Pottery Business Insurance

Getting insurance for your pottery business is essential.

Pottery businesses need to be protected against claims arising from things like breaches of contract, product liability, and intellectual property infringement.

For example, you may face legal action if it accidentally uses a trademarked design on one of its products, or if you fail to meet any contractual obligations (e.g., contract deadlines, etc.).

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Pottery Business

General liability insurance is — generally speaking — one of the most important insurance policies for pottery businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Many additional policies can compound the coverage offered by general liability insurance. Some particularly beneficial ones for pottery businesses include:

- Commercial property insurance: This can cover the cost of replacing damaged physical property belonging to your business.

- Workers’ compensation insurance: A legal requirement if your business employs any workers on a part or full-time basis.

- Commercial umbrella insurance: Useful for ensuring your business remains protected, even if a lawsuit or liability exceeds the limits of your primary policy.

As you go through the process of buying coverage for your pottery business, you’ll realize that insurance providers typically fit into one of two categories:

- Traditional brick-and-mortar insurers — Which includes providers like Hiscox and Nationwide.

- Online insurers — Which includes providers like Tivly and Ergo Next.

Overall, online insurers appear to be the more popular option among businesses as they offer the best of both worlds with great reliability and accuracy at a fantastic price.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

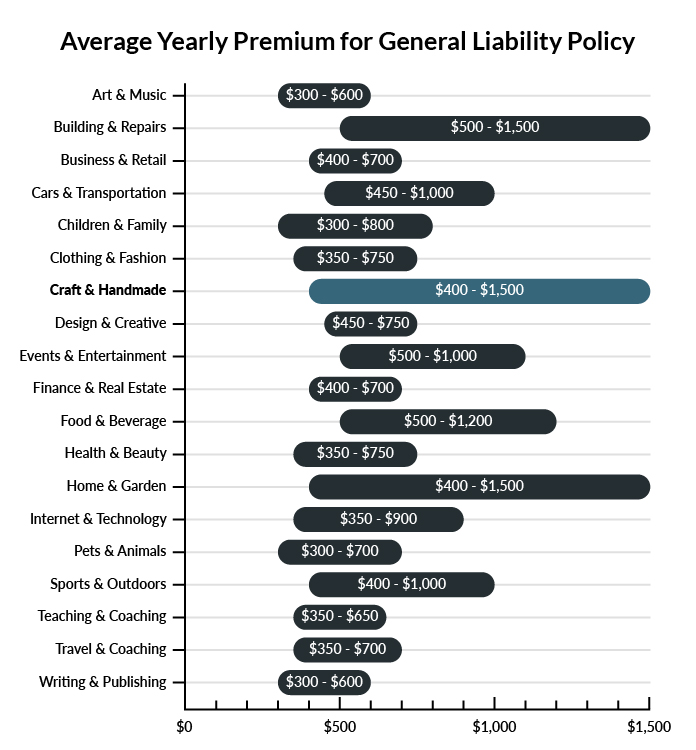

On average, pottery shops in America spend between $400 – $1500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a pottery business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Pottery Business

Example 1: During a beginners’ class, a student accidentally leans on what they think is a dormant kiln and sustains severe burns on their arm and back. General liability insurance would cover the student’s medical bills as well as your legal fees and any awarded payout if they decide to sue.

Example 2: An unscheduled delivery of clay arrives when your shop is understaffed so you ask the driver to unload it on your receiving dock by themselves. The driver doesn’t realize the dock ramp is already down and, without your guidance, hits the ramp. The impact crushes his rear bumper and damages his wheel well. General liability insurance would cover the vehicle repair costs and replace your broken ramp.

Example 3: A customer arrives before opening hours to pick up an order and slips on the newly mopped floor. The resulting fall leaves them badly injured and upset that you did not display a “caution” sign so they threaten to sue. General liability insurance would cover the customer’s medical bills as well as your legal costs and any settlements from a lawsuit.

Other Types of Coverage Pottery Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

You’ve made major investments to create an inviting space for your customers with the right kilns, furniture, and other pottery equipment. If you own the building in which you operate, you’re responsible for all business-related property housed there in the event of a fire or other natural disaster. Commercial property insurance would cover the cost of repairing or replacing your equipment after an accident so you can reopen as soon as possible.

Workers’ Compensation Insurance

Most states require businesses to carry workers’ compensation insurance for their part-time and full-time employees. This coverage protects your employees if they become injured at work or fall ill after a work-related accident. It not only covers an employee’s medical bills and lost wages if they need time to recover but also any disability benefits stemming from a work-related accident.

Commercial Umbrella Insurance

Even the most responsible business owners sometimes face an accident or lawsuit so catastrophic that it threatens to exhaust the limits of their primary insurance coverage. Commercial umbrella insurance protects you from paying out-of-pocket for any legal fees and awarded damages that exceed your primary policy.

Commercial Auto Insurance

Your personal auto coverage won’t pay for damages from a work-related accident when you use your personal car to make deliveries or complete other business duties. Commercial auto insurance protects your employees and other drivers in the event of a work-related accident.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your pottery business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Pottery Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. While the process of launching a pottery business is filled with important tasks, it is paramount to prioritize obtaining business insurance before its opening.

This is not only due to how prone to risk this type of business can be, but also the fact that your business may also be legally obligated to purchase certain types of insurance (e.g., workers’ compensation).

Not necessarily. Certain exceptions may be written directly into your pottery business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.