What Is a DBA?

DBA means “doing business as.” A DBA is any registered name that a business operates under that isn’t its legal business name. A DBA is sometimes called a trade name, fictitious name, or assumed name.

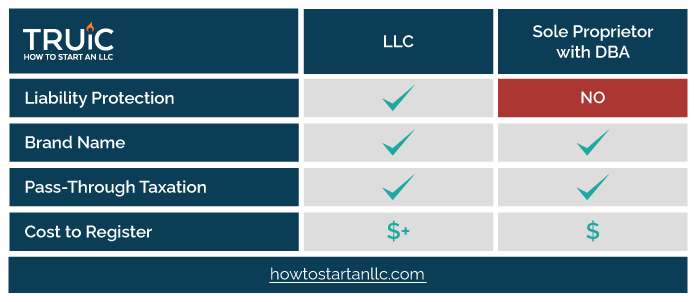

A DBA isn’t a business structure and doesn’t provide any personal asset protection like an LLC or corporation. Visit our DBA vs LLC guide to learn more.

For step-by-step instructions on how to get a DBA for your small business, choose your state below.

Recommended: Use LegalZoom to apply for a DBA and establish your brand.

Do I Need a DBA?

A DBA isn’t required to form or run a business. A DBA is an assumed or fictitious business name that is sometimes used by sole proprietors, partnerships, LLCs, and corporations for branding purposes.

There are mainly only two reasons why you would need a DBA:

- You have a registered formal business entity looking to branch out into new products, services or brands, or to rebrand in general.

- You have an unregistered business such as a sole proprietorship or partnership and would like to operate under a name other than your personal name. This option should only be used by businesses with very low profit and risk.

DBA Meaning

A DBA, also known as a trade name, fictitious name, or assumed name, allows you to conduct business under a name other than your legal business name.

Common DBA Misunderstanding

First-time entrepreneurs often confuse DBAs with a type of business structure. They assume that when they register a DBA, they are creating a formal business structure with liability protection but this is not the case.

When an entrepreneur starts a business and only registers a DBA name, they are actually just creating a sole proprietorship with a DBA name.

The DBA name helps with banking and branding the business, but the business owner’s personal assets are still completely exposed to lawsuits and creditors.

A sole proprietorship with a DBA name is still just a sole proprietorship—your personal assets are not protected by registering a DBA name.

If you have a sole proprietorship, it is easy to convert to an LLC.

LegalZoom offers packages to easily register your DBA starting at $99 + state fees.

What Are the Advantages of a DBA?

The benefits of using a DBA can vary depending on the type of business structure you have.

DBA Benefits for Sole Proprietorships and Partnerships

Registering a DBA name for a sole proprietorship or partnership is good for branding but it doesn’t provide the most important benefit—personal liability protection.

Forming an LLC or corporation is the best choice for a business owner that expects to earn a profit or carry any risk. LLCs and corporations can protect your personal assets in the event that your business is sued or can’t pay creditors.

There are three main benefits to using a DBA name for a sole proprietorship:

- Expanded Branding

- Increased Privacy

- Access to Small Business Banking

Branding

Without a DBA, a sole proprietor or partnership must operate under their personal name(s). A sole proprietor’s personal name is their business name by default.

With a DBA, “John Smith” can market himself under an assumed name like “Advanced Photography”.

You can learn more about branding in our How to Name Your Business guide. Our business name generator and logo maker are useful tools for branding your business.

Privacy

When you file a DBA name, the general public doesn’t see your surname, only your fictitious business name.

Banking

You can accept payments in the business’s name rather than your surname. This can increase trust and credibility.

DBA Benefits for LLCs and Corporations

Formal business structures like LLCs and corporations don’t need to file a DBA name to use a brand name, bank in the LLC name, or to create privacy. Those things are a standard part of those business structures.

The most important benefit is that DBAs allow formal business structures to create multiple brands (business names) or lines of business under one LLC or corporation. They can also be used to rebrand an LLC or corporation rather than change the main legal business name.

LLC DBA Example:

If “Babe’s Hardware, LLC” wanted to expand into furniture sales and restoration, the owner(s) might file for the trade name, “Babe’s Furniture.” This would allow them to promote the business as a furniture store and accept payments under the name “Babe’s Furniture”.

How to Set Up a DBA

1) Select Your State

DBA guidelines and laws vary from state to state. In some cases, you will need to register your DBA with the state government and in others, the county or city government.

Several states require you to register a DBA with more than one level of government. For instance, a general partnership may have to file at the state and county level in one state, while another state may require that same general partnership to file with just the county.

NOTE: You cannot file for a DBA in Kansas, New Mexico, or South Carolina.

The best place to begin your DBA filing process is with our simple step-by-step state DBA guides:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Step 2) Complete a DBA Name Search

Before you file, you should make sure your name isn’t taken by—or too similar to—another registered business in your state. You will also want to make sure your DBA meets your state’s naming guidelines. Our step-by-step guides discuss this step in detail for your state.

If you need extra help choosing a business name, select your state from the drop-down menu on our How to Name a Business guide.

Need Help Creating a Brand Name and Logo?

If you need help coming up with a DBA name, try our business name generator. Then, create a unique logo for your brand with our free logo generator.

We recommend securing your domain name (URL) for your DBA as soon as possible. By reserving your domain name, you ensure it won’t be acquired by another business owner.

Once you reserve a domain name for your DBA, consider setting up a business phone system to help strengthen your customer service and boost credibility. We recommend Phone.com because of its affordable pricing and variety of useful features. Start calling with Phone.com.

Step 3) Register Your DBA with the State

You will need to file your DBA with the state or with the county/city clerk’s office depending on your location and business structure,

Several states require you to register a DBA with more than one level of government. For example, a sole proprietorship may have to file at the state and county level in one state, while another state may require that same sole proprietorship to file with just the county.

We show you exactly how to get a DBA in on our state-specific How to File a DBA guides. You can also read our list of the best DBA filing services.

LegalZoom DBA Service

LegalZoom remains one of the most well known service providers in the industry and has excellent reviews on trustpilot. Their DBA filing packages begin at $99 + Filing Fees.

DBA FAQ

A DBA (doing business as) allows a business to operate under a name different from its legal name.

A DBA allows sole proprietorships to operate under a name different from the owner’s legal name, which can make the company appear more professional. DBAs can also be useful when a company wants to introduce a new product or line of business under a different name but doesn’t want to create a new legal entity.

The DBA filing process differs state to state. In some states, companies file for DBAs at the state level, while in other states, companies must file for DBAs with the cities or counties they operate in. To learn how to form a DBA in your state, check out these state-specific guides.

A DBA is not a separate legal entity, so it does not have to file separate taxes. All business conducted under a DBA is part of the legal entity for tax purposes.

No, it is not necessary to have a separate bank account for a DBA that operates under an LLC. However, if your DBA is for a sole proprietorship, it is a good idea to have a separate business bank account.

Visit our Best Banks for Small Business review for help choosing the best bank for your small business.

The price varies state by state, but the cost of a DBA is typically between $10-$100.

The right choice between getting a DBA for your sole proprietorship/partnership or forming an LLC depends on your business’s unique situation and needs. Operating a sole proprietorship under a DBA name is a simpler, more economical option in the short term, but an LLC offers VERY important advantages such as personal liability protection. You can learn more about this topic in our DBA vs LLC guide.

An example of a DBA would be a sole proprietorship carpentry business owned by John Doe doing business under the name Best Cut Carpentry.

You should write your DBA name exactly how it is registered.

You can have as many DBAs as you can afford to create and are able to keep track of. Each one comes with additional incremental expenses and paperwork, meaning more is not necessarily better.

DBAs aren’t required to have a separate EIN because DBAs aren’t a business entity. The business entity that the DBA is under would have an EIN if an EIN is required.

To learn more about EINs and when you need one for your business, read our What is an EIN guide.

No. An LLC is a business entity, while a DBA is just a name for a business.

Sole proprietorships are often confused with DBAs, but they are not the same: a sole proprietorship is a business entity, therefore it can choose to become an LLC.

To learn how to form an LLC, visit our Form an LLC state guides.

A DBA can only have Inc. in the name if the business entity the DBA is attached to is a corporation.

Holding a rental property in your name and with a DBA will not afford you any protection. The best option is to form an LLC to protect your personal assets in the event of an issue with the rental property. In any case, it is always best to consult an attorney.

Getting a DBA is often a better choice than changing your business’s legal name. If you want to rebrand your company or focus on another line of business, filing for a DBA is a simpler process than filing for a legal name change.

Some state-level laws prevent DBAs that are too similar to existing ones from being used, but this varies from state to state. It is possible to trademark a DBA, which would offer stronger protection across state lines.

In most cases, a DBA is only required if you are using a business name other than your legal business name. There are some states that require one for certain business entity types. For instance, New York requires partnerships to have a DBA.

Check out our state DBA guide for your business’ home state to see the rules and regulations that are relevant to you.

Additionally, if you are operating a sole proprietorship or partnership, and you are using a name other than your own, you will need a doing business as name to open a business bank account or to be listed in certain business directories.

It is not necessary to have a DBA for your LLC, but there may be benefits to having one. As we mentioned earlier, a doing business as name can open up a lot of different opportunities for branding and marketing your business or particular products or services that you offer.