Business Insurance for Bail Bonding Businesses

Every bail bonding business needs insurance. Knowing which type of insurance you need and the best place to get it is the next step.

This article will cover the main types of business insurance and help you find the best bail bonding business insurance.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Bail Bonding Business

The most common and comprehensive type of insurance for a bail bonding business is general liability insurance. We recommend general liability insurance as your first line of defense against a variety of the most general and commonly occurring claims.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While a bail bonding business may not be legally required to carry general liability insurance, operating without it is extremely risky. If your bonding is sued, you could face fees totaling hundreds of thousands of dollars (or more).

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

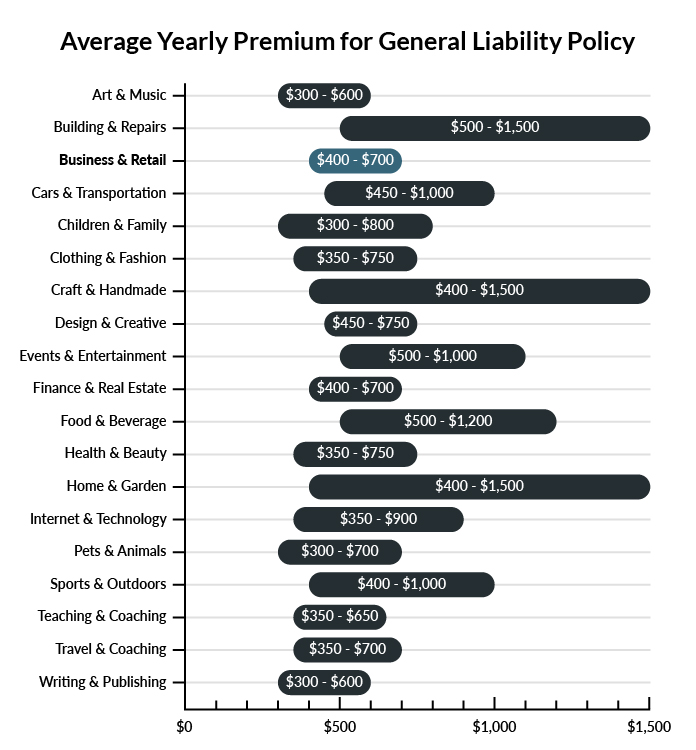

The cost of your bail bonding business’s general liability insurance will depend on the size of the business. On average, bail bonding businesses in America spend $720–$1,020 per year for general liability insurance coverage.

Compare the average cost of general liability insurance for bail bonding businesses to other professional industries using the graph below.

Several factors will determine the price of your insurance policy. These include your:

- Location

- Deductible

- Number of employees

- Volume of business

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Bail Bonding Business

Example 1: One of the bounties that you recover sues you for excessive force, the wrongful use of restraints, and false arrest. Your general liability insurance policy should cover the cost of your legal defense and may help pay any settlements or judgment against you if you are found liable.

Example 2: You execute a bail bond recovery in the middle of the day at a bounty’s place of business. Because your bounty was embarrassed at their business, they sue you for defamation and interfering with their business practices. Your general liability insurance would help pay for your legal defense and if you are found liable may pay a portion of the settlement or judgement against you.

Example 3: You accidentally knock over a bystander while executing a bail bond. The bystander falls and hits their head and requires medical attention and they decide to sue. Your general liability insurance may assist your business in covering the medical bills, some of your legal costs, and part of any court order or settlement.

Other Types of Coverage Bonding Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

If your bail bonding business owns any type of property worth $10,000 or more, you will need to invest in a commercial property insurance policy to insure your business’s assets. Many bail bonding businesses quickly rack up this amount in equipment, computers, and inventory.

Commercial property insurance helps cover the costs of replacing/repairing inventory, equipment, real estate, and more in the event of unexpected damage.

Commercial Umbrella Insurance

For many bail bonding businesses, commercial umbrella insurance is an important policy to take out. Commercial umbrella insurance exists to cover those gaps beyond existing policies, ensuring that your bail bonding business doesn’t find itself crippled by an extreme and unpredictable loss.

Commercial Auto Insurance

If your bail bonding business owns a vehicle to pick up or drop off patients, make pickups or deliveries, or for any other business-related reason, you will also need a commercial auto insurance policy. This insurance policy will cover automotive damages incurred if your automobile or delivery vehicle is damaged on the road.

Cyber Liability Insurance

Another type of insurance that bail bonding businesses may want to consider is cyber liability insurance. In the event of a data breach or other cyber security incident, any business dealing with sensitive information should have cyber liability insurance in place to cover the costs associated with the breach as well as any additional losses the firm may incur.

Home-Based Business Insurance

If your bail bonding business is run from home, your normal home insurance policies may not cover accident damages related to your business.

Home-based business insurance is designed with this in mind, and it is often available through a business owner’s policy or as a rider extension for existing homeowner insurance.

Professional Liability Insurance

Professional liability insurance, sometimes called errors and omissions insurance, is a must-have for any type of business or professional service. Bail bonding businesses could be at risk of being sued for significant amounts for making a mistake. Errors and omissions (E&O) insurance helps protect your business in the case of costly mistakes, oversights, or omissions.

Specialty Insurances

Bail bonding businesses will also want to look into a number of specialty insurances, depending on the exact nature of your work. Specialty insurances for bail bonding businesses may include insurance to defend you against being sued for a number of named actions including wrongful arrest, alleged assault and battery liability, alleged abuse and molestation liability, firearms liability, and more.

Worker’s Compensation Insurance

In most states, if you have any employees other than yourself and sometimes family members, you will need to purchase worker’s compensation insurance. Workers’ compensation insurance, or “worker’s comp” for short, is a type of insurance that covers accidents, injuries, and illnesses that employees may suffer on the job. Worker’s compensation coverage aids with the payment of medical expenses, missed wages, and other costs associated with illness or injury, no matter who was at fault.

Additional Steps To Protect Your Business

Although investing in business insurance is easy (and essential), it shouldn’t be your only defense.

Here are several things you can do to better protect your bail bonding business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Bonding Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

You should invest in business insurance coverage for your business before your first interaction with a customer. Although the cost of insurance may seem high for a brand-new business, it’s best to be proactive when it comes to protecting your assets. After all, you can’t buy insurance to cover a loss that has already occurred.

Not necessarily. Certain exceptions may be written directly into your bail bonding business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.