Voice-Over Service Insurance

Getting business insurance for your voice-over-service is essential.

This is because voice-over services need to protect themselves against things that could reasonably occur and cause them financial losses, such as work-related injuries, employment law disputes, and negligent acts or omissions.

You will likely also want to protect your business’s assets (e.g., recording equipment, etc.) from damage and/or theft.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Voice-Over Service

General liability insurance is — generally speaking — one of the most important insurance policies for voice-over services.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Even so, your voice-over service may benefit from purchasing additional coverage; this is because a general liability policy is not always enough to holistically protect your business from all of its unique risks.

Additional policies you may want to consider include:

- Commercial property insurance will cover the cost of repairing or replacing your recording equipment in the event that it gets damaged or stolen.

- Workers’ compensation insurance will protect your business from employee-related risks, such as those that relate to wrongful termination claims.

- Business income insurance will cover part of your lost income in the event that you halt operations due to a covered risk.

Moreover, you will need to decide what type of business insurer you will go with; there are two general types available as of 2026:

- Traditional brick-and-mortar insurers (e.g., Nationwide, etc.).

- Online insurers (e.g., Ergo Next Insurance, etc.).

In most cases, we recommend going with an online insurer due to the fact that you should be able to find coverage that is tailored to your business’s unique risks at a much more affordable rate. This is because online insurers have significantly lower operating costs.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

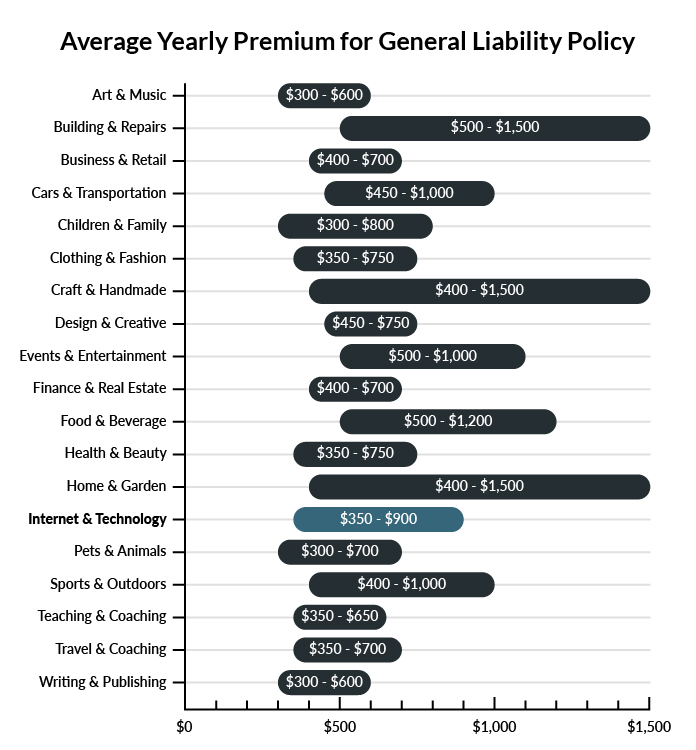

On average, voice-over services in America spend between $350 – $900 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a voice-over service to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Voice-Over Service

Example 1: You record a voice-over session for one movie, but release the wrong soundtrack to a different film. Your client is unable to meet their deadline and sues for breach of contract. General liability insurance would cover the costs associated with the lawsuit.

Example 2: Your employee damages one of your client’s vehicles when they’re trying to maneuver a bulky package to the door. General liability insurance would pay for the costs to fix your client’s car.

Of course, this is not an exhaustive list of perils a general liability insurance policy will cover, and some conditions may result in a particular peril not being covered. It’s always best to talk to your agent in-depth about the specifics of your policy to avoid blind spots in coverage.

Other Types of Coverage Voice-Over Services Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

If you own your own studio, you’ll need commercial property insurance to cover the equipment and the structure. Every policy will differ based on your state and business needs, but most commercial property insurance covers damage from events like fire, criminal activity, and extreme weather.

Professional Liability Insurance

If your business advises clients on how to structure their voice-over content, then professional liability insurance is available in case an employee omits a crucial piece of information. For example, if you give a disclosure statement at the end of a commercial and the client leaves out an important detail based on your advice, this insurance would cover any legal costs associated with the fallout.

Workers’ Compensation Insurance

This insurance needs to be made available to all employees, regardless of whether they work from home or in the studio. Workers’ compensation insurance provides financial compensation in the event a worker is injured while on the job.

Commercial Umbrella Liability Insurance

Umbrella insurance covers a voice-over service if their general liability policy reaching its maximum limits. A single lawsuit can quickly exceed the financial threshold of a general liability policy, but umbrella insurance can help cover additional expenses to keep your business afloat.

Home-Based Business Insurance

If you operate your voice-over services from home, this insurance covers your equipment as well as the space used for your business. A general homeowners policy may not cover commercial expenses, such as recording tools and administrative equipment.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your voice-over service:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Voice-Over Service Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, you do. Since you won’t be able to predict when you will need your business insurance, the safest approach is to purchase your coverage before you begin interacting with clients and/or hiring staff members.

This can end up saving you significant funds in the long run (i.e., as a result of avoiding a compensation settlement.).

Not necessarily. Certain exceptions may be written directly into your voice-over service insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.