Mobile Dog Groomer Business Insurance

Getting insurance for your mobile dog grooming business is essential.

This is because mobile dog groomer businesses need to be protected against a variety of different risks, such as employee injuries, negligent acts or omissions, and traffic accidents.

You will also want to protect your grooming equipment from potential theft and/or damage.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Mobile Dog Groomer Business

General liability insurance is — generally speaking — one of the most important insurance policies for mobile dog grooming businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Having said that, your mobile dog groomer business will likely benefit from purchasing additional coverage.

This is because a general liability policy will not protect it from all foreseeable risks, such as those that relate to:

- Traffic accidents and vehicle damage: Commercial auto insurance

- Employee injuries or other disputes: Workers’ compensation insurance

- Negligent acts or omissions: Professional liability insurance

- Damaged or stolen property: Commercial property insurance

You will also need to find the right coverage insurer for your business; even though there are several options available, we recommend going for an online insurer as a small business owner.

This is because online insurers (e.g., Tivly, etc.) use AI in order to offer personalized coverage (instead of an insurance agent) and so can benefit from having much lower operating costs.

This means that they are generally significantly more affordable.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

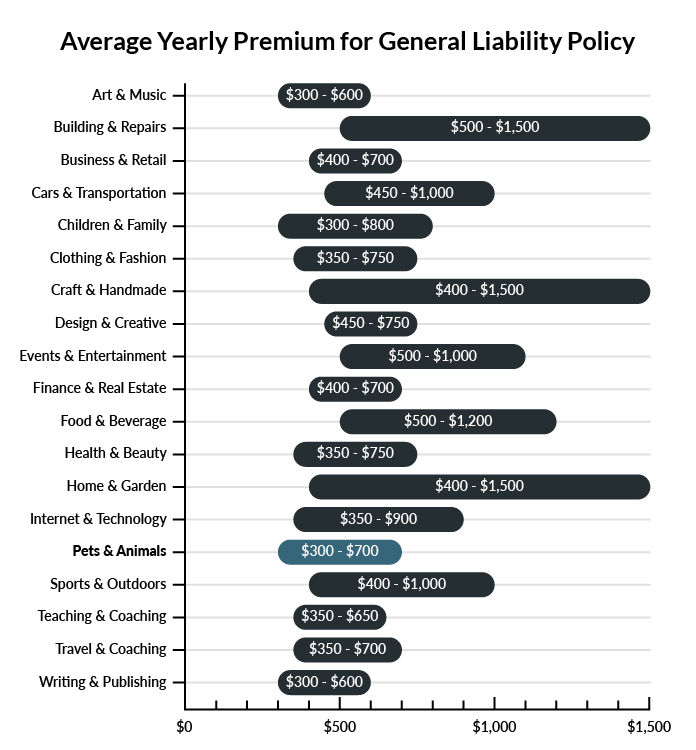

The average mobile dog groomer in America spends between $300-$700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a mobile dog groomer business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Mobile Dog Groomer Business

Example 1: An expensive dog is frightened by a loud noise from some of your grooming equipment. It escapes your grasp and runs into the street where it is fatally hit by a vehicle driving by. If held liable, your business would probably have some coverage under a general liability insurance policy for damages incurred or a settlement reached outside of court.

Example 2: A customer’s toddler is playing while you perform your grooming services on the family dog. During the last few minutes of a shampoo session, you quickly run out to your car for an extension cord for your blow dryer. The dog lashes out and bites the child, who is rushed to the hospital. If liable, your business would probably be covered for some of the resulting damages.

Example 3: While talking with a customer, his priceless show dog, a special purebred, gets into your purse and consumes a large portion of dark chocolate that you left inside. The dog is fatally poisoned. If you were found liable, general liability insurance would probably help cover some of the damages or any settlement reached between your business and the customer.

Other Types of Coverage Mobile Dog Groomer Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Auto Insurance

As a mobile groomer, you will be moving from customer to customer. Any vehicle utilized for commercial purposes must be covered by auto insurance. Commercial auto insurance provides your grooming business coverage in the event of automotive accidents on the road.

Professional Liability Insurance

Businesses that advise customers or perform skilled services can be held liable for any resulting damages. Since your grooming business will be both serving and advising customers regarding their pets, this is an important policy to acquire.

Workers’ Compensation Insurance

If your mobile dog groomer business has any employees (full-time or part-time), you are legally required to carry workers’ compensation insurance. This type of coverage will help compensate your employees in the case that they get injured on the job.

Product Liability Insurance

This policy is designed for businesses that sell products. In this case, you might sell certain shampoos or dog-grooming accessories to your customers. If a customer or their pet suffers some kind of injury from your products, a product liability policy can keep your business covered.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your mobile dog groomer business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Mobile Dog Groomer Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Generally speaking, yes.

This is because you will need to purchase your business insurance before any liability arises, and this could theoretically happen as soon as you begin interacting with clients and/or hiring staff members.

Not necessarily. Certain exceptions may be written directly into your mobile dog groomer business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.