Resale Business Insurance

Getting insurance for your resale business is essential.

Resale businesses need to be protected against things like claims of product liability, personal injury, and property damage.

For example, if a customer slips and falls in your resale store, your business could face a costly lawsuit for this personal injury.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Resale Business

General liability insurance is — generally speaking — one of the most important insurance policies for resale businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Resellers can benefit from additional types of business insurance to round-out the perfect coverage for their enterprise:

- Product liability insurance: This type of coverage protects your business against claims arising from defective products it may have sold.

- Property insurance: This policy covers the financial loss of damage done to your business’s physical assets due to events such as fire or theft.

- Commercial property insurance: Covers loss or damage to physical assets such as inventory, equipment and buildings due to theft, fire or natural disasters.

Your resale business can opt to purchase its coverage from one of two types of insurance providers:

- Traditional brick and mortar insurers: These insurers offer a face-to-face relationship for those who prefer more personalized attention. These agents may be able to guide you through the insurance purchase, offering advice along the way.

- Online Insurers: These insurers provide a more streamlined experience than traditional agencies. Due to their online approach, they usually offer faster policy processing times, automated underwriting, and easy online access to documents. Plus, their policies are typically much less expensive as the operating costs of an online business are far lower.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

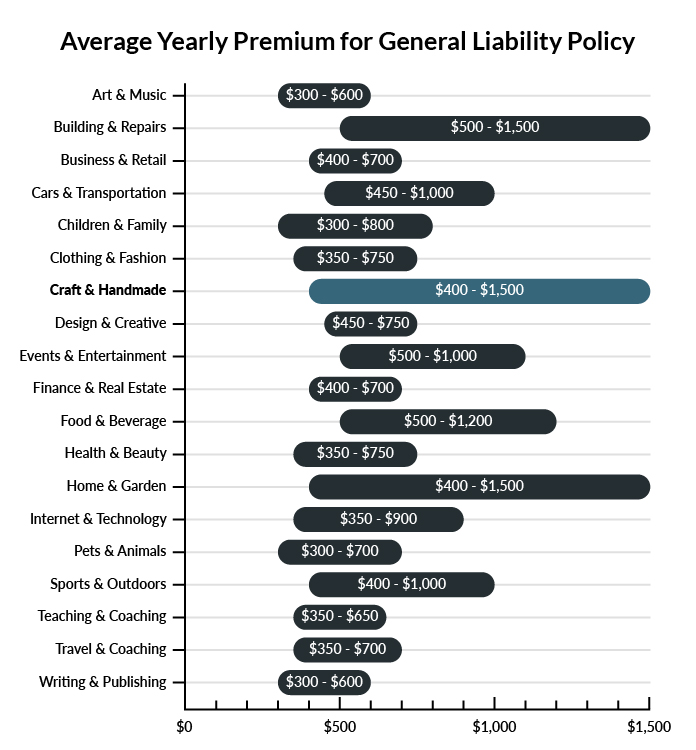

The average resale business in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a resale business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Resale Business

Example 1: A potential client comes to your place of business. During the visit, one of your employees accidentally knocks the woman over with a dolly stacked with boxes. She falls and breaks her elbow. Your general liability insurance policy would likely cover the costs of her medical treatment.

Example 2: You hire a marketing firm to help with a new advertising campaign. Although the response is positive, you also get an email from a competitor. He is suing you for damaging his business with your advertising. Your general liability insurance policy will pay for your legal fees, including a settlement if necessary.

Example 3: You are delivering a table to a buyer when your employee stumbles and crashes into the china cabinet of the homeowner. Your general liability insurance policy would likely cover the cost of replacing the property of your customer.

Other Types of Coverage Resale Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Product Liability Insurance

As a seller of products, it is important to protect yourself from liability related to those products. Product liability insurance will provide protection. Should a customer try to hold you responsible for damage or injury caused by a product you sold, your insurance will pay for your legal fees and any settlements if they are required.

Commercial Property Insurance

All of the products you purchase for resale took an investment on your part to acquire. If they were lost due to an unexpected event, like a fire, it would be expensive to replace them. Commercial property insurance helps you pay to replace your commercial property after a covered event like a fire or a storm.

Commercial Auto Insurance

If you have one or more vehicles that you use primarily for business, commercial auto insurance will provide the coverage required by law in your state. If you or an employee are involved in an accident, the insurance policy will help pay for the cost of repairing or replacing the vehicle. It will also help pay for medical treatment for those injured in the accident.

Workers’ Compensation Insurance

If you are an employer, your state most likely requires you to carry workers’ comp insurance. Your policy will pay for medical treatment for employees who are injured while doing work-related tasks. It will also help to pay lost wages for injured employees while they are unable to work.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your resale business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Resale Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, it’s advisable to purchase business insurance for your resale business long before you open up for business.

This is due to the high probability of accidents and other risks your resale business can expect to face, which can threaten its financial stability in the long run.

Not necessarily. Certain exceptions may be written directly into your resale business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.