from on-the-job accidents, and this policy can come in handy for something as simple as an employee falling off a ladder while reaching toward a high shelf. Employee health, disability, and death are all covered under this policy.

Product Liability Insurance

You may choose to expand your makeup artistry business with the sale of a product line. This can be a patented product of your company’s own manufacture or your sale of a third party’s product. Either way, cosmetic products are generally purchased under the assumption that they are safe for use on a customer’s body.

If a product from your shelf is misused or found to contain ingredients that demand a recall, product liability coverage can protect your business from serious customer health claims. This type of policy will be customized to your business, focusing on the type of product you are selling as well as anything that might go awry through the products’ use.

Commercial Umbrella Insurance

This insurance is a secondary measure that works to enhance certain existing policies your business may have taken out. As long as your other policies are upgraded to the highest limits offered, commercial umbrella insurance can extend their functionality even further. This is a measure for business owners who like to have every last base covered. If you are concerned that the limits of your existing policies will not quite leave you feeling secure, an umbrella policy may be the way to go.

For instance, if your makeup artistry business is located in an area where crime has begun to rise, your insurance company’s provided policy for break-in protection may be based on an earlier estimation of lower risk. An umbrella policy could be a way to gain extra protection by acting as a supplementary provision where your original policy stops its coverage.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your makeup artist business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Makeup Artist Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

In general, the answer is yes; business insurance is vital. A makeup artist is susceptible to various risks that may manifest even before commencement. These risks include property damage, bodily injury, and financial loss that are ubiquitous in day-to-day operations. Additionally, certain state regulations mandate specific insurance coverage.

Not necessarily. Certain exceptions may be written directly into your makeup artist business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.