Nanny Referral Business Insurance

Getting insurance for your nanny referral business is essential.

This is because nanny referral businesses need to be protected against things like professional negligence claims, employment-law-related disputes, and property damage.

For example, if a referred nanny accidentally injures a customer’s child — or accidentally causes damage to their property — your referral business will likely be required to offer compensation.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Nanny Referral Business

General liability insurance is — generally speaking — one of the most important insurance policies for nanny referral businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Even so, your business will likely benefit from purchasing additional coverage. A general liability policy will not be able to holistically cover it from all foreseeable risks, such as those that relate to:

- Professional negligence in relation to referrals: Covered via an errors and omissions insurance policy.

- Employee payment disputes or workplace injuries: Covered via a workers’ compensation insurance policy.

- Having to temporarily stop operations due to a covered risk: Covered via a business interruption insurance policy.

You will also need to spend some time in order to find the right business insurance provider for your business.

There are two different types of insurers available as of 2026:

- Online insurers (recommended) — Popular examples include Tivly and Ergo Next Insurance.

- Brick-and-mortar insurers — Popular examples include Nationwide and CNA.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

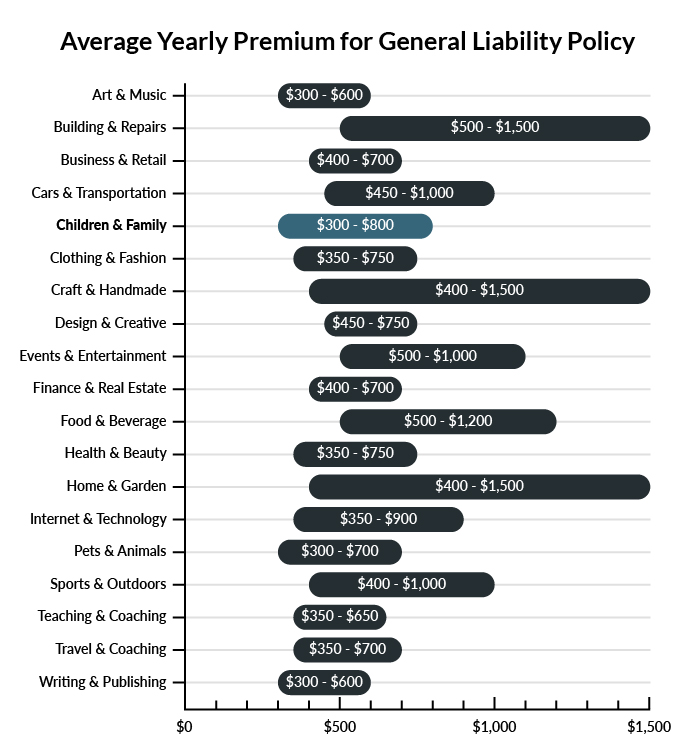

The average nanny referral business in America spends between $300-$800 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a nanny referral business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Nanny Referral Business

Example 1: Your agency recommends a nanny to a family with a newborn baby. The nanny is hired, but one day she slips and falls while carrying the infant. In the event that the baby is seriously injured and your agency is found liable, you would likely be covered through general liability insurance for damages owed or settlements reached.

Example 2: A nanny you connect with a family is hired, and she admires a very expensive vintage typewriter in the client’s home office while the children are napping. She picks it up to move it to a room with better lighting and drops it on the floor. In the event that your company is found liable, general liability insurance could probably help to cover some of the damage you owe.

Example 3: A nanny is hired through your agency and does very well over the course of a couple of years. However, during her employment, she is found to have been filling the family’s car with a low-octane fuel that is not meant for that vehicle. Over time, this leads to badly damaged internal components in the car, requiring thousands of dollars of repairs. If found liable, your business would likely be covered by general liability insurance to assist with damages owed for the vehicle.

Other Types of Coverage Nanny Referral Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

For businesses that provide delicate or complex services with far-reaching consequences, a professional liability policy is a necessity. Nanny referral agencies may find themselves looking down the barrel of a lawsuit for negligent services or a failure to perform its promised function of providing a competent nanny. Keep your agency covered for events such as these, ensuring that you don’t suffer serious losses on account of a nanny you provide to client families.

Commercial Umbrella Insurance

For businesses that would like to go the extra mile and cover extra varieties of damages not addressed by standard policies, commercial umbrella insurance is the ticket. A nanny referral agency is up against a huge host of potentially costly situations. Children are of course precious to clients, who may decide to sue for all kinds of reasons if they think their little one has been harmed in some way. Keep your agency covered above and beyond the normal limits of other policies by opting for commercial umbrella insurance.

Few accidents and unfortunate episodes will escape umbrella coverage, which can only be acquired atop other existing policies that are already purchased at the maximum available coverage.

Home-Based Business Insurance

If your business operates from home, and particularly if it acts as an office for client consultation, a home-based business policy may be something your agency needs. Home insurance is always a good idea, but if damages or accidents occur in your home in a way that is related directly to your business, you may find that your home policy isn’t enough. Keep your home and business fully protected with a home-based insurance policy to cover work incidents that transpire at home.

Workers’ Compensation Insurance

If your agency hires workers for part-time or full-time work, you’ll be legally required to provide a workers’ compensation policy. This is an essential provision for employees, who deserve safety and coverage for the work that they do in your business. Accidents resulting in injury to an employee on the job will be covered by this policy, providing disability and death benefits for the worker and their family.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your nanny referral business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Nanny Referral Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Generally speaking, yes. Even though this isn’t a legal requirement, purchasing the necessary business insurance policies before you begin operating is the “safest” way to go about ensuring that you do not have to face a lawsuit without coverage.

This is because liability could technically arise as soon as you begin operating and interacting with clients.

Not necessarily. Certain exceptions may be written directly into your nanny referral business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.