Nail Salon Business Insurance

Getting insurance for your nail salon is pivotal.

This is because nail salons need to be protected against a variety of different risks, such as those that relate to accidental customer infections and injuries, property damage, and employment law disputes.

For example, if a negligent nail technician leaves an open wound whilst performing a pedicure, a customer could end up getting a bacterial or fungal infection; this could lead to a lawsuit being filed against your business.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Nail Salon Business

General liability insurance is — generally speaking — one of the most important insurance policies for nail salons.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Even so, your nail salon will likely benefit from purchasing additional coverage; this is because a general liability policy will not protect it from all applicable risks.

Additional coverage options you will want to consider include:

- Workers’ compensation coverage — Protects your business’s assets against employment law-related disputes (e.g., accidental injuries, payment claims, etc.).

- Commercial property coverage — Covers the cost of replacing your nail salon’s commercial equipment in the event that it gets damaged or stolen.

- Business interruption coverage — Covers part of your lost income in the event that you are required to stop operating temporarily.

When you are purchasing your business’s coverage, you will notice that there are two different types of insurers available as of 2026:

- Traditional brick-and-mortar insurers — Includes Nationwide, The Hartford, CNA, and other eminent insurers.

- Online insurers — Includes Tivly, Ergo Next Insurance, and other insurers that use AI instead of an insurance agent in order to offer personalized coverage.

As a small business owner, we recommend going with an online insurer. This is because online insurers have lower operating costs and can thus offer coverage at significantly more affordable rates.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

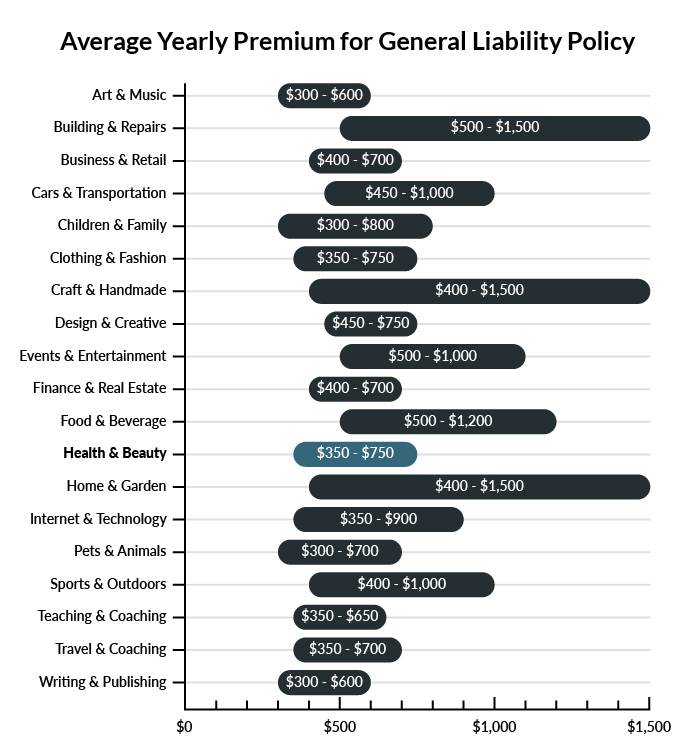

The average nail salon in America spends between $350-$750 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a nail salon business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Nail Salon Business

Example 1: You have decided to sell your commercial building and move to a space that receives more foot traffic. The landlord of the new building you wish to rent requires all commercial tenants to carry at least $1 million of general liability insurance as part of the lease requirement. Having a general liability policy with the required limits would make you eligible to rent the space you’ve been looking at.

Example 2: The salon tech is cleaning the foot basin next to someone getting their nails done. They accidentally spill the cleaning agent, which splashes all over the client’s personal belongings, ruining their expensive handmade leather purse. A general liability insurance policy would cover payments that are owed to the customer to replace their personal belongings.

Example 3: Your front office employee mops up some water that a guest spilled. Per standard protocol, they place a sign in the area indicating the floor is wet and slippery. Despite warnings, another customer slips and falls and breaks her arm. A general liability policy would cover the medical bills stemming from such an accident.

Other Types of Coverage Nail Salon Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Workers’ Compensation Insurance

Each state requires all businesses to carry a certain level of workers’ compensation insurance for each employee. This policy covers medical treatment and lost wages in the event of a work-related illness or injury.

Workers’ compensation is typically purchased as a standalone policy.

Commercial Property Insurance

If you own your location instead of renting, you need property insurance to protect the building. If your business is based out of your home, your homeowners’ insurance will not cover the home when it is being used for commercial purposes. Property insurance also covers items owned by your business.

This coverage is generally offered in a Business Owners’ Policy (BOP).

Business Interruption Insurance

In the event of a fire, flood, or other catastrophes, there is a good chance your business operations will be halted for some time. Business interruption coverage is designed to help you recoup a portion of the revenue your business would lose due to the inability to operate.

This type of insurance is typically included in a business owner’s policy.

Commercial Umbrella Insurance

Umbrella coverage allows you to extend above and beyond the standard limits of your other business insurance policies. If you are faced with a large lawsuit or other claim situation, there’s a possibility that the coverage limits of your standard policies will be insufficient. In this case, your umbrella policy will allow you to surpass these limits.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your nail salon business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Nail Salon Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Generally speaking, yes.

This is because purchasing the right business insurance policies before liability arises can end up saving you tens of thousands of dollars and can go a long way in ensuring that you will continue operating successfully in the long term.

Not necessarily. Certain exceptions may be written directly into your nail salon business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.