Welding Insurance

Getting insurance for your welding business is essential.

Welding businesses need to be protected against claims involving things that could foreseeably occur and cause them significant financial loss, such as property damage and bodily injuries.

For example, if one of your welders was to accidentally damage a client’s property — or injure themselves during work — you would be liable for compensating them.

We’ll help you find the most personalized and affordable welding insurance coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Welding Business

General liability insurance is — generally speaking — one of the most important insurance policies for welding businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical expenses

- Legal fees, defense, and judgment

- Personal and advertising injury

Having said that, your welding business might benefit from purchasing additional coverage policies. This is because general liability coverage may not be enough to “fully” protect you depending on your unique risks.

Additional insurance policies worth considering include:

- Business income insurance

- Workers’ compensation insurance

- Commercial property insurance

- Commercial auto insurance

You will also need to decide what type of provider you want in order to acquire your coverage; broadly speaking, there are two options available for small businesses:

- Traditional brick-and-mortar insurers (e.g., CNA, Hiscox, etc.).

- Online insurers (e.g., Ergo Next Insurance, Tivly, etc.).

We recommend choosing an online insurer as a small business owner; this is because they are significantly more affordable while still offering a similar degree of customization.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

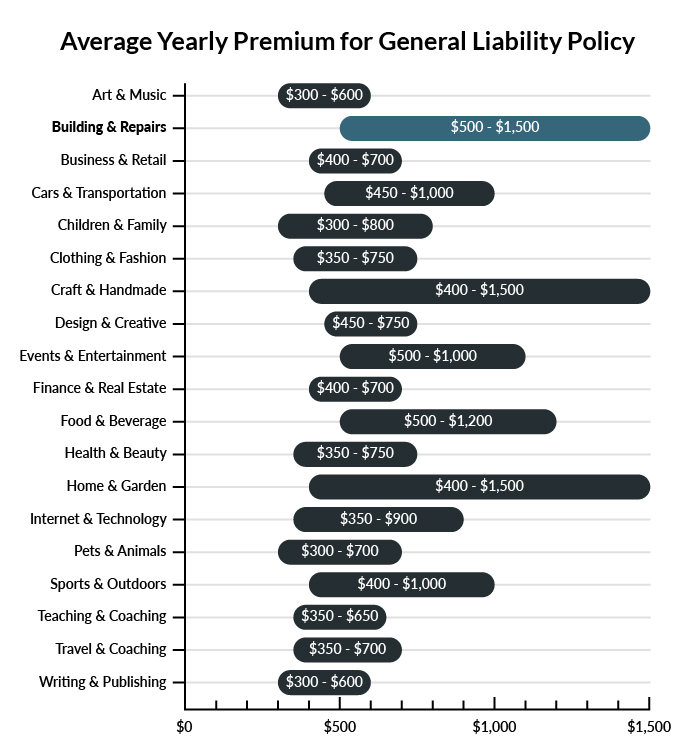

The average welder in America spends between $500-$1,500 per year for $1 million in general liability coverage.

Check out the chart below for a snapshot of average general liability insurance policy prices across a variety of industries.

Several factors will determine your welding insurance cost. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Welding Business

Example 1: Poor ventilation causes fumes to build up at a job site, and those fumes are ignited by a spark. Although relatively small, the explosion causes substantial property damage and some injuries. General liability insurance would probably cover legal expenses associated with the incident.

Example 2: While welding in a customer-owned building, equipment malfunctions and causes a fire. The fire spreads throughout the building, damaging a large portion of the structure. General liability insurance would probably cover the property damage.

Example 3: A customer drops off items that need to be welded at your company’s facility. On their way out, the customer trips over a hose on the ground and falls. General liability insurance would likely cover any resulting serious injuries.

Other Types of Coverage Welders Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

Businesses that employ skilled workers may be held financially responsible for any errors their employees make while working. Professional liability insurance helps protect against errors in work, and it’s widely available for different types of professions.

Welding is potentially dangerous work, and an error can lead to substantial property damage, severe injuries, and (in some cases) even death. Make sure your business’s professional liability coverage has high enough limits to provide protection in even the worst scenarios.

Professional liability insurance can be purchased through a package policy or by itself.

Commercial Property Insurance

Most welders need commercial property insurance for the physical assets their business owns. This insurance can cover both buildings and equipment (as well as supplies and inventory).

Welding equipment often costs thousands of dollars, and many businesses in the field have several different welders. Check the terms and limits of your business’s commercial property insurance to make sure it fully insures your welding equipment.

Commercial property insurance can be purchased through a business owner’s policy (BOP).

Commercial Auto Insurance

If your business has a vehicle that’s used to offer welding services at customers’ locations, that vehicle needs to be insured with commercial auto insurance. State law generally requires all commercial vehicles that are driven on public roads to be insured.

Commercial auto insurance can be purchased through a package policy or by itself.

Workers’ Compensation Insurance

If your business has employees, it is required by state law to carry workers’ compensation insurance. This insurance protects against work-related illnesses and injuries.

Even welders who are self-employed and don’t hire other workers may want workers’ compensation insurance. Health insurance sometimes won’t cover work-related injuries, but workers’ compensation can fill in this potential gap.

Commercial Umbrella Insurance

Welding-caused fires and explosions can quickly cause a lot of property damage, which can lead to expensive and lengthy lawsuits. Commercial umbrella insurance affords extra liability protection in the event that lawsuits exceed primary policies’ limits.

Commercial umbrella insurance can be purchased through a package policy or by itself.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your welding business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Welding Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Generally yes, as insurance for welders is crucial. Purchasing business insurance before you begin interacting with your clients, as this can end up saving you thousands of dollars down the line.

This is because, as a high-risk business, you will not be able to predict when you will actually need your coverage.

Not necessarily. Certain exceptions may be written directly into your welding insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.