Ski Resort Business Insurance

Getting business insurance for your ski resort is crucial.

This is because you will need to protect your assets against a variety of different risks, such as personal injuries within the resort, property damage, and employment law disputes.

For example, business insurance can cover the costs associated with compensating a third party that becomes injured in your resort (e.g., due to a ski instructor’s negligence, etc.).

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Ski Resort

General liability insurance is — generally speaking — one of the most important insurance policies for ski resorts.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Even so, you will likely benefit from purchasing additional coverage. This is because a general liability policy will not be enough to holistically cover you from every foreseeable risk.

Additional coverage that you will likely want to consider includes:

- Commercial property insurance — Protects your commercial ski resort equipment against damage.

- Workers’ compensation insurance — Will cover the cost of compensating a ski instructor or other employee in the event that they get injured.

- Commercial umbrella insurance — Covers the same risks as a general liability policy, but will only kick in if your general liability coverage is not enough to cover all damages.

Next, you will need to find the right insurer for your ski resort business; even though there are several great options available, they all fall within one of the following two categories:

- Traditional brick-and-mortar insurers (e.g., Hiscox, CNA, etc.).

- Online insurers (e.g., Tivly, Ergo Next Insurance, etc.).

The main difference between the two options is that online insurers use AI in order to offer personalized coverage (rather than an insurance agent).

This allows them to benefit from having lower operating costs, which in turn translates into lower prices.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

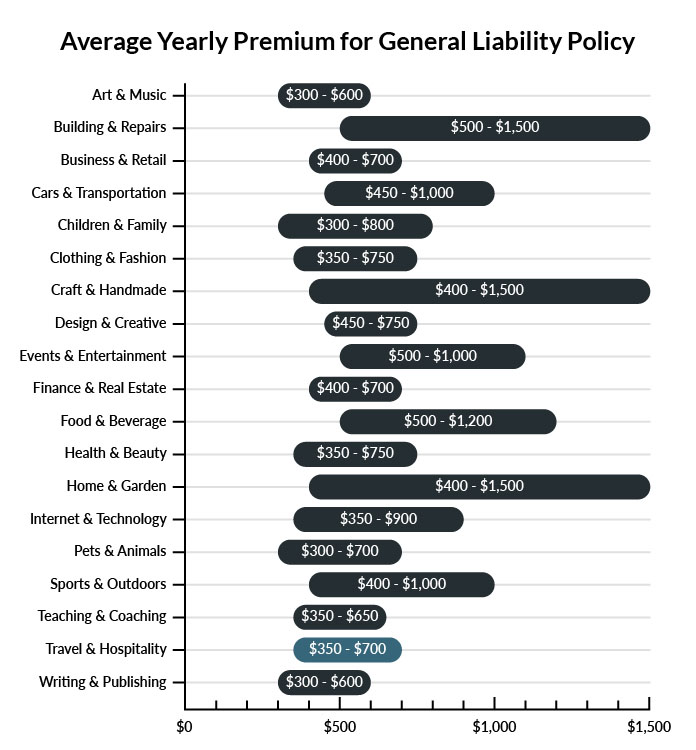

On average, ski resorts in America spend between $350 – $700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a ski resort to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Ski Resort

Example 1: During a routine ski lift ride, the lift malfunctions and injures a guest as they exit the lift. General liability insurance would cover the injured guest’s medical treatment.

Example 2: After a skier accidentally knocks one of your “black diamond” signs over, another guest without the appropriate skill level takes on the course and injures himself. General liability insurance would pay for the injured guest’s medical expenses.

Example 3: While operating a piece of equipment, one of your employees accidentally backs into a guest’s car in the parking lot. General liability insurance would cover the cost of the guest’s vehicle repair costs.

Other Types of Coverage Ski Resorts Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

You made a major investment in the equipment, supplies, and real estate needed to establish your ski resort. In the event of a fire, theft, or natural disaster, commercial property insurance would cover the cost of repairing or replacing your business-related property. This includes structural damage to your buildings, grounds, and ski slopes.

Business Interruption Insurance

If you need to close your ski resort temporarily after a fire, avalanche, or other covered events, it could take weeks, months, or even years to complete the necessary repairs. Business interruption insurance helps cover your expenses and lost revenue until you can reopen.

Workers’ Compensation Insurance

Most states require businesses to carry workers’ compensation insurance for their part-time and full-time workers. This coverage protects your employees if they become injured at work or fall ill after a work-related accident. It not only covers an employee’s medical bills and lost wages if they need time to recover but also any disability or death benefits stemming from a workplace accident.

Commercial Auto Insurance

Any vehicle you use primarily for business — such as to transport employees or guests — requires commercial auto insurance to protect the vehicle, driver, and others on the road in the event of an accident. Be sure to select a policy that covers not only accident-related vehicle repair costs and medical treatment for anyone injured but also sufficient protection for any business equipment you carry in your vehicle.

Professional Liability Insurance

While you strive to provide accurate guidance to your guests, there’s always a chance someone might decide you failed to provide pertinent information or made a mistake during a ski lesson that caused them injury. If a client sues your business for negligence, professional liability insurance would cover your legal fees and any required settlement.

Liquor Liability Insurance

If you sell any alcoholic beverages on your premises, liquor liability insurance would cover both property damage and legal fees that may arise from the consumption of alcohol you sold.

Commercial Umbrella Insurance

While your general liability insurance policy covers most claims, some accidents or lawsuits may be so catastrophic that they threaten to exhaust the limits of your primary coverage. Commercial umbrella insurance protects you from paying out-of-pocket for any legal fees and awarded damages that exceed your primary policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your ski resort:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Ski Resort Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Generally speaking, yes. Getting business insurance before you start your ski resort is generally recommended because it is the safest way of ensuring that you will not have to cover the cost of an accident or of replacing damaged property without any help.

Not necessarily. Certain exceptions may be written directly into your ski resort insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.