Wedding Officiant Business Insurance

Getting insurance for your wedding officiant business is essential.

This is because wedding officiant businesses need to be protected against things like claims that relate to negligent acts or omissions.

It is also important to note that a significant number of venues require all vendors (including wedding officiants) to have some form of business insurance in order to operate.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Wedding Officiant Business

General liability insurance is — generally speaking — one of the most important insurance policies for wedding officiant businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Having said that, some wedding officiant businesses might benefit from purchasing additional coverage policies. This is because a general liability policy may not holistically cover all aspects of your business, such as those that relate to professional negligence.

Additional policies worth considering include:

- Professional liability insurance

- Commercial auto insurance

- Business income insurance

You will also need to decide what type of insurer you will get your coverage from; there are two options available for small businesses:

- Traditional brick and mortar insurers — Examples include The Hartford, Hiscox, and CNA

- Online insurers — Examples include Next Insurance and Tivly

We recommend going for the second option as a small business owner due to the fact personalized coverage is significantly more affordable.

This is because online insurers have lower operating costs (e.g., no insurance agent, etc.).

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

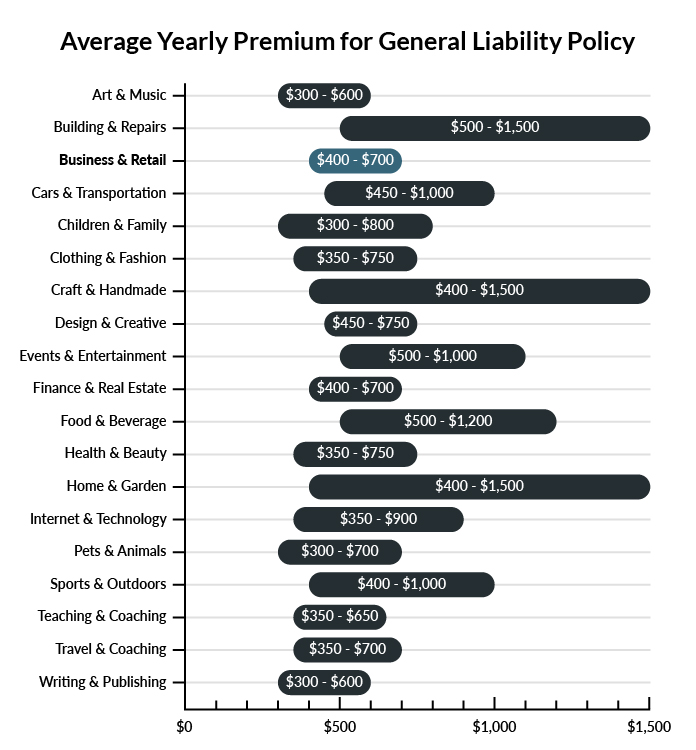

On average, wedding officiants in America spend between $400 – $700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a wedding officiant business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Wedding Officiant Business

Example 1: When you’re filling out the paperwork for a client, you make an error on the forms. Due to the mistake, the couple isn’t technically married for several months. They decide to file a lawsuit for missed financial opportunities (e.g., tax rebates) as well as general aggravation. General liability insurance would compensate for any financial repercussions of the mistake.

Example 2: After performing a ceremony, one of your customer’s believes that you disrespected their spouse during the event. They begin to smear your business on social media and other independent review sites. General liability insurance would cover the costs associated with fighting the claims of the customer, so you can protect your reputation.

Example 3: During the ceremony, you back into one of your clients and they fall over. General liability insurance would cover the medical costs if the person sustained any major injuries.

Other Types of Coverage Wedding Officiant Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

Many wedding officiants will work from home, but others will have a small office where they can meet and discuss matters with their clients. If this is the case and you own your property, you will need commercial property insurance. This insurance covers the structure, grounds, and administrative equipment in the case of loss due to fire, natural disaster, or criminal activity.

Data Breach Insurance

If you keep your clients’ details in a database, this insurance keeps your business safe in case of a data breach or hack. It works to compensate both you and your clients in the event that sensitive information is used for criminal gain.

Commercial Umbrella Liability Insurance

Commercial umbrella insurance will cover your business in the event that your primary general liability policy reaches its coverage limits. If you face a particularly large lawsuit, your general liability policy may max out before all damages or liabilities are satisfied. An umbrella policy will continue to provide funds to when a general liability policy has been exhausted.

Liquor Liability Insurance

Some wedding officiants may offer simple event planning for weddings. Even if you’re just planning to offer a champagne toast at the end of the ceremony, you may need liquor liability insurance to protect yourself against any adverse events that occur due to excess alcohol consumption.

Home-Based Business Insurance

If you operate your business from home, a home-based insurance policy will cover any commercial equipment you need to conduct your affairs. A general liability policy may deny requests if you have not disclosed you were using your home as your company’s base.

Workers’ Compensation Insurance

If you decide to hire additional officiants under your brand name, you’ll need workers’ compensation insurance in case they’re injured on the job. This includes part-time officiants or event workers.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your wedding officiant business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Wedding Officiant Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, you should. As a wedding officiant, some venues will not allow you to attend unless you have some form of basic business insurance (e.g., general liability, etc.).

Even so, it is still a good idea to purchase your coverage before you start in order to ensure that you are covered as soon as you start interacting with clients.

Not necessarily. Certain exceptions may be written directly into your wedding officiant business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.