HOW TO START A LAS VEGAS LLC

You can start a Las Vegas LLC by filing the Articles of Organization with the Nevada Secretary of State and meeting the city’s local requirements.

We’ll show you how to form an LLC in the state of Nevada and establish your Las Vegas LLC.

Or simply use a professional:

Starting a Las Vegas LLC Is Easy

In order to start a Las Vegas LLC, you’ll need to follow Nevada state laws and start an LLC within the state of Nevada.

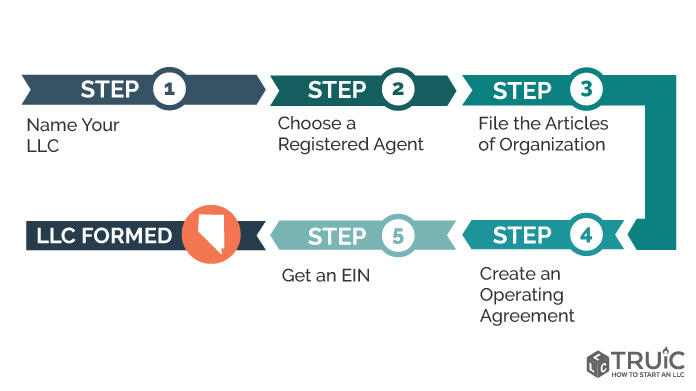

Follow our step-by-step How to Start a Las Vegas LLC guide to get started today.

Step 1: Name Your Las Vegas LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Step 5: Get an EIN

Step 1: Name Your Las Vegas LLC

Choosing a company name is the first and most important step in setting up your Las Vegas LLC. Be sure to choose a name that complies with Nevada naming requirements and is easily searchable by potential clients.

1. Follow the Nevada naming guidelines for your Las Vegas LLC:

- Your name must include the phrase “limited liability company” or one of its abbreviations (LLC or L.L.C.).

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- Restricted words (e.g. Bank, Attorney, University) may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your LLC.

- Your name must be distinguishable from any other Nevada limited liability company (LLC), corporation, limited liability partnership (LLP), limited partnership (LP), or limited liability limited partnership (LLLP).

2. Is the name available in the state of Nevada? Perform a Nevada business search on the Secretary of State’s website to ensure that your Las Vegas LLC name is not already in use within the state.

To learn more about searching for a Nevada LLC name, read our full guide.

3. Is the URL available? We recommend that you check to see if your business name is available as a web domain. Even if you don’t plan to start a business website today, you may want to buy the URL in order to prevent others from acquiring it.

Now that you have verified your name and secured the URL you may select a professional service to complete the LLC formation process for you. We recommend using one of these professional services:

Step 2: Choose a Nevada Registered Agent

You are required to appoint a registered agent for your Las Vegas LLC.

What is a registered agent? A registered agent is an individual or business entity responsible for receiving important tax forms, legal documents, notice of lawsuits, and official government correspondence on behalf of your business. Think of your registered agent as your business’s point of contact with the state.

Who can be a registered agent for your Las Vegas LLC? A registered agent must be a resident of Nevada or a corporation, such as a registered agent service, authorized to conduct business in the state of Nevada. You may elect an individual within the company including yourself.

To learn more about Nevada registered agents, read our full guide.

Recommended: Northwest provides the first year of registered agent service free with LLC formation ($29 + State Fees)

Step 3: File the Nevada LLC Articles of Organization

To register your Las Vegas LLC, you’ll need to file the following forms with the Nevada Secretary of State:

- Articles of Organization

- Initial List of Managers and State Business License Application

- Certificate of Acceptance of Appointment by Registered Agent

Nevada places these files into one formation PDF packet. You can apply online, by mail, by fax, by email, or in person.

Now is also a good time to determine whether your LLC will be member-managed vs. manager-managed.

File the Articles of Organization

OPTION 1: File Online With Nevada SilverFlume

File Online– OR –

OPTION 2: File by mail, by fax, by email, or in person

Download FormState Filing Cost: $425 ($75 Articles of Organization + $150 Initial List of Manager or Members + $200 Business License Application)

Filing Address:

Secretary of State

Commercial Recordings Division

202 N. Carson St.

Carson City, NV 89701-4201

Fax: (775) 684-5725

Email: [email protected]

For help with completing the form, visit our Nevada Articles of Organization guide.

Step 4: Create Your Las Vegas LLC Operating Agreement

Nevada LLCs are not required to have an operating agreement, but we recommend creating an operating agreement for your Las Vegas LLC.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our Nevada LLC operating agreement guide.

Recommended: Download a template or create a free operating agreement using our tool.

Step 5: Get an EIN for Your Las Vegas LLC

What is an EIN? EIN stands for Employer Identification Number. EINs are a nine-digit number assigned by the Internal Revenue Service (IRS) to help identify businesses for tax purposes. It is essentially a Social Security number for a business.

An EIN is sometimes referred to as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN).

Why do I need an EIN? An EIN is required to:

- Open a business bank account

- File and manage federal and state taxes

- Hire employees

What if I already have an EIN for my sole proprietorship? The IRS requires that sole proprietorships get a new EIN when converting to an LLC.

Where do I get an EIN? You can get an EIN for free from the IRS. Getting an EIN is an easy process that can be done online or by mail.

For International EIN Applicants: You do not need an SSN to get an EIN. For more information, read our How to Get an EIN as a Foreign Person guide.

Get an EIN

Option 1: Request an EIN from the IRS

– OR –

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

Keep Your Company Compliant

Las Vegas Business Permits and Licenses

To operate your Las Vegas LLC, you must comply with federal, state, and local government regulations. For example, restaurants likely need health permits, building permits, signage permits, etc.

The details of business licenses and permits vary from state to state. Make sure you read carefully. Don’t be surprised if there are short classes required as well. What’s more, fees for business licenses and permits will vary depending on what sort of license you are seeking to obtain.

The City of Las Vegas offers over 100 general and privileged business licenses and permits. Some of the more popular license categories include:

- Mobile Food Vendors

- General Retail Sales

- General Services

- Hotels

- Restaurants

- Wholesale Alcoholic Beverages

- Temporary Merchants

- Insurance Agencies

- General Entertainment Establishments

- Construction-Related Services

Find out how to obtain necessary Las Vegas business licenses and permits for your LLC or have a professional service do it for you:

- Business License Guide: Use our detailed Nevada Business License guide.

- Federal: Use the US Small Business Administration (SBA) guide.

- State: Use the Nevada Secretary of State’s Licensing page.

- Local: See the City of Las Vegas’ Business Licenses page for more information.

Recommended: If you are a first-time entrepreneur, consider having a professional service research your business’s licensing requirements. Read our best business license services review on Startup Savant.

Las Vegas LLC Tax Filing Requirements

Depending on the nature of your business, you may be required to register for one or more forms of state tax.

Sales Tax

If you are selling a physical product, you’ll typically need to register for a seller’s permit through the Nevada Tax Center website.

This certificate allows a business to collect sales tax on taxable sales.

Sales tax, also called “Sales and Use Tax,” is a tax levied by states, counties, and municipalities on business transactions involving the exchange of certain taxable goods or services.

Read our Nevada sales tax guide to find out more.

Employer Taxes

If you have employees in Nevada, you will have to register for Unemployment Insurance Tax through the Nevada Unemployment Insurance Tax Portal. You will also need to sign up for Employer Tax through the Nevada Department of Taxation.

Register for Nevada State Taxes

Local Taxes

Depending on your business activity, you may need to register for additional tax accounts with the city. Check out the City of Las Vegas’s website to learn more.

Federal LLC Tax Filing Requirements

Most LLCs will need to report their income to the IRS each year using:

- Form 1065 Partnership Return (most multi-member LLCs use this form)

- Form 1040 Schedule C (most single-member LLCs use this form)

How you pay yourself as an owner will also affect your federal taxes. Visit our guide to learn more about how to pay yourself from your LLC.

Read our LLC Tax Guide to learn more about federal income taxes for LLCs.

File Your Nevada LLC Annual Report

Nevada requires Las Vegas LLCs to file an annual report with the state. This annual report is also known as an annual list in Nevada.

File Your Annual List

OPTION 1: File Online with the Secretary of State

File Online– OR –

OPTION 2: File by Mail or In-Person

Download FromFee: $150 payable to the Secretary of State (Nonrefundable)

Mail to:

Secretary of State

202 North Carson Street

Carson City, NV 89701

Due Date: Due by the end of the anniversary month of your original LLC filing.

Late Filings: Nevada will charge a $100 penalty if you miss the filing deadline. In addition, LLCs may be dissolved or revoked after one year.

Small Business Resources

Get Help Starting a Las Vegas LLC

After forming your Las Vegas LLC, you will likely encounter many challenges. Take a look at our Nevada Small Business Resources page to find more information on resources for Las Vegas entrepreneurs.

Additionally, learn more about current US business trends so you can make the most informed business decisions.

TRUiC’s Small Business Tools

TRUiC believes business tools should be free and useful. Our tools help solve business challenges, from finding an idea for your business, to creating a business plan, writing an operating agreement for your LLC, and more.

Check out TRUiC’s small business tools: