LLC Taxes

A limited liability company (LLC) is one of the most flexible business structures when it comes to taxes, having the ability to elect to be taxed as a sole proprietorship, general partnership, C corp, or S corp.

It is important to note that, regardless of the tax status you elect, your LLC will also likely be subject to a variety of taxes at the federal, state, and local levels.

In this LLC Taxes article, we break down how an LLC is taxed, guide you through the potential deductions you’ll be able to make, and break down how you can go about filing your taxes both efficiently and on time.

Recommendation: One consultation with 1-800Accountant could save your business thousands in taxes. Schedule Your Free Call.

LLC Taxes By State

Pick the state in which your LLC is registered in order to have a look at all of the business taxes that you will be subject to:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

How Is an LLC Taxed?

The default tax situation for an LLC is that it doesn’t pay federal income taxes directly. Instead, its profits go straight to the owners, who then report this money and pay personal income and self-employment tax on their earnings. This process is known as “pass-through taxation.”

Below, we’ve explained how these taxation rules vary in a number of common scenarios and tax classifications that an LLC can elect during its formation.

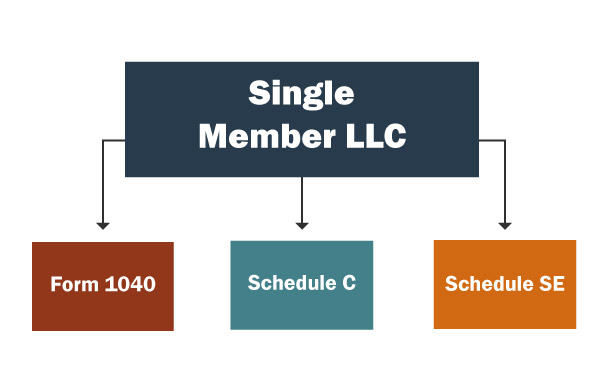

Single-Member LLC Taxes

If your LLC only has one owner, the IRS treats it the same as if you were a self-employed sole proprietor and ignores your business’s structure entirely (i.e., a disregarded entity). This means that your LLC’s profits aren’t dealt with separately, and you will instead pay personal income and self-employment tax on your LLC’s total profits when you submit your tax return at the end of the year.

However, since you pay these taxes on the total profits of your single-member LLC, you won’t need to pay taxes again on any distributions you withdraw from these profits to pay yourself a salary.

Multi-Member LLC Taxes

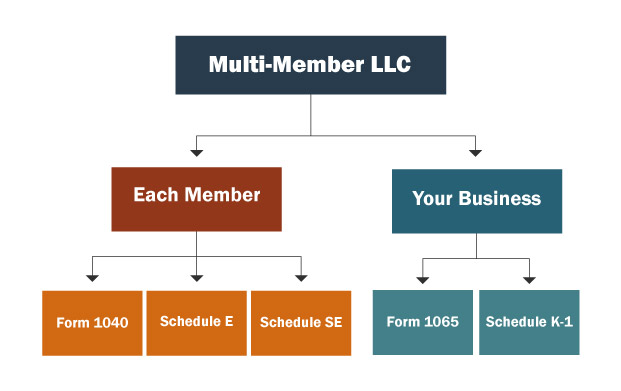

If you own a multi-member LLC, it will be treated by the IRS as a partnership for tax purposes by default.

This means that the LLC itself will not have to pay income tax to the IRS, and the profits will instead be divided among the LLC members according to the rules set in its partnership agreement.

Each member will then report their share of the profits on their personal tax return and pay the necessary income and self-employment taxes to the IRS.

LLCs Taxed as C Corps

If an LLC decides to be taxed as a C corporation, its total profits will be taxed at a corporate rate of 21% instead of the personal tax rates that the owners would pay if the LLC were taxed as a pass-through entity. After this, any money the owners take as dividends will be taxed again on their personal tax returns; this is known as “double taxation” because the same stream of revenue is taxed twice.

Paying these corporate taxes can be a great way for larger companies to retain earnings in the business, but this is generally not recommended for small business owners due to the added cost of electing and maintaining a C corp.

For a more in-depth overview, we recommend having a look at our LLC vs Corporations Taxes article.

LLCs Taxed as S Corps

LLCs can also elect to be taxed as an S corporation; this allows owners to retain the pass-through taxation benefits of an LLC whilst getting some of the benefits of a C Corp.

This is because S Corp owners are considered “employee shareholders” and are required to receive a reasonable salary. This is subject to both income and FICA taxes but not self-employment tax.

Any profits that are then distributed after the salaries – known as distributions – are neither subject to FICA nor self-employment taxes, which can potentially lead to significant tax savings for the owners.

It’s important to note that the IRS requires all owner-employees to be paid a “reasonable salary” for their duties, which is generally commensurate with what other companies in the industry would pay an employee for the same job and/or responsibilities.

Take care with this requirement as the IRS is particularly strict with S corps in order to prevent owners from evading tax by taking a minimal salary and paying themselves with distributions instead.

Recommended Service

1800Accountant offers easy-to-use accounting software and excellent customer support to manage your finances and file your taxes easily.

Additional LLC Taxes

Regardless of the tax designation you elect for your LLC, there are a number of different taxes at various levels that your business will be required to pay. We’ve explored each of these in more detail in the sections below.

Federal Taxes

This group of taxes is set by the national government and applies to businesses across the country, regardless of their location. Below are some of the main types you may need to pay for federal tax purposes:

- Income Tax: This is a tax imposed by the government on the total revenue generated by your business.

- Estimated Taxes: Payments made to the IRS throughout the year on income that isn’t subject to withholding.

- Self-Employment Tax: A tax levied against primarily self-employed individuals with net earnings that exceed $400.

- Employment Taxes: The set of taxes any business with employees must pay to cover things like social security, payroll, and Medicare taxes.

- Excise Tax: A tax levied against businesses selling certain types of goods or services (such as alcohol, tobacco, or fuel, among others), often in order to discourage consumption.

- Capital Gains Tax: A tax on any profits your business makes from investments or the sale of assets that have appreciated in value (e.g., real estate, stocks, and bonds).

Understanding and fulfilling these federal tax obligations is crucial for keeping your LLC compliant and avoiding unnecessary financial penalties and/or fines.

State Taxes

In addition to your federal tax obligations, your LLC may also have certain taxes specific to its state that it will need to pay. Many of the taxes we’ve already explored in the section above are also levied at a state level, including:

- State Income taxes (such as corporate income and gross receipts tax)

- Employment taxes

- Excise tax

One of the most important statewide taxes to be aware of is sales tax. With the exception of a handful of states, this consumption tax is added to the price of a range of goods and services and paid by your customers when they purchase your products.

You’ll typically need to register with your state by applying for a sales tax permit. This enables you to file the sales tax paid by your customers to your state’s Department of Revenue (or equivalent agency) – so be sure to keep accurate records of all the sales tax collected.

Local Taxes

Most of the taxes that your LLC deals with will be at a federal or state level, but it’s important to note that there are also several local taxes you may come across, such as:

- Property Tax: Your business will need to pay this tax if it owns or uses any real estate and tangible personal property. The rate for this tax is determined by local government authorities and can vary quite significantly based on the area and its financial needs.

- Excise Tax: Local municipalities may also decide to impose this tax on the sale of certain goods. If so, your business will be expected to pay it in addition to any state or federal excise taxes that apply.

Grasping the various tax responsibilities your LLC has at these different governmental levels is crucial for maintaining compliance and ensuring your business operates legally. As we continue, we’ll examine the ways you can take advantage of deductions to minimize your tax obligations.

Tax Write-Offs for LLC

With the various tax obligations your LLC is expected to meet, it’s important to consider how you can effectively reduce your tax bill. As a business, the IRS allows you to deduct certain expenses deemed as both “ordinary and necessary” for your business’s operation from its total tax bill (delineated in Publication 535).

Tax-deductible expenses encompass a variety of different expenses, though some of the most common ones include:

- Start-Up Costs: Any expenses incurred during the first year of establishing your business are tax deductible.

- Business Travel Expenses: Travel-related expenses surrounding your business, such as transit fares, meals you bought while traveling, or accommodation, are often deductible.

- Office Supplies and Services: Routine business necessities, such as computers to stationery, can often be written off your tax bill.

- Depreciation: Any decreases in the value of long-term assets owned by your business are likely tax deductible. These assets could include machinery, buildings, and other business property.

It’s especially beneficial to capitalize on above-the-line deductions, as they have the power to reduce your adjusted gross income (AGI). What this means is that they essentially lower the amount that serves as the basis for your income tax. Some common examples are:

- Payments made into qualifying retirement plans.

- Interest paid on student loans.

- Business-related expenses for self-employed workers, such as health insurance premiums.

By using these deductions, you can decrease your total taxable income and potentially place yourself in a lower tax bracket, further saving you money.

Of course, expenses are only deductible if they are considered “appropriate.” You might think a rooftop Jacuzzi is important for maintaining your business, but the IRS probably won’t agree with you unless you’re a Jacuzzi-selling business.

Recommended: See our LLC Tax Write-Offs and Tax Deduction Cheat Sheet article for more information.

How to File Taxes for LLC

Below, we’ve outlined the general process an LLC will need to follow in order to file their tax return correctly. Note that the specificities of each step will vary slightly depending on how your LLC is organized.

Step 1: Gather Your Documentation

To ensure accurate tax filing, thorough record-keeping is essential. Begin by collecting your personal information, including:

- You (and your partners’) Social Security number, date of birth, and residential address

- The previous year’s tax returns

- Your LLC’s Employer Identification Number (EIN)

Then, you’ll need to gather all documentation related to your business’s income, such as:

- Invoices you’ve issued

- Sales transaction logs

- Electronic payment reports from services like PayPal or Stripe

Lastly, assemble all records pertaining to your business expenses, which should cover:

- Lease receipts for your business premises

- Bills for utilities

- Records of office supplies purchases

- Documentation of business-related travel

- Payroll records for employees

Note: Depending on how your LLC is organized and its tax election, you may need different information for your tax return.

Step 2: Find The Right Tax Forms

Once you’ve gathered all necessary documents, the next step is to select the correct tax forms for your LLC based on its organization:

- Single-Member LLCs: The business’s total income and expenses are reported on a Schedule C form, which is attached to the owner’s personal tax return and due by April 15 or the following business day if it lands on a weekend or holiday.

- Multi-Member LLCs: File an information return using Form 1065. Members must fill out a Schedule K-1 showing their individual earnings or losses by March 15 or the next business day.

- C Corporations: File a corporate tax return using Form 1120 by the April 15 deadline or on the next business day if it’s a weekend or holiday.

- S Corporations: Use Form 1120-S for the corporate tax return and distribute Schedule K-1 forms to shareholders for reporting their shares of profits or losses. The filing deadline is March 15 or the following business day.

With the appropriate documentation gathered and the correct tax forms for your business entity on hand, you’ll be ready to fill them out and submit them.

Step 3: File Your Taxes

The majority of businesses choose electronic filing for its speed, enhanced security, and reliability compared to paper filing. The IRS provides two electronic services for tax submission: Free File for businesses with an AGI below $72,000 and Free Fillable Forms for those above this threshold.

Though these tools are available for you to use, there are several key points to keep in mind when considering these e-filing options:

- They are not suitable for submitting overdue tax returns.

- They apply exclusively to federal tax filings, not state-level taxes.

- These services do not include error-checking features.

These electronic filing tools are best suited for those who are already confident in handling their business taxes as if filling out a paper form.

While the resources are available for you to do it yourself electronically, many business owners opt for the expertise of a tax professional to ensure accuracy and compliance in their tax filings.

Recommended Service: Book a call with 1-800Accountant in order to discuss the best way of moving forward with filing your taxes in order to potentially save your business thousands in taxes. Schedule Your Free Call.

LLC Taxes FAQs

Depending on how the owner has organized an LLC, it can be taxed in various ways: as a sole proprietorship, a partnership, a C corporation, or an S corporation. Each comes with different filing requirements that impact how revenue is reported to the IRS for federal income tax purposes.

If you’re unsure which tax status best suits your needs, check out our article on How to Choose Your LLC Tax Status.

One of the main disadvantages that LLCs face is self-employment taxes on all profits, which can become quite costly for larger businesses. Additionally, changing tax classifications can be quite complex, which requires careful consideration and sometimes professional assistance.

However, LLCs come with a number of tax perks – see our LLC Tax Benefits article for a detailed list.

Single-member and multi-member LLCs file their business income on Schedule C alongside their individual returns, while S corps do the same with Form 1120-S. C corporations are the only entities that file business taxes separately, submitting a corporate income tax return using Form 1120.

For more information on paying taxes as an LLC owner, see our article on How to File Your LLC Taxes.

Owners of an LLC are typically considered self-employed as they are responsible for paying self-employment taxes and making estimated quarterly tax payments, similar to other forms of sole proprietorship or partnerships.

However, there are a few important distinctions in terms of tax between these two structures. To find out more, see our LLC vs Sole Proprietorship Business Taxes.

If your LLC didn’t engage in any business or turn a profit, it generally doesn’t need to file a tax return if taxed as a disregarded entity or partnership. However, corporations must file annually regardless of activity.

For more information on the tax differences between these two business structures, see our LLC vs Corporation Taxes article.

Absolutely, your LLC still provides limited liability protection and establishes your business as a separate legal entity, regardless of how the IRS treats it for tax purposes.

For a more in-depth look at how this works, see our Single-Member LLC Taxes article.

More LLC Tax Guides

- How to Choose Your LLC Tax Status

- LLC Partnership Taxes

- LLC vs. Sole Proprietorship Business Taxes

- LLC Pass-Through Taxation

- LLC Taxes By State

- Single-Member LLC Taxes

- How to File Your LLC Taxes

- LLC vs. Corporation Taxes

- LLC Tax Benefits

- LLC Late Tax Filing

- LLC Expenses Cheat Sheet

For more information, have a look at our LLC Taxes Resources page.