Plumbing Business Insurance

Getting insurance for your plumbing business is essential.

Plumbing businesses need to be protected against things like claims of property damage, negligence, and false advertising.

For example, if one of your business’s plumbers accidentally damages a customer’s sink while attempting to repair it, your business could be sued for this property damage.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Plumbing Business

General liability insurance is — generally speaking — one of the most important insurance policies for plumbing businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

By itself, general liability is not enough to fully protect your plumbing business, for that, several additional policies are necessary, such as:

- Commercial property insurance: Provides financial coverage for business property if it is damaged by certain stipulated events.

- Commercial auto insurance: If you decide to invest in a business vehicle, this policy will be required by law as your standard policy will not cover commercial-related accidents.

- Workers’ compensation insurance: Any employees working full or part-time for your business must be protected by this policy.

Keep an eye out for the two distinct types of insurance providers when shopping for your plumbing business’s coverage:

- Traditional brick-and-mortar insurers — Includes companies with a physical storefront.

- Online insurers — Includes companies that only operate online.

Due to the lower overheads of a digital business, online insurers like Tivly and Next are extremely popular due to their ability to marry affordability with reliability.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

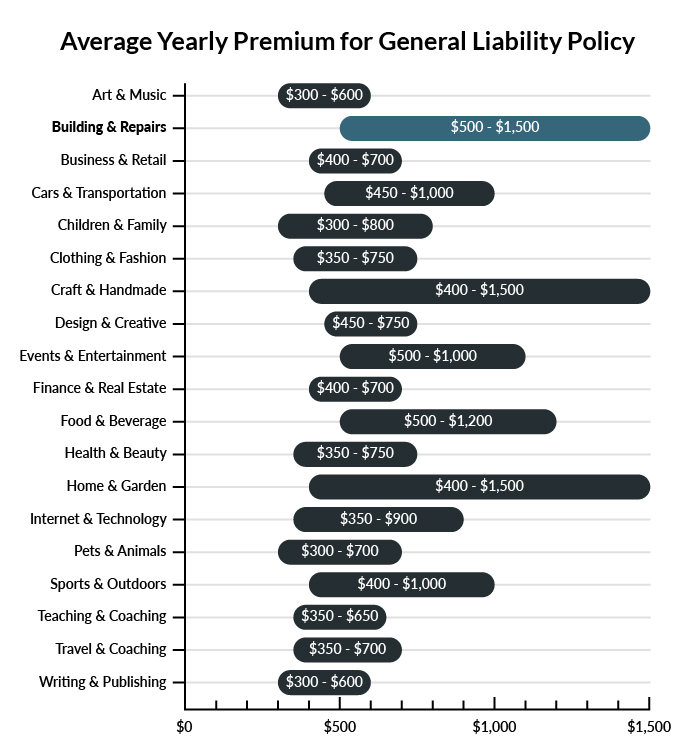

The average plumbing business in America spends between $500 – $1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a plumbing business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Plumbing Business

Example 1: One of your plumbers is working in a customer’s home. He accidentally causes a pipe to leak onto a staircase. To fix it, he heads outside to his vehicle to retrieve a specific type of wrench. The customer walks down the steps while the pipe continues leaking and slips on the staircase, sustaining a broken ankle and a concussion on the way down to the bottom. If your company is found liable, general liability insurance could probably cover some of the damages as ordered by the court or agreed upon in a settlement.

Example 2: While working beneath a sink, one of your plumbers ends up damaging the food disposal unit. After the plumber leaves, the homeowner loses their wedding ring in the drain. As they reach in, the broken disposal triggers and badly damages the homeowner’s hand. General liability insurance would probably help to cover court-ordered payments or any settlement reached in the event your business is found liable.

Example 3: A plumber fails to correctly repair a leaky pipe, fixing the problem for only a day. The leak resumes worse than before, dripping steadily for many hours onto a hardwood floor. The flooring is badly damaged by the excess water and requires a complete replacement. General liability insurance would probably serve to cover some of the cost if found liable in court, or if a settlement were reached.

Other Types of Coverage Plumbing Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

Plumbing companies need plenty of equipment as well as somewhere to store it. If these assets are damaged, it can be disastrous for your business. A wise business owner will acquire a good commercial property policy to protect his or her valuable tools, vehicles, machinery, storage facilities, and other physical items. Commercial property insurance covers damages to owned real estate and company equipment due to disasters like fire and extreme weather.

Commercial Auto Insurance

Reliable trucks or vans can be incredibly beneficial for a plumbing company to own. Hauling lots of heavy tools and equipment to customers’ homes is a normal part of the plumbing business, meaning that if you invest in a commercial vehicle for you or your employees, you may need this policy. Commercial auto insurance covers vehicular damages to your company vehicles, whether they are driven by you personally or by your workers.

Workers’ Compensation Insurance

Most plumbing companies hire a number of plumbers in order to meet the daily demands of local houses and their water systems. Plumbers hired full-time or part-time by your company will need to be covered by a workers’ compensation policy. This insurance keeps them covered in the event of on-site accidents and provides various benefits that result from damages suffered by your workers while on the job.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your plumbing business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Plumbing Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. One of your main concerns when launching your plumbing business should be protecting your venture from the get-go. This means obtaining adequate business insurance to mitigate the common risks inherent to the industry.

On top of giving your business a solid foundation from which to flourish, it also enables it to stay compliant with state laws in cases where specific policies are mandated (e.g., workers’ compensation).

Not necessarily. Certain exceptions may be written directly into your plumbing business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.