Pressure Washing Insurance

Getting pressure washing insurance is essential.

Pressure-washing businesses need business insurance to protect against professional malpractice and property damage.

For example, you could damage a customer’s home with your pressure washer and face legal fees even if found not liable.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Pressure Washing Insurance Types

General liability insurance is — generally speaking — one of the most important insurance policies for pressure washer businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance offers extensive coverage for your business, there are certain risks that may not be covered by this type of insurance. To address these potential risks, it would be wise to explore additional policies as a way to mitigate them.

- Commercial auto insurance: A commercial auto insurance policy is needed for your company vehicles, as any accidents you or your employees get into on the job won’t be covered by your standard auto insurance.

- Professional liability insurance: This type of insurance provides protection against allegations of professional negligence or failure to provide proper advice or service. In the event of a lawsuit, legal fees and damages will be covered.

- Workers’ compensation insurance: If one of your employees gets sick or injured due to the work they’re performing on the job, this type of insurance will cover their medical bills and related expenses.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Pressure Washing Insurance Cost

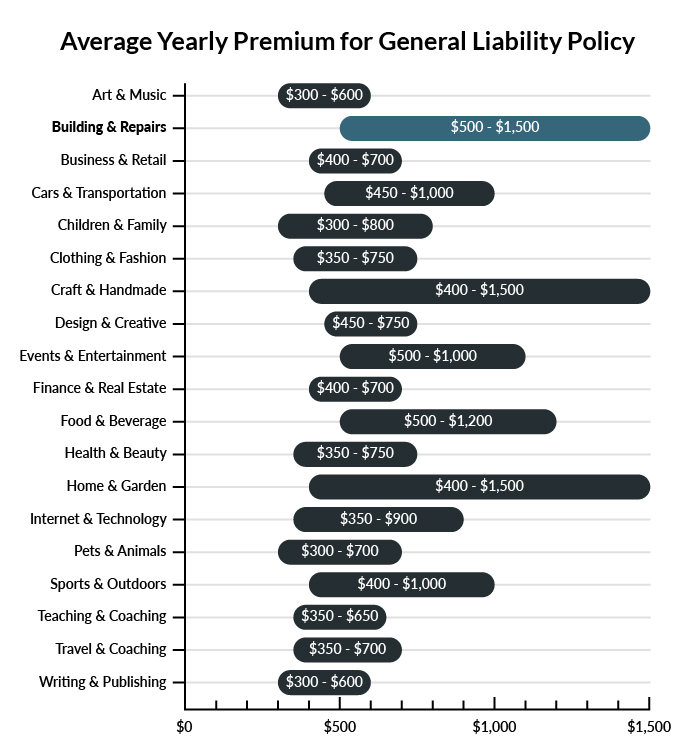

The average pressure washing business in America spends between $500-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a pressure washing business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Pressure Washing Business

Example 1: To clear the stubborn grime from the grooves in a concrete surface, you use your highest-intensity nozzle. You accidentally drop the hose, and the pressured stream passes over your client’s hand, producing a laceration that requires medical attention. In the event you are found responsible, general liability insurance would probably cover any damages you are asked to pay.

Example 2: Your employee is pressure washing a client’s expensive modern vehicle, but he underestimates the potency of the water stream. While focusing on the front bumper, he cracks the surface and leaves a very noticeable dent. Due to the car’s specialized modern build, replacement parts and repairs for the damaged section amount to a sizeable claim. If your company is held liable, general liability insurance would likely be able to cover some amount of what you owe.

Example 3: A new employee in your business uses an electric pressure washer to scrub the dirt and grime from a farmer client’s pig crates. Due to an interior electrical fault, an exposed metal surface on the washer becomes energized. It comes into contact with pooling water from the crates and starts a fire, destroying a large chunk of the client’s barn and livestock pens. In a case like this, general liability insurance would assist your company in covering lawsuits or settlements resulting from the accident.

Other Types of Coverage Pressure Washing Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

As a business that thrives on its use of complex, specialized equipment, commercial property insurance is a must-have. Different washer units and their accessories, like spray nozzles and motor/electrical components, will be expensive to replace or repair. This policy will allow pressure washing businesses to protect some of their most important equipment investments. Fire, storms, explosions, and vandalism are commonly covered in commercial property insurance policies.

Your business will need a storage center for its equipment and vehicles, and this insurance will also cover any owned real estate on which you maintain your important supplies. Fires and destructive weather are examples of what may be covered by your commercial property insurance with regard to real estate.

Commercial Auto Insurance

You’ll need reliable transportation for your pressure washing equipment, and that usually means trucks or vans. For any business that uses vehicles on public roads, commercial auto insurance is required by the state. Your vehicles will be essential assets to company productivity, so skipping auto insurance is out of the question. This policy will cover a variety of damages to vehicles, and potential items for coverage can include standard cars, trucks, or even trailers.

In addition to the policies outlined above, there are a few other types of coverage your pressure washing business may require depending on certain aspects of your operations. Some of these might not apply to you, so be sure to ask your agent which policies are right for your business.

Workers’ Compensation Insurance

A pressure washing business may start small, but as it grows, a compensatory policy for employees will become a priority. In some states, part-time or full-time employees will legally require a business to take out a workers’ compensation policy. This covers a range of on-the-job mishaps, including those resulting in medical intervention, disability, or death. High-pressure washing units require careful, professional handling in order to meet safe working standards. Even if you trust your employees, a good compensation policy is ultimately in everyone’s best interests.

Crime Insurance

A pressure washing business cannot function without its expensive service equipment. It is natural to give your employees easy access to the utility storage locations in which you house washing units, company vehicles, and other valuable items. However, in the event that an employee abuses their company access to steal your equipment, crime insurance is a smart way to recoup the losses incurred as you replace the stolen goods.

This policy may also cover employee dishonesty along the lines of deliberate property damage, theft of securities, or even the direct theft of money by accounting staff or similar office workers.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your pressure washing business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Pressure Washing Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

For a pressure washing business to start operations, obtaining business insurance is essential due to the particular risks that it faces. Failing to secure adequate protection before starting the store could result in significant liability and financial insecurity.

In addition, not having insurance could lead to legal issues, especially if certain policies like workers’ compensation insurance are mandatory.

Not necessarily. Certain exceptions may be written directly into your pressure washing business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.

The cost of pressure washing insurance can vary depending on the size of your business, the types of services you offer, your location, and your claims history. It’s essential to work with an experienced insurance provider who can help you understand the different types of coverage available.

While the cost of pressure washing liability insurance may seem like an additional expense, it’s important to remember that the cost of not having adequate insurance coverage can be much more significant. Investing in the right coverage will protect pressure-washing contractors and ensure that you can continue to provide pressure-washing services.