Surfing School Business Insurance

Getting business insurance for your surfing school is essential.

This is because surfing schools need to be protected against things like negligence claims, property damage disputes, and bodily injuries.

You will also want to protect yourself against employment law-related claims, such as wrongful termination accusations and payment disputes.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Surfing School

General liability insurance is — generally speaking — one of the most important insurance policies for surfing schools.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Even so, you will likely benefit from purchasing additional coverage; this is because a general liability policy will not be enough to adequately protect you from all relevant risks.

Additional coverage options you should consider include:

- Commercial property insurance (property damage)

- Workers’ compensation insurance (employee disputes)

- Business interruption insurance (lost income)

You will also need to spend some time in order to find the right business insurer for your unique needs.

Even though there are several great options, we recommend going with an online insurer that offers customizable coverage without needing to use an insurance agent.

This is because these types of insurers (e.g., Tivly, Ergo Next, etc.) have significantly lower operating costs and are thus able to offer much more affordable rates in comparison to their more “traditional” brick-and-mortar counterparts.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

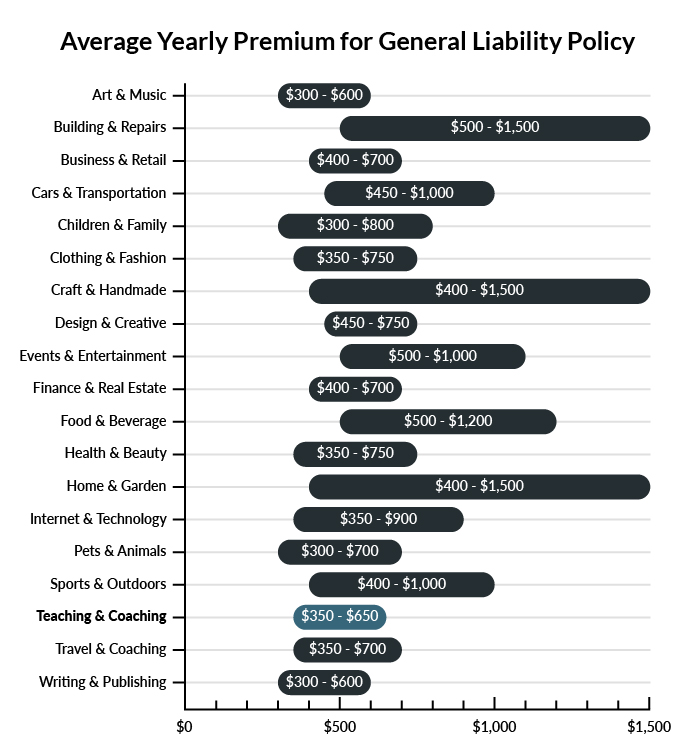

On average, surfing schools in America spend between $350 – $650 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a surfing school to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Surfing School

Example 1: While trying to catch a wave, your student falls and is hit in the head by the fin of their board. Despite having signed a waiver assuming certain risks, she’s named the school in a lawsuit. While you might ultimately be exonerated, you will need legal representation. General liability insurance would cover the legal fees and any payout awarded by the courts for injury.

Example 2: Several of your students store their surfboards at the school on off days. An employee fails to properly secure the property before leaving for the evening and thieves steal everything of value. General liability insurance would cover the cost to replace your students’ boards.

Example 3: Unbeknownst to you, your website designer uses a photo on the school’s new site that is copyright protected. The photo owner is suing both you and the designer for copyright infringement. A general liability policy would cover your legal representation and damages the court orders the school to pay.

Other Types of Coverage Surfing Schools Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

Your students rely on your professional expertise to ensure they meet their surfing goals. If a client claims they are wronged or harmed due to your professional negligence, they have a right to sue you for damages. Professional liability insurance, also known as Errors and Omissions (E & O) insurance, covers associated legal costs and court-awarded damages.

Commercial Property Insurance

Commercial property insurance provides coverage for owned buildings and their contents, should a covered loss such as a natural disaster, fire, or theft occur. Business owners should discuss their business model and financial responsibilities with an insurance agent to properly protect their business investments.

Commercial Auto Insurance

Vehicles used for business purposes are specifically excluded on personal auto policies. If you use your vehicle for business purposes, you must obtain commercial auto insurance to fill any gaps in coverage. This policy covers the cost to repair or replace third-party property, the company’s damaged vehicle, and any equipment damaged in an accident. Purchasing the state-mandated minimum coverage leaves many entrepreneurs underinsured. Therefore, we encourage you to discuss policy coverages at length with your insurance professional.

Inland Marine Insurance

If you and your team frequently take business-owned tools and equipment offsite, an inland marine policy may be necessary. Commercial property insurance covers against a loss at the insured location, but limits the coverage while in transit or at another property. Inland Marine Insurance fills this coverage gap.

Workers’ Compensation Insurance

Once your business has grown enough to hire a team, your state will require a workers’ compensation policy. This covers medical bills associated with an on-the-job injury, employee lost wages, and legal representation for the business owner if a lawsuit is filed.

Business Interruption insurance

If you experience a commercial property loss, your business could face a serious financial setback. Business interruption insurance provides loss of income and fixed expense coverage, and assists in moving the insured to a temporary location while their claim is being settled.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your surfing school:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Surfing School Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, you do. This is because you will want to avoid liability before it arises, and this isn’t something that you will be able to predict.

The most sensible approach is generally to purchase your business insurance before you begin purchasing equipment and/or interacting with clients.

Not necessarily. Certain exceptions may be written directly into your surfing school insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.