How to Start an S Corp in Michigan

Considering S corporation (S corp) status for your Michigan business? This guide will walk you through the process of forming an S corp and help you decide if it’s the right choice for you.

Learn how a Michigan S corp could help reduce your tax burden while keeping your business compliant.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

Factors to Consider Before Starting an S Corp in Michigan

Before forming an S corp, you have to consider the following factors:

- Is an S corporation the best strategy for your business?

- S corporation restrictions

- Are S corp tax advantages right for you?

Is an S Corporation the Best Strategy for Your Business?

For help with choosing the right structure for your business, visit our Choosing a Business Structure guide.

S Corporation Restrictions

S corps have several restrictions, such as being limited to one class of stock and 100 shareholders. Read our What Is an S Corporation guide for full details.

Are S Corp Tax Advantages Right for You?

An S corporation is a tax designation that can be elected by a limited liability company (LLC) or corporation. With an S corp, business owners are considered employees of the company and must receive a reasonable salary. Since all S corps technically have employees, the s corp must run payroll.

In order to benefit from a Michigan S corp tax designation, your business needs to make enough money to offset payroll expenses. Furthermore, S corps are beneficial for business owners who take large distributions in addition to their salary.

To learn more about the tax advantages of an S corp, read our LLC vs. S corp guide and take a look at our S corp tax calculator.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

How to Form a Michigan S Corp

There are two main ways to start an S corp:

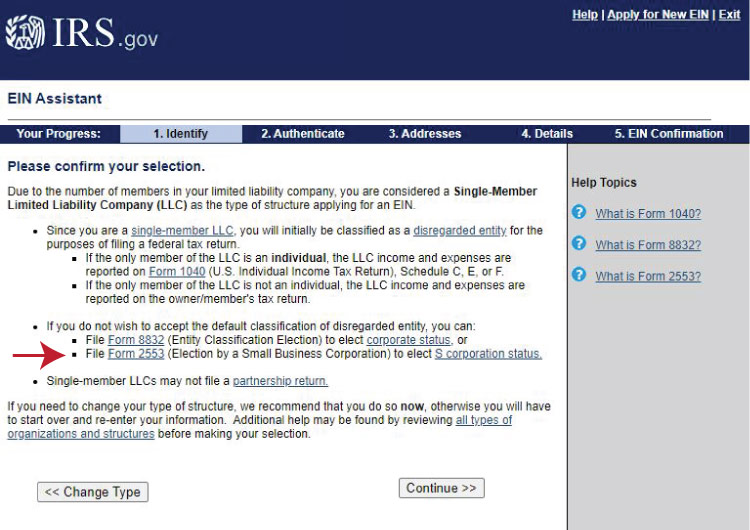

- By forming an LLC and electing S corp tax status from the IRS when you request your employee identification number (EIN)

- By forming a corporation and electing S corp status from the IRS

We recommend forming an LLC because it’s simpler and more cost-effective.

Want to form an S corp elsewhere? Check out our other How to Start an S Corp guides to learn more.

Recommended: If you have an existing LLC, visit our How to Convert an LLC to S Corp guide.

Steps for Forming an LLC and Electing S Corp Status in Michigan

Starting a Michigan LLC and electing S corp tax status is easy. You can use our guides to start an LLC with the S corp status yourself, or you can hire a service provider like Northwest to guide you through this process.

There are five basic steps to start an LLC and elect S corp status:

Step 1: Name Your LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Step 5: Get an EIN and File Form 2553 to Elect S Corp Tax Status

Step 1: Name Your LLC

Choosing a company name is the first and most important step in starting your LLC in Michigan.

Be sure to choose a name that complies with Michigan naming requirements and is easily searchable by potential clients.

1. Follow the naming guidelines for a Michigan LLC:

- Your name must include the phrase “limited liability company,” or one of its abbreviations (LLC, L.L.C., LC, or L.C.).

- Your name cannot imply that the LLC is organized for any purpose other than the one outlined in its articles of organization.

- Your name cannot contain the words “corporation” or “incorporated” or the abbreviations “corp.” or “inc.”

- Michigan has a long list of restricted words that may require approval for your LLC to use in its name. You can see the full list on the State of Michigan website.

- The name of a low-profit LLC must contain the words “low-profit limited liability company” or the abbreviation “L.3.C.” or “l.3.c.,”, with or without periods.

You can also read the Michigan state statute about LLC naming guidelines for more information.

2. Is the name available in Michigan? You can use the business entity search on the Michigan Department of Licensing and Regulatory Affairs website to see if your desired LLC name is available.

3. Is the URL available? We recommend checking to see if your business name is available as a web domain. Even if you don’t plan to create a business website today, you may want to buy the URL in order to prevent others from acquiring it.

Step 2: Choose Your Michigan Registered Agent

You must elect a resident agent, also known as a registered agent, for your Michigan LLC.

An LLC registered agent will accept legal documents and tax notices on your LLC’s behalf. You will list your registered agent when you file your LLC’s Articles of Organization.

Many business owners choose to hire a registered agent service. Many of these services will form your LLC for a small fee and include the first year of registered agent services for free.

Step 3: File the Michigan LLC Articles of Organization

The Michigan Articles of Organization is used to officially register an LLC.

File Your Michigan Articles of Organization

OPTION 1: File Online With the Michigan Department of Licensing and Regulatory Affairs

File Online– OR –

OPTION 2: File Form 700 by Mail or in Person

Download FormState Filing Cost: $50, payable to the Michigan Department of Licensing and Regulatory Affairs (Nonrefundable)

Mailing Address:

Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau

Corporations Division

P.O. Box 30054

Lansing, MI 48909

Office Address:

Michigan Department of Licensing and Regulatory Affairs

2501 Woodlake Cir.

Okemos, MI 48864

Step 4: Create an LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your LLC.

For more information, read our LLC Operating Agreement guide.

Our operating agreement tool is a free resource for business owners.

Step 5: Get an EIN and Complete Form 2553 on the IRS Website

An EIN is a number that is used by the US Internal Revenue Service (IRS) to identify and tax businesses. It is essentially a Social Security number for a business.

EINs are free when you apply directly with the IRS.

Elect S Corp Tax Status

During the online EIN application, the IRS will provide a link to Form 2553, the Election By a Small Business form.

Visit our Form 2553 Instructions guide for detailed help with completing the form.

This is the form to elect S corp tax status for your LLC:

Ready to start saving on your taxes?

We recommend using a formation service to start your Michigan S corp for you, so you can focus on the things that matter most – growing you business.

Keep Your Michigan S Corp Compliant

After setting up your Michigan S corp, it’s essential to stay compliant with both state and federal regulations to ensure your business remains in good standing.

File the BOI Report

Federal regulations require all LLCs and corporations to submit a Beneficial Ownership Information (BOI) report to the Financial Crimes Enforcement Network (FinCEN). This report is critical for maintaining accurate records about the ownership and control of your business, which is necessary for compliance with federal laws.

You can file the BOI report through the FinCEN website.

Open a Business Bank Account

It’s important to separate your business finances from your personal accounts to protect your S corp’s liability status. A business bank account also is essential for maintaining organized financial records and ensuring compliance with state regulations.

For banking options that suit small businesses, review our guide on the Best Banks for Small Business.

Obtain Required Business Licenses

Michigan requires businesses to obtain various licenses and permits based on the nature of their operations and their location within the state. Ensuring you have the proper licenses is crucial for legal operation.

To find out which licenses apply to your business, visit our Michigan Business License guide.

File Your Annual Statement

Michigan S corps must file an Annual Statement with the Michigan Department of Licensing and Regulatory Affairs (LARA). This report helps keep the state updated on your business’s details, including changes in ownership or contact information. The Annual Statement is due by Feb. 15 each year, and failing to file can result in penalties or administrative dissolution of your business.

You can file your Annual Statement online at the Michigan LARA website.

Understand S Corp Tax Obligations

Michigan imposes a Corporate Income Tax (CIT) on corporations, including S corps that have elected federal S corporation status. Additionally, Michigan S corps must comply with federal tax requirements.

For more details on Michigan’s tax requirements, visit the Michigan Department of Treasury website.

Michigan Sales Tax Requirements

If your Michigan S corp sells taxable goods or services, you must register to collect sales tax. Michigan has a statewide sales tax, and businesses need to comply with both state and local sales tax regulations.

To learn more about sales tax obligations, visit the Michigan Department of Treasury’s Sales and Use Taxes page.

Start a Michigan S Corp FAQ

An S corporation (S corp) is a tax designation for which an LLC or a corporation can apply.

No. The default taxes for an LLC and taxes for an S corp are not the same.

With an S corp, owners pay personal income tax and self-employment tax on a predetermined salary. They may then withdraw any remaining profits from the business as a “distribution,” which isn’t subject to self-employment tax.

With an LLC, all company profits pass through to the owners’ personal tax returns, and then the owners must pay personal income tax and self-employment tax on the entire amount.

S corp owners are required to earn a “reasonable” salary, which basically means a fair market rate based on the individual’s qualifications as well as their duties and responsibilities at the company. The purpose of this requirement is to prevent S corp owners from paying themselves an artificially low salary in order to pay less self-employment tax.

A distribution is a dividend that a shareholder/owner can take from the business profits that remain after a company pays all of its employee salaries. Shareholders must pay personal income tax on distributions, but distributions aren’t subject to self-employment tax.

LLCs and corporations that operate under a “doing business as” (DBA) name can choose the S corp election.

While there’s no perfect state in which to form an S corp, you should start your business where you plan to operate. By forming an S corp in Michigan, you can benefit from the state’s supportive small business landscape while enjoying its year-round natural beauty.

Some major industries currently thriving in Michigan include agriculture, manufacturing, food and beverage, tourism, and much more. To form an S corp in Michigan, simply confirm your business meets the requirements set by the IRS because S corps can exist within most industries.