Travel Agency Business Insurance

Getting business insurance for your travel agency is essential.

Travel agencies need to be protected against claims involving things that could reasonably occur and cause them significant financial damage, such as employment or contract law-related disputes and professional negligence.

For example, an employee happens to get injured while on the job and requires medical leave, or a client claims an agent caused them unnecessary financial loss from a vacation.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Travel Agency

General liability insurance is — generally speaking — one of the most important insurance policies for travel agencies.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Having said that, it is important to remember that not all travel agencies will be fully covered by a general liability policy.

This means that, depending on your agency’s unique risks, it may be a good idea to consider purchasing additional coverage, such as

- Commercial auto

- Workers’ compensation

- Business income

You will also need to decide what coverage provider you will work with; there are two different types available for small business owners:

- Traditional brick-and-mortar insurers (e.g., The Hartford, CNA, etc.).

- Online insurers (e.g., Ergo Next Insurance, Tivly, etc.).

We recommend going with an online insurer because they are generally significantly more affordable and time-efficient due to the lower overhead involved.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

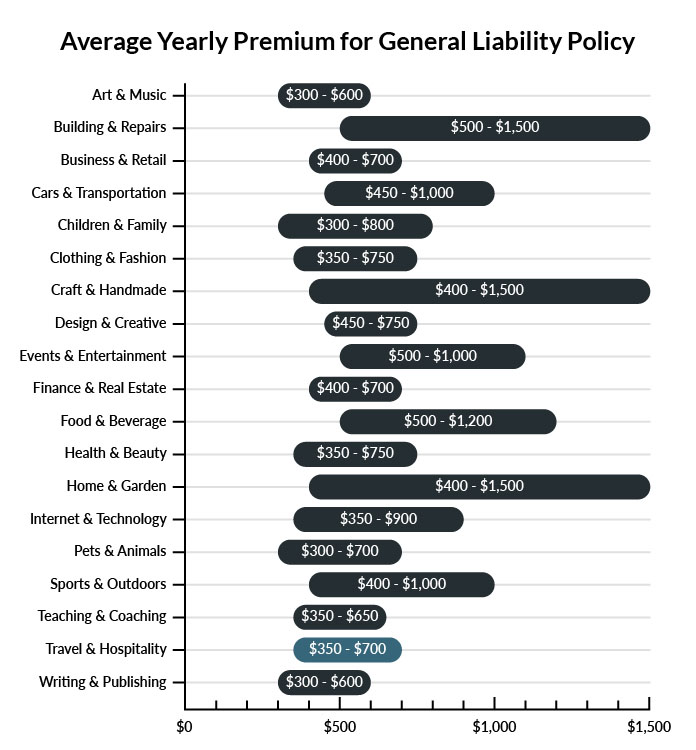

The average travel agency in America spends between $350-$700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a travel agency to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Travel Agency

Example 1: An employee in your agency often tells customers horror stories about trips gone wrong that were scheduled through another local travel agency. He doesn’t use the agency’s name specifically, but word gets around to the other business, which sues your agency for slander. In a case like this one, general liability insurance would likely cover either a settlement or a court-ordered damage estimate owed to the other agency.

Example 2: Backing out of your parking spot after a long day, you fail to check your rear-view mirror and T-bone another car as it passes behind you. The other car’s driver-side door is crushed. The accident occurs on your business’ property, which means that general liability insurance would probably cover some amount of damage to the other driver’s car, as well as any medical payments for which a court found you liable.

Example 3: As you go over itinerary details with a customer in your office, her young child unplugs a computer monitor and pulls it off a desk and onto his head, causing injuries that require medical attention. If found liable, you could probably count on general liability insurance to cover medical expenses or any settlement reached.

Other Types of Coverage Travel Agencies Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Business Interruption Insurance

In the event that your storefront is destroyed or severely damaged, usually through forces like fire or tornadoes, business interruption insurance can help your travel agency get back on its feet. This policy covers estimated losses in revenue during a temporary period of commercial inactivity. Additionally, if your business requires a temporary relocation, this policy may cover the expenses accrued from the move. Business interruption insurance can keep your travel agency alive and kicking as it recovers from a major disaster.

Professional Liability Insurance

Travel agents don’t simply book flights and cruises. They can organize and book lodging, tourist activities, and more. A travel agent is not immune to error though. Scheduling errors, bad advice, or poor communication can result in negative customer experience.

While many trips are intended to be relaxing vacations, a travel agent can be found liable in the event that their advice or trip management results in damages to the customer. Keep your agency and your employees covered with professional liability insurance, which will cover workers who accidentally ruin business travelers’ trips or cause injury through poor advice.

Workers’ Compensation Insurance

A growing company’s needs will include more agents to handle an increase in customers. Once you employ part-time or full-time workers, it is legally required to carry workers’ compensation insurance. These policies typically include disability and death benefits in the event that an employee is injured or killed at work.

Data Breach Insurance

Much of the modern travel agent’s work includes digital data entry, including customer itineraries, destinations, hotels, and debit or credit card info. In the event that your devices or network are breached, your business could be found liable and be required to compensate for customer losses of any kind.

Hackers and online scammers continue finding cleverer methods of digital theft, and data breach insurance can protect your company from damaging legal action.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your travel agency:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Travel Agency Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, you do.

Since you will not be able to accurately predict when your agency will need business insurance, we generally recommend acquiring it before you begin interacting with your clients.

All in all, this can end up saving you thousands of dollars in the long term.

Not necessarily. Certain exceptions may be written directly into your travel agency insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.