Summer Camp Business Insurance

Getting business insurance for your summer camp is essential.

Summer camps need to protect themselves against a variety of different risks, particularly in relation to customer injuries and employee negligence.

You will also want to protect your camp’s equipment, structures, and other business assets from potential damage.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Summer Camp

General liability insurance is — generally speaking — one of the most important insurance policies for summer camps.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Here are some other types of insurance that a summer camp should consider:

- Professional Liability Insurance: Also known as Errors & Omissions (E&O) Insurance, this protects against claims of negligence related to professional services or advice. For example, if a parent alleges that their child was harmed because of improper supervision or instruction, this coverage could protect the camp.

- Accident & Health Insurance: This coverage provides benefits for medical expenses resulting from an accident during camp activities. It can act as a supplement to parents’ health insurance and help cover costs like deductibles and copays.

- Directors & Officers Liability Insurance (D&O): This provides protection for the camp’s board members and officers against legal action brought for alleged wrongful acts in their capacity as directors and officers. It can cover legal fees, settlements, and other costs.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

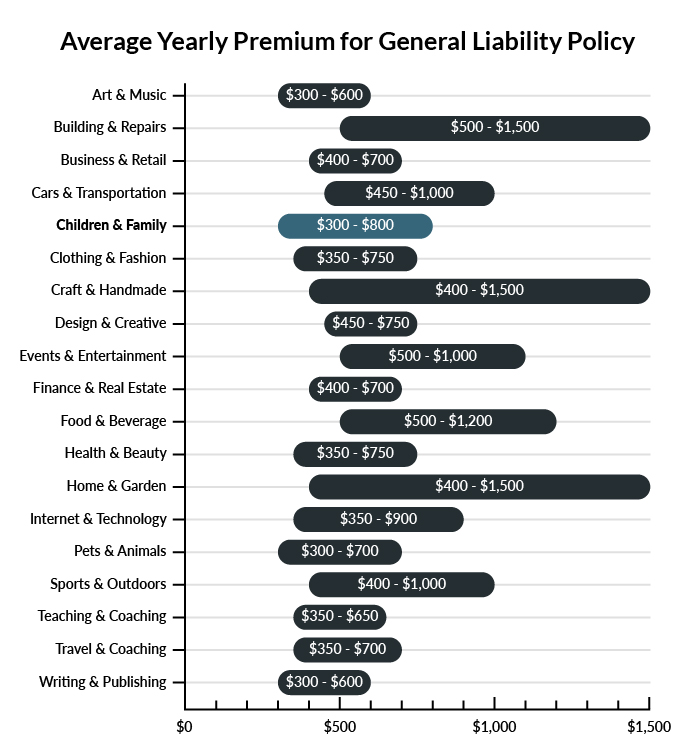

On average, summer camps in America spend between $300 – $800 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a summer camp to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Summer Camp

Example 1: A visiting parent slips on the pool deck and needs stitches on his forehead. General liability insurance would cover the parent’s trip to the emergency room and any resulting medical bills.

Example 2: On a canoe trip, one of your counselors drops a cooler in a rented canoe and dents the bottom. The canoe company asks you to replace the damaged canoe. A general liability policy would cover the canoe repair or replacement costs.

Example 3: During a small fireworks display on the last night of camp, a falling flame burns a local homeowner as they walk by the property. General liability insurance would cover damage to the homeowner’s clothing and any medical bills resulting from the incident.

Other Types of Coverage Summer Camps Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

If your camp owns the buildings in which it operates, you need commercial property insurance to cover the buildings and business property stored there in the event of a fire, burglary, or natural disaster. Be sure to carefully consider any build-outs and renovations to your buildings—as well as replacement costs for your business property—when securing coverage.

You can typically purchase this coverage as part of a business owner’s policy (BOP).

Workers’ Compensation Insurance

Most states require businesses to carry workers’ compensation insurance for their part-time and full-time employees. This coverage protects your employees if they become injured at work or fall ill after a work-related accident. It not only covers an employee’s medical bills and lost wages if they need time to recover but also any disability benefits stemming from a work-related accident. While your state may allow exemptions for business owners, consider including yourself in your workers’ compensation policy if you engage in the daily operation of the business.

You can typically purchase workers’ compensation insurance as a standalone policy.

Commercial Auto Insurance

If your camp owns a van to transport campers or to conduct other business, state law requires you to carry at least state-mandated minimum levels of commercial auto insurance. Since the minimum requirement only offers basic protection, consider purchasing limits greater than those required by state law.

You can typically purchase commercial auto insurance as part of a business owners’ policy (BOP).

Commercial Umbrella Insurance

Summer camps often face sizable risks and, while your general liability policy covers most claims, some accidents or lawsuits may be so catastrophic that they threaten to exhaust the limits of your primary coverage. Commercial umbrella insurance protects you from paying out-of-pocket for any legal fees and awarded damages that exceed your primary policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your summer camp:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Summer Camp Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, you do.

Even though it isn’t always a legal requirement, getting business insurance before you start operating is generally recommended because it is a relatively inexpensive way of ensuring that you will not have to face a legal dispute while being uninsured.

Not necessarily. Certain exceptions may be written directly into your summer camp insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.