Massage Therapy Business Insurance

Getting insurance for your massage therapy business is essential.

Massage therapy businesses need to be protected against things like claims of professional negligence, false advertising, and sexual assault.

For example, a client feels that they were injured further by a negligent masseuse, or a customer claims that you grossly misrepresented your massages’ health benefits.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Massage Therapy Business

General liability insurance is — generally speaking — one of the most important insurance policies for massage therapy businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

For massage therapy businesses, general liability will form part of their protection, alongside some of the following policies:

- Commercial property insurance: Can save your business huge amounts in cases where it suffers a serious loss due to a covered event (e.g., fires and natural disasters).

- Professional liability insurance: Protects your business in instances where frustrated customers decide to sue because they feel your service has been ineffective.

- Workers’ compensation insurance: A policy that is a legal requirement for any business for one or more payrolled employees.

Sellers of insurance are commonly categorized into the two following groups:

- Traditional brick-and-mortar insurers — Including firms such as Hiscox and Nationwide.

- Online insurers — Including firms such as Tivly and Next.

For the most part, new and small businesses tend to prefer online businesses as they offer more affordable access to high-quality insurance than traditional insurers.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

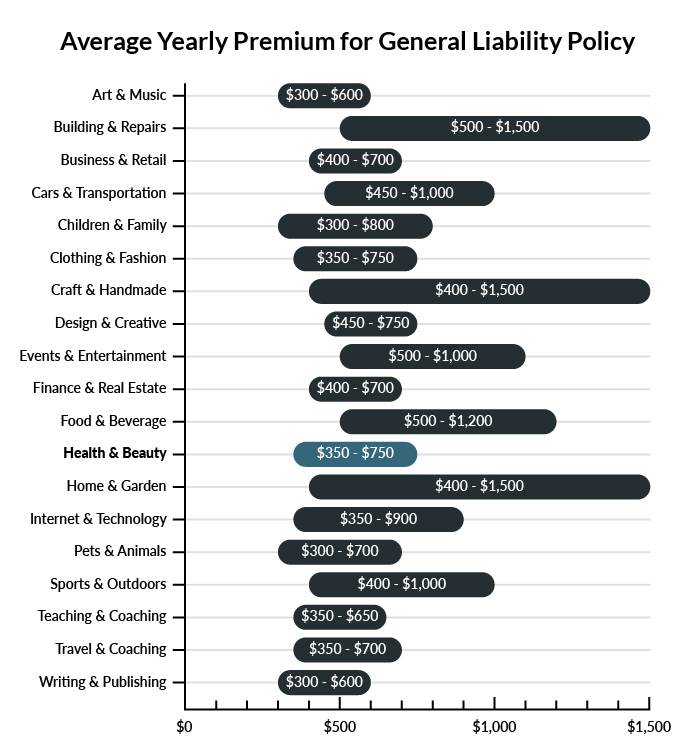

The average massage therapist in America spends between $350-$750 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a massage therapy business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Massage Therapy Business

Example 1: Over multiple sessions, one of your masseuses fails to properly apply a lower back rubbing technique to her elderly male client. This actually worsens the back pain, a condition for which her client must seek recurring medical attention. The client sues your business for his ongoing medical payments and hospital bills. General liability insurance could probably help to cover medical expenses owed or any settlement reached.

Example 2: A female client claims that her male masseuse was inappropriate and unprofessional during their session. She reports that his conduct has led to significant mental anguish that has affected her work and hurt her family. If found liable, your business would probably be covered by general liability insurance for anything the court ordered you to pay or any settlement reached.

Example 3: A client is allergic to your standard rubbing lotion. He suffers a severe rash and has difficulty breathing. An ambulance arrives in time to help, but the client brings your massage business to court. If liable, your company would probably be covered by general liability insurance for a settlement or court estimations of damage incurred.

Other Types of Coverage Massage Therapy Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

This policy is a must-have for the vast majority of businesses, particularly those that rely on either inventory, equipment, or owned real estate to function. Disasters can strike rapidly, leaving shocked businesses to improvise a recovery process particular to the nature of the destruction.

Commercial property insurance is part of a plan businesses can put in place for disaster recovery scenarios. Damage from fires and violent weather are examples of what this policy can cover, saving your company huge amounts when it suffers serious losses. Don’t leave your business vulnerable to the loss of its owned offices, tables, office computer equipment, and other vital commercial property.

Professional Liability Insurance

Massage therapy businesses provide a service that clientele depend on for improved health, comfort, and even professional performance. If clients come out of sessions with no relief, or with exacerbated bodily discomfort, your offices could be taken to court for a return of its service fees. The failure to perform over time may leave your business vulnerable to frustrated customers who have invested their time and money in what they ultimately feel has been a waste. Keep your massage therapy business covered in the event that it is found liable for a failure to provide services as promised.

Workers’ Compensation Insurance

The bigger your therapy practice, the more help you will probably need. If your business intends to hire part-time or full-time employees, it is a legal necessity to provide employees with workers’ compensation insurance. This policy keeps your workers covered in the event that workplace accidents cause injury or death.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your massage therapy business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Massage Therapy Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. Since business insurance will only provide protection if it is bought in advance, and your massage therapy business will face threats from its first day, it is strongly advised.

Furthermore, it is very likely your business will be obligated by law to carry certain policies, such as workers’ compensation insurance for the masseuses your business will need to hire.

Not necessarily. Certain exceptions may be written directly into your massage therapy business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.