What Is the Typical Salary for a Real Estate Investor?

Real estate investing can be a highly lucrative side hustle or full-time career. Many of the world’s wealthiest individuals rely on real estate investment to build and maintain wealth. How much do investors make on average and what can you expect to earn? Real estate investor salaries vary based on the location, type of real estate investment, and how much you put in. To maximize your real estate investor salary, you’ll want to choose the right location, team, and goals to grow progressively.

Seem confusing? We’ll cover all you need to know to start earning your target real estate investor salary and more.

Use Northwest ($29 + State Fees) to form your real estate LLC for you.

What Is Your Initial Real Estate Investing Strategy?

Your investment strategy is where you choose to focus your time and attention within real estate investing. This can have a significant impact on your earning potential. For example, a real estate investor salary figure for someone participating in one real estate investment trust (REIT) is usually much lower than the figure for a professional house flipper or someone with 20 rental properties.

Your earning potential will also depend on how much time and effort you are willing to invest. If you are part-time or inconsistent, you will get an inconsistent real estate investor salary.

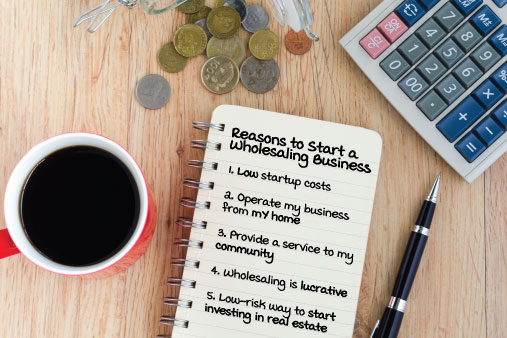

Salaries for real estate investors vary widely from niche to niche and even within the same niche. To give you an idea, here are annual salary ranges for different types of real estate investment:

- Wholesaling: $21,000 to $100,000+

- House Flipping: $15,000 to $200,000+

- Buying Rental Property: $20,000 to $150,000+

- REITs: $5,000 to $60,000+

- Crowdfunding: small amounts to $150,000+ (depending on the initial investment)

It is clear that real estate investor salaries vary widely. Choose your initial strategy based on available time, salary goals, and interest in real estate investing. Keep in mind that the average salary of a full-time real estate investor nationwide is $123,937, so the earning potential is there. Of course, that varies by state, location within the state, and real estate investment type.

Location

Location is key for any type of real estate investment. It can make the difference between a high annual salary and losses. Generally, you’ll be looking to work in or near metropolitan areas where housing or rentals are needed. Carefully choosing your location for investing will give greater possibilities for a high return on investment (ROI).

Invest in areas that are:

- Large or small cities. Metropolitan areas will generally bring additional real estate investing income because there is greater demand, higher initial prices, and more amenities to attract buyers or renters.

- Areas with job growth. When jobs are increasing, housing or rentals are needed. This is a great way to increase your investment income. Think of the rise in housing prices in Seattle after Amazon made its headquarters there — housing prices rose more than 41% in seven years.

- Areas with high turnover rates. High turnover makes it easy to flip houses for a profit, wholesale, or find consistent tenants for rental properties. Examples of high turnover areas for increasing real estate investor salary figures include college towns and towns or cities where a job force dominates (like Atlanta or Seattle) and “war zones” (i.e., areas with lower incomes and higher crime rates).

- Areas of gentrification. If you plan to buy and hold, areas of cities or towns that were previously undesirable but are becoming popular offer excellent investment opportunities. If there is an area of a city near you that is becoming the center of an art scene, consider investing there for good returns.

While all of these strategies will help, the most important point is to know your local area. You can find opportunities for real estate investing almost anywhere.

Recommended: If you’re looking for low-cost (distressed), foreclosed properties that are more difficult to find, search foreclosure.com to maximize your inventory and business opportunities. The website’s database updates twice on a daily basis, which will give you access to the most current, local properties on the market.

An area where the average home price is higher will generally lead to larger profit margins. But, do your research to make sure that you are buying under market value and acquiring a property that not only has future earning potential but also profit upfront.

Having the Right Team

The right team can make the difference between a mediocre and excellent real estate investor salary. At a minimum, you should have on your team:

- A good title company that will vet all properties for you before investing.

- A real estate investor mentor to guide and advise you based on their experience and even work with you on some projects.

- One or more trustworthy and proven general contractors who know the building codes and can keep your project on schedule and within your budget.

This team will keep you on track with your goals and projects, but it is still your responsibility to know the numbers for your ROI. You’ll need to keep track of, check, and double-check all the numbers. Miscalculations can eat up your real estate investor salary and delay your project.

Create More Deals

If you want to increase your salary through real estate investing, the best way is to do more deals. While one house flip a year may add $15,000 in real estate investor salary, six house flips a year becomes a full-time salary.

It’s a good idea to have more than one investing strategy. Don’t limit yourself to just one avenue of real estate investing income. You can combine house flipping along with wholesaling or buy and rent along with REITs. Choose one or more options that will work for you to increase your real estate investor salary.

One of the main challenges when starting a business is having enough capital, especially when buying real estate properties. There are many ways to find funding (family, angel investors, etc,), but a more traditional route is to secure a business loan. Before you apply for a loan, you should formalize your business first. You can learn more about how to start a business, build business credit, improve your business’s credit score, and apply for a business loan with our business guides.

Recommended: Looking to Build Business Credit? Apply for an easy approval business credit card from BILL and build your business credit quickly.

Maximize Profits With Other Investors

For volume, you’ll want to see what is realistically achievable from your personal finances and then see how you can increase that. You might only be able to do one or two deals a year, but if you can engage investors or take an additional mortgage, you can increase volume and annual returns.

Investors could mean an increase from just one or two deals a year to four or more. The more volume of deals, the more annual income you can expect.

If your business is an LLC or a corporation with increased profits, you should consider an S corporation tax status, which can provide you with certain tax advantages. To learn more about these tax benefits, read our guide Why Elect S Corp Tax Status for Your LLC.

Real Estate Investing Through Joint Ventures

If you are inexperienced or don’t have a lot of time to work on real estate investing, consider joining a joint venture or partnership. Depending on the nature of the partnership, you will benefit from the experience of the other investors and learn the ropes of real estate investing while getting a good ROI.

Upgrades

Of course, it is not only about volume. You can also add value or improve a property to increase resale value. An excellent strategy is to purchase a property at the lowest price point in a neighborhood, improve it, and sell it at a higher price point. Improvements should be relative to the desired features and amenities of the neighborhood — from kitchens to pools, be sure amenities are not too cheap or extravagant when compared to the surrounding neighborhood.

Increase Rental Property Prices

If you are renting your property, consider increasing rent. However, your increase must be justified. For example, consider upgrading the kitchen and baths in order to charge more. Just be sure to keep it in line with other properties in the area, or your risk having a vacant property.

Real Estate Marketing

Finally, and most importantly, to increase real estate investor salary, you’ll want to increase marketing. Market yourself, your services, and your properties. Network and build your resources from the ground up. The more you are known in the real estate investing community and local community, the more you’ll be trusted to offer great properties and close deals. The benefits of a great reputation will lead to an increase in your own real estate investor salary.

To learn more about how to market your real estate investing business, read our guides on marketing strategies. You can also create an email marketing newsletter to get your name out there and let people know about your current deals and success stories.

Summary

Investing in real estate can be a side hustle or a full-time job. While the average real estate investor salary varies by state ($100,000 to $136,000), there is no limit to how much you can make. With the right strategy, location, and team, you can continue to build returns every year.

By systematically increasing your investment portfolio and carefully assessing the numbers on each property before purchase, you set yourself up to build long-term security and increased wealth for you and your family.

Frequently Asked Questions

Real estate investors can make money through reselling properties at a higher price, earning a fee on wholesale properties, and through rental income. If the investor is holding property for rental, they may also earn money through appreciation of the property value. Inflation can also play a role in increasing the property value and in investors making more money on the final sale.

If you are ready to get started, check out our overview of how to invest in real estate.

While some estimates say as much as 95% of all real estate investors fail, that is because of just a few simple factors: lack of planning, research, and/or time to follow through. A good real estate investor salary doesn’t come without work. The most important work is to gather your team, do your research, and get a good mentor.

If you follow the steps in our real estate investing guide and consistently apply what you learn, you will be at the 5% success rate in no time. There is no limit to your real estate investor salary.

Real estate investor salaries from house flipping can easily reach $100,000 or more per year. The key to great returns on house flipping is to carefully select your target neighborhoods, accurately calculate renovation costs, and secure a quick sale.

TV shows can make it seem like house flipping gives automatic returns. In reality, this requires far more research and perseverance. But, as you learn the market, house flipping can lead to a consistent salary and good ROI.

For more information, read our full guide on how to start a house flipping business.