HOW TO START AN LLC IN CHICAGO

You can start an LLC in Chicago by filing the Articles of Organization with the Illinois Secretary of State and meeting the city’s local requirements.

We’ll show you how to form an LLC in the state of Illinois and establish your LLC in Chicago.

Or simply use a professional:

Starting an LLC in Chicago Is Easy

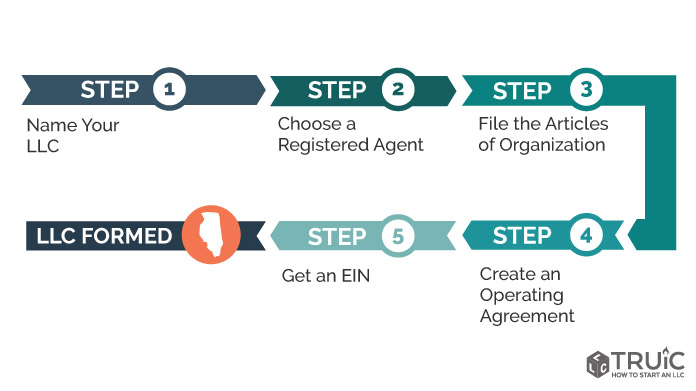

In order to form an LLC in Chicago, you’ll need to follow Illinois state laws and start an LLC within the state of Illinois.

Follow our step-by-step How to Start an LLC in Chicago guide to get started today.

Step 1: Name Your Chicago LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Step 5: Get an EIN

Step 1: Name Your Chicago LLC

Choosing a company name is the first and most important step for setting up your LLC in Chicago. Be sure to choose a name that complies with Illinois naming requirements and is easily searchable by potential clients.

1. Follow the Illinois naming guidelines for your Chicago LLC:

- Your name must include the phrase “limited liability company” or one of its abbreviations (LLC or L.L.C.).

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- Restricted words (e.g. Bank, Attorney, University) may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your LLC.

2. Is the name available in the state of Illinois? Perform an Illinois LLC name search on the Secretary of State’s Cyberdrive website to ensure that your Chicago LLC’s name is not already in use within the state.

To learn more about searching for an Illinois LLC name, read our full guide.

3. Is the URL available? We recommend that you check to see if your business name is available as a web domain. Even if you don’t plan to start a business website today, you may want to buy the URL in order to prevent others from acquiring it.

Now that you have verified your name and secured the URL you may select a professional service to complete the LLC formation process for you. We recommend using one of these professional services:

Step 2: Choose an Illinois Registered Agent

You are required to appoint a registered agent for your LLC in Chicago.

What is a registered agent? A registered agent is an individual or business entity responsible for receiving important tax forms, legal documents, notice of lawsuits, and official government correspondence on behalf of your business. Think of your registered agent as your business’s point of contact with the state.

Who can be a registered agent for your Chicago LLC? A registered agent must be a resident of Illinois or a corporation, such as a registered agent service, authorized to conduct business in the state of Illinois. You may elect an individual within the company including yourself.

To learn more about Illinois registered agents, read our full guide.

Recommended: Northwest provides the first year of registered agent service free with LLC formation ($29 + State Fees)

Step 3: File the Illinois LLC Articles of Organization

To register your LLC in Chicago, you’ll need to file Form LLC-5.5 – Articles of Organization with the Secretary of State. You can apply online or by mail.

Now is also a good time to determine whether your LLC will be member-managed vs. manager-managed.

File the Articles of Organization

OPTION 1: File Online With Cyberdrive Illinois

File Online– OR –

OPTION 2: File Form LLC-5.5 by Mail

Download FormState Filing Cost: $150, payable to the Secretary of State (Nonrefundable)

Mailing Address:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62746

For help with completing the form, visit our Illinois Articles of Organization guide.

Step 4: Create Your Chicago LLC Operating Agreement

Illinois LLCs are not required to have an operating agreement, but we recommend creating an operating agreement for your LLC in Chicago.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our Illinois LLC operating agreement guide.

Recommended: Download a template or create a free operating agreement using our tool.

Step 5: Get an EIN for Your Chicago LLC

What is an EIN? EIN stands for Employer Identification Number. EINs are a nine-digit number assigned by the Internal Revenue Service (IRS) to help identify businesses for tax purposes. It is essentially a Social Security number for a business.

An EIN is sometimes referred to as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN).

Why do I need an EIN? An EIN is required to:

- Open a business bank account

- File and manage federal and state taxes

- Hire employees

What if I already have an EIN for my sole proprietorship? The IRS requires that sole proprietorships get a new EIN when converting to an LLC.

Where do I get an EIN? You can get an EIN for free from the IRS. Getting an EIN is an easy process that can be done online or by mail.

For International EIN Applicants: You do not need an SSN to get an EIN. For more information, read our How to Get an EIN as a Foreign Person guide.

Get an EIN

Option 1: Request an EIN from the IRS

– OR –

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

Keep Your Company Compliant

Chicago Business Permits and Licenses

To operate your LLC in Chicago, you must comply with federal, state, and local government regulations. For example, restaurants likely need health permits, building permits, signage permits, etc.

The details of business licenses and permits vary from state to state. Make sure you read carefully. Don’t be surprised if there are short classes required as well. What’s more, fees for business licenses and permits will vary depending on what sort of license you are seeking to obtain.

The City of Chicago’s Small Business Center handles all of the city’s license- and permit-related regulations. Some of the industries the city requires licensing for include:

- Accommodations

- Animal Care and Services

- Transient Vendor License

- Child Services

- Commercial/Business Services

- Entertainment

- Food

- Home-Based Businesses

- Home Repair/Construction Services

- Hospital/Commercial Care Facilities

- Liquor-Related Businesses

- Manufacturing

- Motor Vehicle Services

- Outdoor Vending

- Parking Lot/Parking Garage Businesses

- Pawnshops/Secondhand Dealers

- Personal Services

- Public Vehicles

- Tobacco-Related Businesses

- Valet Operators

Some Chicago businesses are exempt from city licensing requirements and are instead regulated by the state. The city provides a list of these professions on its official website.

Find out how to obtain necessary Chicago business licenses and permits for your LLC or have a professional service do it for you:

- Business License Guide: Use our detailed Illinois Business License guide.

- Federal: Use the US Small Business Administration (SBA) guide.

- State: Use the Illinois.gov Registrations, Licenses & Permits page.

- Local: See the City of Chicago Business Licensing page for more information.

Recommended: If you are a first-time entrepreneur, consider having a professional service research your business’s licensing requirements. Read our best business license services review on Startup Savant.

Chicago LLC Tax Filing Requirements

Depending on the nature of your business, you may be required to register for one or more forms of state tax.

Sales Tax

If you are selling a physical product, you’ll typically need to register for a seller’s permit through the MyTax Illinois website.

This certificate allows a business to collect sales tax on taxable sales.

Sales tax, also called “Sales and Use Tax,” is a tax levied by states, counties, and municipalities on business transactions involving the exchange of certain taxable goods or services.

Read our Illinois sales tax guide to find out more.

Employer Taxes

If you have employees in Illinois, you will need to register for Unemployment Insurance Tax and Employee Withholding Tax on behalf of your employees. You can pay both these taxes through the MyTax Illinois portal.

Register for Illinois State Taxes

Local Taxes

Depending on your business activity, you may need to register for additional tax accounts with the city. Visit the City of Chicago’s website for more information.

Federal LLC Tax Filing Requirements

Most LLCs will need to report their income to the IRS each year using:

- Form 1065 Partnership Return (most multi-member LLCs use this form)

- Form 1040 Schedule C (most single-member LLCs use this form)

How you pay yourself as an owner will also affect your federal taxes. Visit our guide to learn more about how to pay yourself from your LLC.

Read our LLC Tax Guide to learn more about federal income taxes for LLCs.

File Your Chicago LLC Annual Report

Illinois requires Chicago LLCs to file an annual report with the state. This form can be submitted online by mail, or in person.

File Your Annual Report

OPTION 1: File Online with the Secretary of State

File Online– OR –

OPTION 2: File by Mail or In Person

Download FormFee: $150 Online, $75 By Mail (Nonrefundable)

Mail to:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

Due Date: Due each year prior to the first day of the month in which the LLC was formed. Reports can be filed starting 60 days prior to the due date.

Late Filings: Illinois charges a late fee of $75 by mail and $125 online. In addition, LLCs will be dissolved after 180 days for failure to file an annual report.

Small Business Resources

Get Help Starting an LLC in Chicago

After forming your LLC in Chicago, you will likely encounter many challenges. Take a look at our Illinois Small Business Resources page to find more information on resources for Chicago entrepreneurs.

Additionally, learn more about current US business trends so you can make the most informed business decisions.

TRUiC’s Small Business Tools

TRUiC believes business tools should be free and useful. Our tools help solve business challenges, from finding an idea for your business, to creating a business plan, writing an operating agreement for your LLC, and more.

Check out TRUiC’s small business tools: