LLC Partnership Taxes

When forming an LLC, it is important to know how you will be taxed; as a result, you’ll be able to choose the best tax status for your business, discover tax advantages, and avoid future penalties.

In this guide, we will define the basics of LLC partnership taxes.

Recommended: One consultation with 1-800 Accountant could save your business thousands in taxes. Schedule Your Free Call.

What is an LLC Partnership?

Multi-member LLCs are taxed as partnerships and do not file or pay taxes as the LLC. Instead, the profits and losses are the responsibility of each member; they will pay taxes on their share of the profits and losses by filling out Schedule E (Form 1040) and attaching it to their personal tax return.

From their share of LLC profits, each owner can pay themselves with a distribution. While the owner doesn’t have to pay additional income tax on their distribution, they do have to pay self-employment tax. You can learn more with our guide to paying yourself from your LLC.

How ownership is divided within the LLC should be outlined in your operating agreement. The formal term often used for LLC ownership is “distributive share,” also known as an LLC unit. The partners’ distributive shares are typically determined in proportion to their initial investment or based on their level of ongoing involvement with the day-to-day activities of the business.

Distributive Share Example 1

Jonny, Brittany, and Laura want to start a coffee business. They all agree to split their distributive share of profits or losses in thirds since they are equally splitting all the startup costs, daily operations, and so on.

Distributive Share Example 2

Brandon and Savannah want to start a food truck business. Brandon will operate the business on a daily basis and believes his efforts are worth 70% of ownership.

Therefore, when outlining the distributive share, Brandon believes he should be responsible for 70% of profits and losses. Savannah is then responsible for 30% of profits and losses since her involvement is solely administrative and much less time-intensive.

Multi-Member LLC Federal Taxes

As stated above, a multi-member LLC does not file or pay taxes as the LLC. Instead, the profits or losses will be the responsibility of each co-member in proportion to their distributive share.

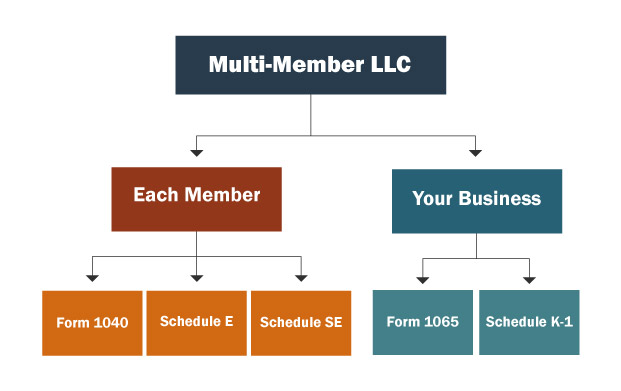

Here is a list of the various forms you will need to file:

- Income 1040: Individual Income Tax Form. All taxpayers must file this form.

- Schedule E: Partners report their individual share of profit or loss on their personal tax return.

- Schedule SE: This form is for filing and paying your self-employment taxes. The owner of a disregarded entity must pay Medicare and Social Security taxes.

- Schedule E: Partners report their individual share of profit or loss on their personal tax return.

- Form 1065: An information form for partnerships to report profits and losses, filed for the partners by the LLC.

- Schedule K-1: A document that details the profits and losses of an individual partner.

Multi-Member LLC State Taxes

The only difference between paying federal and state income taxes will be the forms you need to file.

Some states like California and Texas require LLCs to pay a special business tax. This tax is usually called a franchise tax, but can also be a business excise tax or a privilege tax. This tax can either act as a yearly fee with a flat amount, or it can be a percentage of the business like any other tax.

Other states have taxes that are specifically for multi-member LLCs. Minnesota, for example, levies a partnership tax on partnership LLCs that reach a certain level of annual sales.

If you are selling a product or service, you will most likely have to pay sales tax. See our sales tax guide so you can learn everything you need to know about collecting sales and use tax.

Check out our guide for a complete list of business taxes by state.

Get a Free Consultation

A professional accounting and bookkeeping consultation can help you efficiently apply for tax credits or deductions depending on your industry and business.

LLC Employee Taxes

If you hire employees for your business, you will have to register for your State’s employment taxes. These taxes can include things like paying for workers’ compensation and withholding income taxes on behalf of your employees.

In order to report employee taxes, your LLC is required to have an EIN.

FICA Taxes

Taxes that are part of the Federal Insurance Contributions Act (FICA) include two types of taxes that are paid by all employers and employees: Social Security tax and Medicare tax. Employers are required to match their employees’ FICA tax obligations. The result is that an employer and employee each pay one half of the total FICA tax rate.

Unemployment Taxes

Employers are required to pay both federal unemployment taxes (FUTA) and state unemployment taxes (SUTA). These taxes go toward unemployment benefit funding for workers between jobs.

Bookkeeping and Accounting for LLCs

You must keep your multi-member LLC’s finances in order to protect your corporate veil. By opening a dedicated business bank account, getting a business credit card, and creating a good bookkeeping system, you can easily separate your personal and business finances.

Benefits of Good Accounting

By making sure every possible deduction is monitored and recorded, good accounting can provide some considerable advantages:

- Cuts your tax bill by thousands every year.

- Prevents trouble with the IRS and state governments.

- Provides insight into where your money is going and how to spend it.

- Saves time and frustration.

To get started, we recommend visiting our guide to the best accounting software for small businesses.

LLC Partnership Tax FAQ

Multi-member LLCs do not have to elect to be taxed as a partnership, as the IRS automatically taxes them as a partnership by default. A multi-member LLC may choose to remain taxed as a partnership to benefit from pass-through taxation and avoid owing business income tax.

No. Because a single-member LLC has only one owner, their only tax options are to be taxed as a disregarded entity or as a corporation. An LLC taxed as a partnership has more than one owner.

A multi-member LLC can become a single-member LLC when the LLC’s members sell their shares to a single remaining member.

Because a single-member LLC cannot continue to be taxed as a partnership, the remaining owner must file a new tax election with the IRS specifying whether the single-member LLC will be taxed as a disregarded entity or as a corporation.

Multi-member LLCs with no business activity do not have to file a partnership return unless the LLC wishes to claim any expenses.