Pet Grooming Business Insurance

Getting insurance for your pet grooming business is essential.

Pet grooming businesses need to be protected against things like claims of negligence and injury, employment-related disputes, and animal welfare concerns.

For example, a customer’s pet suffers an injury due to the negligence of one of your employees during the grooming process, or a groomer claims that you violated their contract by failing to pay them on time.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Pet Grooming Business

General liability insurance is — generally speaking — one of the most important insurance policies for pet grooming businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Some further policies to look into if you are interested in bolstering the protection of your pet grooming business include:

- Professional liability insurance: Shields your business from the legal costs of a claim due to a mistake it made in the performance of its services.

- Commercial property insurance: Safeguards you from the costs of replacing any property belonging to your business that has been destroyed by covered events.

- Home-based business insurance: Covers problems related to your business that occur at home, which are not typically covered by a standard homeowner’s policy.

When attempting to figure out which insurance provider best suits your business’s needs, it’s worth paying attention to the two key types:

- Traditional brick-and-mortar insurers

- Online insurers

Although brick-and-mortar insurers are traditionally more renowned, online insurers like Tivly and Ergo Next are preferred due to their ability to offer far cheaper policies that match the quality of their traditional counterparts.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

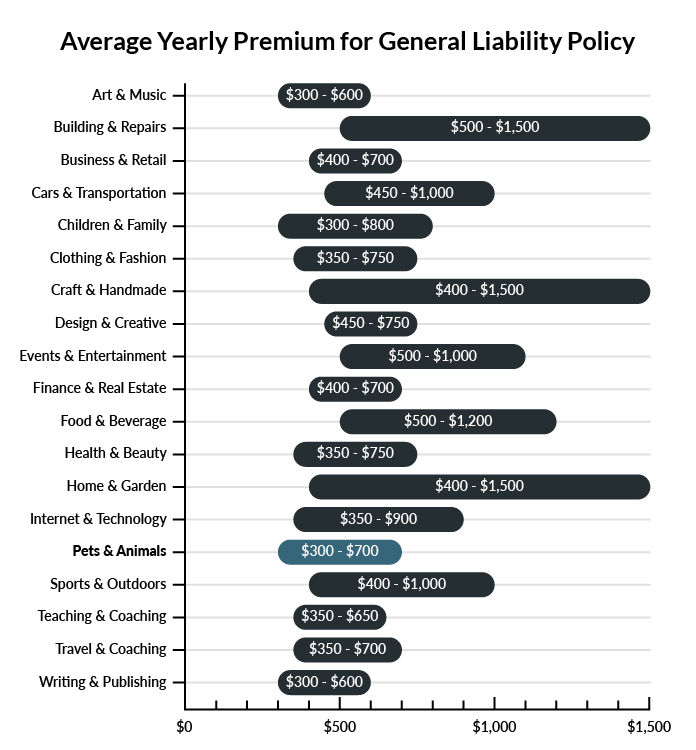

The average pet grooming business in America spends between $300-$700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a pet grooming business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Pet Grooming Business

Example 1: During a shampoo session, a dog in your storefront becomes scared and attacks a customer who is paying by the front desk. In the event of significant injury to the customer, general liability insurance would probably help to cover damages owed by your business or any settlement reached.

Example 2: A distracted employee tries to help multiple customers at once. She neglects one of the dogs in her care, and the dog wanders into the back of the store where it consumes chemical cleaner for the floor. The dog is badly poisoned by the cleaning agent. In the event your grooming business is found liable for this accident, general liability insurance would likely help to cover anything you owed.

Example 3: An expensive cat is frightened during its bathing process and escapes your building. It is hit by a car and badly injured. If liable, your business would probably be covered by general liability insurance for settlements reached or damages owed.

Other Types of Coverage Pet Grooming Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

This policy is helpful for any business in the habit of performing tricky services that could result in significant mistakes or severe client dissatisfaction. A pet-grooming business might find itself in a situation where, for example, its failure to completely rid an animal of lice or fleas causes the pet’s home to become infested. Professional liability insurance keeps businesses covered for any damages or costs incurred through negligence or omissions while undertaking their promised services.

Commercial Property Insurance

A pet grooming business owns plenty of cleaning equipment, products, and other commercial supplies that need to be kept safe and maintained. If these items are destroyed, not to mention the premises on which your business operates, it can mean serious financial trouble. Commercial property insurance helps to cover your business property including equipment, inventory, and owned real estate. Keep your business safe from fires, violent weather, and similar threats with a property policy.

Home-Based Business Insurance

If you run your pet-grooming business from home, this policy will be an important addition to your other coverage. Home insurance often doesn’t cover business-related issues that occur in the home. With this policy, you’re helping to cover accidents that take place in your home during business hours and ones related directly to your business. This can be acquired as part of a business owner’s policy or as a rider extension to the existing homeowner’s policy.

Product Liability Insurance

If your pet-grooming business provides products for sale in addition to its performed services, you may want to look into a product liability policy. This policy will cover damages and injuries caused by products that your business sells. For your grooming business, this may include shampoos, brushes, and other pet supplies. Keep your business covered in the event of product misuse, abuse, and other negative unintended consequences with a product liability insurance policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your pet grooming business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Pet Grooming Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. For a pet grooming business, obtaining business insurance in advance is greatly recommended as it’s one of the means of shielding it from the inherent risks it will face.

Another reason it is so highly recommended is that it is increasingly common for businesses to be required to carry specific policies by law (e.g., workers’ compensation insurance).

Not necessarily. Certain exceptions may be written directly into your pet grooming business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.