Professional Meditation Business Insurance

Getting insurance for your professional meditation business is essential.

Professional meditation businesses need to be protected against things like claims of breach of contract, misrepresentation, and negligence.

For example, a customer might claim that you didn’t provide the services you promised or that your meditation techniques don’t work for them and were a waste of money.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Professional Meditation Business

General liability insurance is — generally speaking — one of the most important insurance policies for professional meditation businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Although general liability insurance offers comprehensive coverage, there may be specific risks that your business could encounter which are not covered by this type of insurance. In order to reduce these risks, it may be advisable to explore other insurance policies.

- In the event of a data breach where your clients’ online information is stolen by hackers and you face potential lawsuits, data breach insurance can help cover legal fees and any resulting judgments.

- Commercial property insurance can protect all the physical assets that your business relies on, such as computers, printers, and other equipment.

- If you or your employees use a company vehicle, you’ll need commercial auto insurance to cover any accidents that occur while on the job that may not be covered by your personal auto insurance.

When searching for an insurance provider, it is important to keep in mind that there are two main types of providers, each with its own advantages and disadvantages depending on your particular circumstances. The first type includes traditional brick-and-mortar insurers such as Nationwide or Allstate, while the second type consists of online insurers like Ergo Next or Tivly.

In general, if you’re a small business owner, it is highly recommended to consider online-based insurers as they are often the most cost-effective and offer high-quality insurance coverage.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

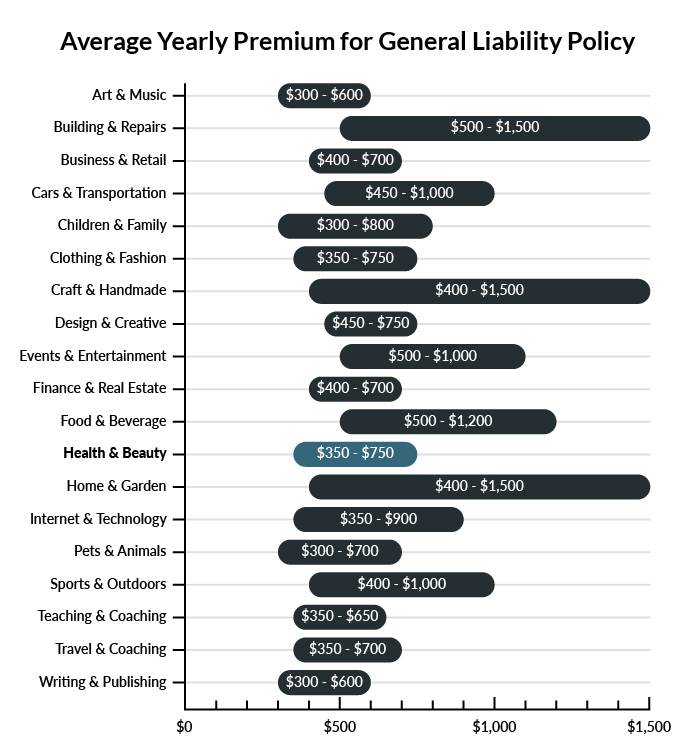

On average, professional meditation businesses in America spend between $350 – $750 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a professional meditation business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Professional Meditation Business

Example 1: You’ve decided to see an important VIP client before regular business hours to help accommodate her schedule. She arrives at her appointment while your cleaners are still in the building and slips on the wet lobby floor, seriously injuring herself. Your general liability insurance will likely cover her medical bills and your legal fees if there is a lawsuit.

Example 2: Your loading dock door is damaged, making it necessary to receive shipments through an alternate entrance. An employee unloads the van through the front lobby but loses control of the dolly and sends it slamming into a customer. The customer is seriously injured and threatens to take you to court. General liability insurance will likely pay for their medical expenses and any settlement payouts.

Example 3: After successfully launching a new advertising campaign for your business, you receive an influx of new clients. Unfortunately, a competitor has also seen the new television commercials and believes you’ve libeled their business. Your general liability policy will likely pay for your legal fees and any damages if you settle the claim out of court.

Other Types of Coverage Professional Meditation Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Workers’ Compensation Insurance

Most states require any business with part-time or full-time employees to carry workers’ compensation insurance. This coverage will help to cover an employee’s medical bills if they are injured at work or become ill following a work-related accident. Additionally, if they are unable to return to work, they may be eligible to receive disability benefits.

Professional Liability Insurance

If a client believes that your advice has resulted in an injury or other issues, they may seek damages. In this case, professional liability insurance will pay for your legal fees and, any settlement payments.

Commercial Property Insurance

To create a tranquil and welcoming atmosphere at your office, you’ve probably invested a great deal of time and money into your equipment, furniture, and other tools of the trade. If any of these items are damaged or destroyed in a fire or other disaster, it’s likely that it would be very costly to replace them out-of-pocket. Commercial property insurance will cover the cost to replace or repair these items.

Data Breach Insurance

Offering a rewards program for your returning clients is a great way to thank them for their loyalty. But to do so, you must keep some of their important personal and financial information on file. If your computer system is ever breached by cyber attackers, this insurance policy will help to protect your business from potential lawsuits.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your professional meditation business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Professional Meditation Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. It is essential for a professional meditation business to have business insurance before launching because there are certain risks associated with the business that could result in significant liability and financial instability.

In addition, some insurance policies may be mandatory by law, such as workers’ compensation insurance. Failing to obtain them could lead to legal issues for the company.

Not necessarily. Certain exceptions may be written directly into your professional meditation business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.