What to Do After Forming an LLC

Starting a limited liability company (LLC) is a big step for a business, and what you do after forming an LLC is just as important.

To help, we’ve put together these steps to take after starting an LLC.

Take the first step. Protect your personal assets by setting up an account with our top-ranked small business bank, Mercury.

9 Things to Do After Forming an LLC

Starting an LLC is a great way to start your small business journey. Once your new company is registered and official, you’ll need to know what to do after forming an LLC.

It’s important to comply with any relevant local, state, and federal regulations, keep your liability protection intact, maintain accurate financial records, and attract customers to your business.

You can do that by following these steps:

1. Create an Operating Agreement

If you didn’t create an operating agreement during the limited liability company formation process, now’s the time to get started. An operating agreement outlines the ownership and member duties of an LLC.

Use our free LLC operating agreement tool to create the document in an easy-to-use question-and-answer format.

Or, download our free operating agreement template if you prefer. If you’d rather not write it yourself, you can also hire an attorney to assist you.

A handful of states (CA, DE, ME, MO, NB, and NY) legally require LLCs to have an operating agreement, but it is optional in most states. However, even if it is not a requirement in your state, we highly recommend having one.

An LLC operating agreement can help prevent or resolve disputes between LLC owners by creating a set of rules for how the LLC is operated. If you don’t have an operating agreement, your LLC will be subject to default regulations concerning business operations.

2. Open a Business Bank Account

You’ll need to open a business bank account for your LLC immediately, preferably before you start operating.

When you open your account, you may need to provide your LLC’s Employer Identification Number (EIN) or federal tax id number, banking resolution, and Articles of Organization.

A business bank account provides credibility, the ability to accept credit cards, the ability to accept checks in the business’s name, and most importantly, a business account will help protect your limited liability.

Limited liability protection is the most significant advantage of creating an LLC. Limited liability protection ensures that the owner’s personal assets aren’t in danger if the business is sued or goes into debt.

This protection — sometimes called the corporate veil — is not absolute, and it can be lost under certain circumstances. The easiest way to lose personal liability protection is to mix your personal financial accounts with the business’s.

For this reason, it’s essential that you open a business bank account before you start operating.

Recommended: Apply for a small business bank account with Mercury, our top-ranked bank for small businesses.

Mercury is a fintech company, not an FDIC-insured bank. Checking and savings accounts are offered by their bank partners Choice Financial Group, N.A., and Evolve Bank & Trust; Members FDIC. Deposit insurance covers the failure of an insured bank. Checking and savings account deposits may be held by sweep network banks. Certain conditions must be satisfied for pass-through insurance to apply. Learn more here.

3. Create a Business Website

Every business, large or small, needs to have a business website.

The first step in building your website is securing a web domain name. Securing your domain right away will also prevent others from acquiring it. Some domain providers offer free website builder tools with a domain name purchase.

Having a website is a must for all businesses. A website supports:

- Branding

- Marketing

- Ecommerce

- Organic web traffic

- Customer service

The good news is that It can take as little as five minutes to set up a website with a modern website builder.

Recommended: Use a website builder tool like the GoDaddy Website Builder. They’ve made creating a website simple and affordable, and incredibly fast.

4. Get Business Insurance

Every LLC should have some type of business insurance.

That’s because an LLC protects your personal assets, but you’ll need business insurance to protect your business assets.

At a minimum, your LLC should have general liability insurance, which is a broad insurance policy that protects your business from lawsuits. Other insurance policies an LLC may need depend on the type of business, if you have employees or not, and other factors.

In addition to general liability insurance, common types of business insurance include:

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policies at the best price.

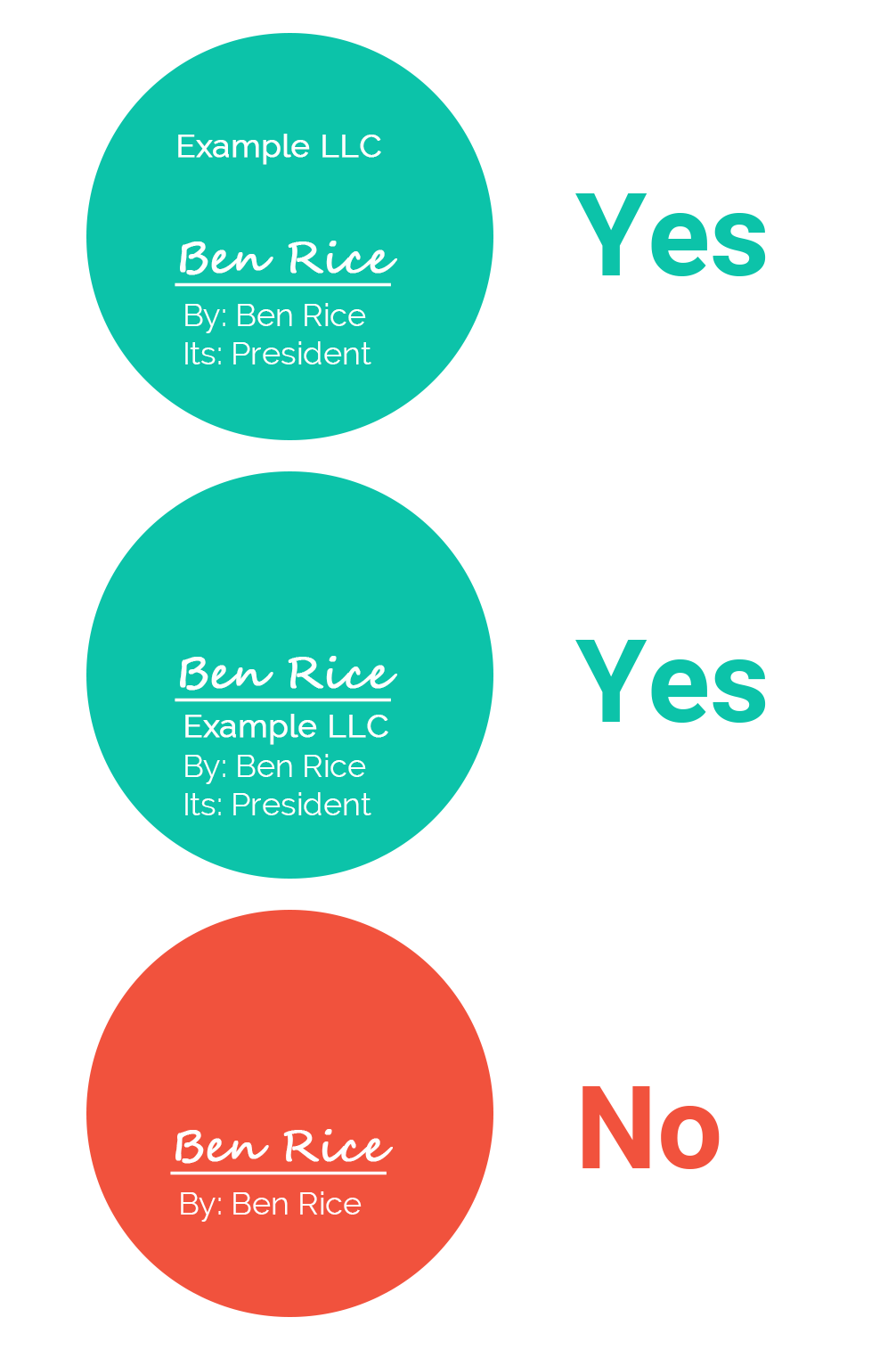

5. Learn How to Sign Documents Properly

It’s important to sign documents in a way that separates you from your business. This will protect your corporate veil and, in turn, your personal liability protection.

Examples of correct and incorrect signing procedures are found below:

By signing on behalf of the company, it more clearly indicates that you are not individually responsible for the debts of the company.

6. Establish Business Credit

Once you have your LLC in place, you’ll need to start building business credit.

The first step in this process is to apply for net 30 accounts and apply for an easy approval credit card.

We recommend getting started right away because lack of funding is one of the most significant stressors for small businesses. And, before your business can be approved for small business loans and other forms of credit, you’ll need to establish and build your business’s credit.

Ready to Build Business Credit? Apply for an easy approval business credit card from BILL and build your business credit quickly.

7. Register for Taxes

Owning an LLC comes with the responsibility of paying taxes and maintaining business finances. But before you get started, you need to choose your LLC’s tax status and register with the necessary government offices.

Choose Your LLC’s Tax Status

One of the advantages of an LLC is that owners have flexibility in how the company is taxed.

Use our How to Choose Your LLC Tax Status guide details the pros and cons of the different options and can help you figure out the best option for your LLC.

An LLC is classified by default as either a disregarded entity or a partnership based on the number of owners (members). A single-member LLC is automatically treated as a disregarded entity by the IRS, and a multi-member LLC is considered a partnership.

However, an LLC also has the option to be taxed as an S corporation (S corp) or as a C corporation (C corp).

The best tax structure depends largely on how much profit the business makes and what the owner’s financial plans and goals for the company are

Tax requirements vary by state and by an LLC’s tax status. It is a good idea to consult with your state’s tax office to determine which taxes you need to register for and pay.

The following are some common types of state taxes an LLC might have to pay:

- Franchise tax

- Sales tax

- Employment tax

- Withholding tax

- Unemployment insurance tax

Depending on an LLC’s tax status, it may or may not have to pay corporate federal taxes. Either way, you do not have to register ahead of time (aside from potentially getting an EIN) for federal taxes.

That being said, whether your LLC is taxed as a C corp that pays federal income tax or as a pass-through entity where only the owner pays personal income tax, you should be aware of how to file your LLC taxes and understand the differences between each tax status.

Accounting

Many small business owners plan to do their own accounting and are looking to avoid paying for a professional service. However, hiring an accountant can save you money, stress, and potentially legal troubles in the long run.

If you want to keep track of your LLC’s finances yourself, check out our guide to the best accounting software.

Here are some of the advantages of hiring an accountant for an LLC:

- Prevents the business from overpaying on taxes and helps it avoid penalties, fines, and other costly tax errors

- Makes bookkeeping and payroll easier, leaving you with more time to focus on your growing business

- Manages your business funding more effectively, discovering areas of unforeseen loss or extra profit

8. Research and Apply for Business Licenses and Permits

Before operating your business, you’ll need to make sure you have the right business licenses and permits.

Our state business license guides are a good resource for researching what permits and licenses your business might need.

Getting the right LLC business licenses and permits can sometimes feel like an intimidating step, as the business license and permit requirements vary considerably from state to state and even between counties and cities. Different types of businesses may also have different licensing requirements. There are three main licensing jurisdictions: federal, state, and local.

Federal Business Licensing

Not all businesses need a federal license. Only certain industries are subject to federal regulation. These include (but are not limited to):

- Agriculture

- Alcoholic beverage

- Aviation

- Firearms, ammunition, and explosives

- Fish and wildlife

- Commercial fisheries

- Maritime transportation

- Mining and drilling

- Nuclear energy

- Radio and television broadcasting

- Transportation and logistics.

State Business Licensing

State business licenses and permits vary state by state, but the most common one is the seller’s permit, which allows businesses to sell products and/or services in the state. Some states may refer to this as a “sales tax permit” or a “vendor license.”

In addition to the seller’s permit, there are a number of different types of state business licenses and permits, including:

- General business licenses

- “Doing business as” (DBA) licenses

- Zoning and construction permits

- Health permits

- Food service licenses

- Liquor licenses

- Medical licenses

- Electrical permits

- Fundraising licenses

- Farming licenses

- Real estate licenses

To help you figure out which business licenses you need in your state and how to get them, check our How to Get a Business License state guides.

Local Business Licenses

Some cities and counties require certain businesses (or sometimes all businesses) to have local business licenses or permits. If you have physical locations in more than one city or county, you may be required to have different licenses for each location.

Some of the common types of local business licenses include:

- General business licenses

- Zoning and construction permits

- Health permits

- Seller’s permits

- Professional licenses

9. Set Up Business Phone Service

It’s best to set up a business phone line immediately. For help with choosing a service, read our review of the best business phone services of 2026.

A business phone line lets clients know they are dealing with a legitimate company and sets the tone for future communications.

A business phone service can be used to create a separate line for business calls on the same phone. This helps keep personal and business calls separate, which can be helpful in organizing and prioritizing tasks. Additionally, it can help protect personal contact information from being accessed by unintended individuals.

Learn More About Maintaining the LLC Corporate Veil

Most of the steps you’ll need to take after starting an LLC revolve around safeguarding your LLC’s corporate veil.

The corporate veil is the legal protection that separates a company from its owners. It acts as a shield to protect the owners from personal liability in the event of any legal issues or debts the company may incur.

To maintain the corporate veil, you must:

- Keep your business and personal finances separate

- Avoid commingling funds and assets between your company and personal accounts

- Correctly sign on behalf of the company (e.g., John Doe, as Authorized Member of Example LLC, for and on behalf of Example LLC)

- Hold and record LLC meeting minutes

- Have adequate startup capital (e.g., business loan, business credit card, etc.)

- Follow all state and federal laws governing LLCs

You should know that the corporate veil is not absolute, and it can be lost under certain circumstances. The easiest way to lose personal liability protection is to mix your personal financial accounts with the business. This includes things like buying business supplies, accepting payments, and paying bills with your own personal checking account or credit card.

For this reason, it is essential that you keep business finances separate by opening a business bank account and getting a business credit card before you start operating.

If you do these things, you can rest assured that your LLC will offer you some key protection from personal liability in the event of any legal issues or debts your company may incur.

After Forming an LLC FAQs

There are nine next steps after forming an LLC: create an operating agreement, get an EIN, register for taxes, learn how to sign documents, get an accountant, apply for business licenses and permits, open a business bank account, get insurance, and establish your web presence.

Learn more in our steps after forming an LLC guide.

The state government office with which you register your LLC will inform you when it is approved.

Approval time for an LLC varies depending on the state and whether you register online or by mail. In many states, an LLC is approved immediately after registering and paying online.

When you get an LLC, you have limited liability protection for your personal assets as long as you don’t pierce the LLC’s corporate veil.

An LLC needs a federal tax ID (called an EIN) if it is a multi-member LLC or if it has employees. Additionally, most banks require businesses to have an EIN to open a business banking account, so we recommend that all LLCs get one.

LLCs do not pay quarterly taxes, but owners of LLCs (who are considered self-employed) are supposed to pay estimated quarterly personal income tax payments.

Some benefits of becoming an LLC include personal asset protection, tax flexibility, and management flexibility.

Check out our 7 Benefits of Starting an LLC article for more details.

You should form an LLC before getting an EIN.

Yes, all LLCs should have business insurance. At a minimum, you should get general liability insurance, but there are other types you may want to get as well, depending on the type of business you have.

You might need a business license if you have an LLC, depending on the type of business and location.

Check out our state business license guides to see what licenses you might need for your LLC in your state.