How to Start a Business in North Carolina

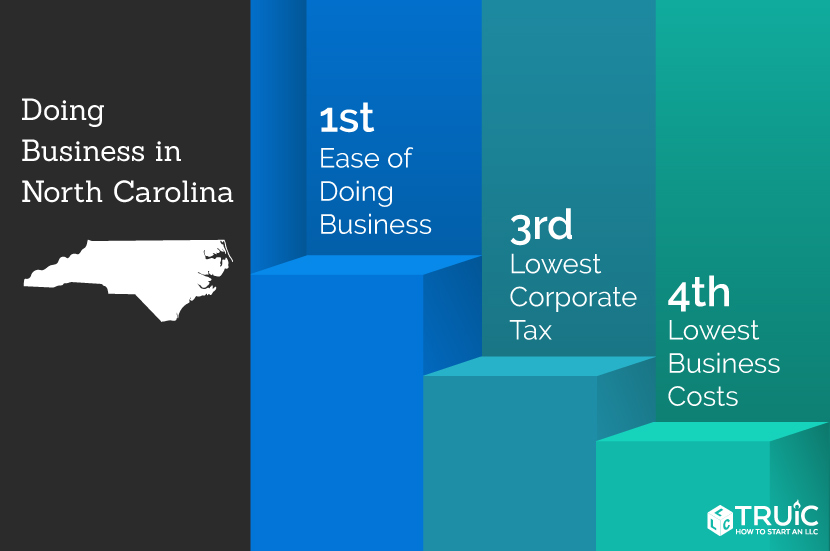

Ranked 1st in the nation by Forbes for ease of doing business, starting a business in North Carolina is a great choice for entrepreneurs. Start your business today with our simple step-by-step guide and get on the fast track to financial and personal independence.

Also check out TRUiC’s free Small Business Startup Guide – a step-by-step course for turning your business idea into reality.

Or simply use a professional service:

Northwest ($29 + State Fees)

LegalZoom ($249 + State Fees)

To Start a Business in North Carolina, Follow These Steps

Are you ready to start your own business?

Creating a North Carolina business of your own can be challenging. You will need adequate funding, time, personal support, and professional support in order to move forward successfully with your entrepreneurial dreams.

To see if you’re prepared to take the leap, check out our Entrepreneurship Quiz. To learn how to form a Business in Spanish, read our Cómo crear una empresa en North Carolina guide.

Skip Ahead To:

- Choose the Right Business Idea

- Plan Your North Carolina Business

- Choose a Business Structure

- Register Your North Carolina Business

- Set up Banking, Credit Cards, & Accounting

- Get Funding

- Get Insured

- Obtain Permits & Licenses

- Hire Employees

- Define Your Brand

- Build a Business Website

- Promote & Market Your Business

Step 1: Choose the Right Business Idea

The first step toward business ownership is deciding what kind of business to start. Look for an idea that suits your interests, your personal goals, and your natural abilities. This will help you stay motivated when the going gets tough and will greatly improve your odds of success. We have assembled a comprehensive list of small business ideas to help you get started. Need inspiration? Here were the most popular ideas among our North Carolina visitors in 2020:

Find the Right Business Idea for You

Our free Business Ideas Generator will help you identify great businesses that match your interests and lifestyle.

Step 2: Plan Your North Carolina Business

Successful businesses are built through careful planning. Before committing a significant amount of money and other resources toward your business in North Carolina, critically analyze your idea, and create a game plan. At a minimum, you should complete the following:

Name Your Business

What will you name your business? When naming a business, you’ll want to choose an available name that follows North Carolina’s naming rules and resonates with your customers Use our Business Name Generator to find the perfect brand name and website.

Before you reserve your business name, make sure your domain is available.

Once you register a domain name, we recommend choosing a business phone system to enhance your customer service. Phone.com provides a high-quality phone service that integrates with all devices. Try Phone.com.

Find a Business Location

Do you know where your business will be located? Whether you’re opening a brick-and-mortar establishment or starting a business from home — your business location informs the type of licensing and permits you’ll need as well as your business’s growth potential. Doing your research on North Carolina’s popular areas such as Charlotte or Greensboro can help increase foot traffic and drive customer interest.

Conduct Market Research

Have you gotten to know your market? Before you write your business plan, conducting thorough market research is crucial. This can involve conducting surveys, doing search engine optimization (SEO) research, or holding focus groups. The goal of market research is to better understand your target market and competitors in order to craft an effective business plan.

Write a Business Plan

Have you written a business plan? Our Business Plan Generator makes writing your business plan easier than ever; just add your business’s information and you’re done!

A well-crafted business plan doesn’t just help you get organized while you start your small business in North Carolina. Business plans are used to obtain business funding and help you reach important milestones.

Here are some of the main components of a well-written business plan:

- Product Development: What problem does your business solve? What will set your product or service apart from the competition?

- Sales & Marketing: Who are your potential customers? How will you get their attention and convert them into buyers?

- People & Partnerships: What roles will you need to hire, and what professional relationships will you need to form in order to succeed?

- Financial Planning: How many clients or sales will you need in order to break even? How much money will it take to get there, and where will you get the funding?

Business Planning Resources

- Need Help? Find organizations in your local area that can assist you with planning.

- If you’re a woman in business, find funding, tools, and resources with this great Women in Business series.

Step 3: Choose a Business Structure

Registering your North Carolina company as a legal business entity — such as an LLC, corporation, or nonprofit — has two major advantages:

- Increased credibility

- Protection from personal liability in the event your business is sued

Find out which business structure is right for your new business in North Carolina.

Sole Proprietorship

A sole proprietorship is an informal business structure that isn’t incorporated or separated from its owner. This means that 100% of the business’s profits go to the owner; however, 100% of the financial liability should the business accrue debt or get sued falls on the owner as well.

Partnership

A partnership, like a sole proprietorship, is an informal unincorporated business structure but with multiple owners. Similarly, partnerships do not have liability protection that you find with a formal business structure.

LLCs

A limited liability company (LLC) combines the personal asset protection of a corporation with the flexibility of a partnership or sole proprietorship. Most small businesses prefer the LLC structure due to its easy maintenance and favorable tax treatment. Find out if you should start an LLC for your small business.

Find the Right Business Structure For You

Figure out which business structure works best for you — in just a few easy questions.

Answer a few short questions about your business and we’ll recommend the right structure for you — plus show you how to get started.

Corporations

A corporation is a separate legal entity that is owned by its shareholders. Corporations have more formal regulations than LLCs and tend to be more attractive to investors. Most large companies like Apple fall under the corporate category.

Nonprofits

A nonprofit organization is one that is funded by donations instead of investors. Nonprofits are typically created to further a social cause and are exempt from paying taxes. The Red Cross is an example of such an organization.

If you choose not to register your company as a business entity, you will be held personally responsible for the debts and liabilities of your business.

In addition, partnership and sole proprietorship business owners may need to file a DBA, known in North Carolina as an assumed business name. A DBA is not a business structure and does not give you and your personal belongings the protection like an LLC would.

Find out more about how to file a DBA in North Carolina by visiting our guide.

Step 4: Register Your North Carolina Business

Once you’ve chosen your business structure, the next step is to form your business. No matter what formal business structure you choose, there are a few common steps, including:

- Naming your business

- Choosing a registered agent: an individual or business entity that accepts tax and legal documents on behalf of your business.

- Getting an Employer Identification Number (EIN): a number assigned by the Internal Revenue Service (IRS) to help identify businesses for tax purposes.

- Filing formation documents.

In addition to these steps, each business structure has its own requirements that are unique to that business structure.

Here are the steps you need to take to register your business:

Form an LLC in North Carolina

LLCs are the simplest formal business structure to form and maintain. With less paperwork than other business structures, you can easily form an LLC in five easy steps.

- Name Your LLC

- Choose a Registered Agent

- File Your LLC With the State

- Create an LLC Operating Agreement

- Get an EIN

To file the Articles of Organization for an LLC in North Carolina, you must submit formation documents to the Secretary of State online, by mail, or in person, along with the $125 filing fee.

Read our full guide on How to Form an LLC in North Carolina or have a professional service form an LLC for you.

Start a Corporation in North Carolina

If you think starting a corporation is right for your business, there are five steps to starting your business as a corporation.

- Name Your Corporation

- Choose a Registered Agent

- Hold an Organizational Meeting

- File Formation Documents

- Get an EIN

To file the Articles of Incorporation for a corporation in North Carolina, you must submit formation documents to the Secretary of State online, by mail, or in person, along with the $125 filing fee.

Read our full guide on How to Start a Corporation in North Carolina or have a professional service form a corporation for you.

Form a Nonprofit in North Carolina

Choosing to form a nonprofit involves many of the same steps as a corporation or LLC; however, with this business structure, you can apply for tax exemption, otherwise known as 501(c)(3) status, through the IRS.

- Name Your Nonprofit

- Choose a Registered Agent

- Select Your Board Members and Officers

- Adopt Bylaws and Conflict of Interest Policy

- File the Articles of Incorporation

- Get an EIN

- Apply for 501(c)(3) Status

To file the Articles of Incorporation for a nonprofit in North Carolina, you must submit formation documents to the Secretary of State online, by mail, or in person, along with the $60 filing fee.

Read our full guide on How to Form a Nonprofit in North Carolina or have a professional service form a nonprofit for you.

Step 5: Set up Business Banking, Credit Cards, and Accounting

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil.

You can protect your North Carolina business with these three steps:

1. Opening a business bank account:

- Separates your personal assets from your company’s assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Find the right bank for you, read our review of the Top 5 Banks for Your Small Business

2. Getting a business credit card:

- Helps you separate personal and business expenses.

- Builds your company’s credit history, which can be useful to raise capital (e.g., small business loans and small business grants) later on.

Read our guide on small business credit cards to find one for your business.

Build Your Business Credit Quickly

Visit BILL to apply for their easy-approval business credit card.

3. Setting up business accounting

An accounting system helps you track the performance of your business and simplifies annual tax filings. Quality accounting software lets you download your bank and credit card transactions, making accounting fast and easy. Learn more about the importance of accounting and how to get started with accounting today. Or, hire a business accountant to help you navigate all your business accounting and tax needs from payroll to sales tax.

Recommended: An accounting service could be saving your business thousands of dollars a year. Try our recommended accounting service today to help simplify your taxes.

Step 6: Get Funding

It’s no secret that you need funding to start a business, but before you can secure the money you need to cover startup costs, there are a few things you need to do first. Calculate your business costs before seeking outside funding. This will help you choose the right funding source for your North Carolina business’s needs. Next, be smart with your spending and get organized by creating a detailed financial plan.

Explore Business Funding Options

- Bootstrapping: This is the do-it-yourself approach to business funding which means you provide the capital for your business through personal savings as well as your current income. Once your business is in operation, profit is reinvested back into the business to continue its growth.

- Friends and Family: Financing your business through friends and family loans can be a great way to get the capital you need to start your small business. When mixing business with family and friends, it’s a good idea to establish a written agreement and repayment plan.

- Small Business Grants: Small business grants are essentially business funding for your business you don’t have to pay back. You can obtain a small business grant by completing an application process with a grantor.

- Small Business Loans: You can typically apply for small business loans through a bank or other lending institution. This funding method requires repayment but will provide you with the capital to cover startup costs or more.

Learn how to plan, raise, and manage your funds by visiting our guide to Small Business Finance.

Step 7: Get Insured

Business insurance helps you manage risks and focus on growing your business in North Carolina. The most common types of business insurance you should consider are:

We recommend that all small businesses, including home-based businesses, purchase a general liability policy. Businesses selling professional advice or services, such as consulting and accounting firms, should also consider a professional liability policy.

In North Carolina, businesses with three or more employees, excluding business owners, are required by law to have workers’ compensation insurance.

Ready To Protect Your Business?

We recommend getting a free quote from Ergo Next Insurance, which includes industry-specific coverage and discounted pricing.

You can also read our review of the best small business insurance companies.

Step 8: Obtain Permits and Licenses

To operate your new business legally, you will need to comply with federal, state, and local government regulations. In many cases, this involves obtaining one or more business permits and/or licenses. For example, a restaurant will likely need health permits, building permits, signage permits, etc.

To start a business in North Carolina, you’ll need different licenses and permits depending on the type of business you’re operating. Find out the licensing your business needs by performing a business license search or by utilizing the following resources:

- Federal: Use the US Small Business Administration (SBA) guide.

- State: Use the North Carolina Economic Development Partnership’s Business Licenses & Permits page.

- Local: Contact your local county clerk and ask about local licenses and permits

Step 9: Hire Employees

For any business (unless you plan to be your business’s sole employee), building a strong team is a crucial next step in starting a successful business. But it isn’t just about finding the right people; you need to ensure you stay compliant with requirements for hiring employees legally. This includes ensuring that you are registered with the IRS for employee taxes and reporting new hires to the State of North Carolina.

Register for North Carolina State Employee Taxes

Once you’ve built your team, we strongly recommend utilizing a payroll service to issue paychecks, track time, and make tax season more manageable.

Step 10: Define Your Brand

The strongest and most memorable businesses are built on a solid brand. When developing your brand, you should consider:

- what your business stands for

- what are your core values

- what will earn customer trust

Once you feel confident about your answers to these questions, take the next step with our Free Logo Generator to get a unique logo for your North Carolina business. Our logo maker is free (no sign-ups or email addresses needed), and it comes in all social media sizes. It’s easy and hassle-free — no design experience required! Or, if you want to explore your options, you can also use this free logo maker by Tailor Brands.

Step 11: Build Your Business Website

After defining your brand and creating your logo the next step is to create a website for your business.

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites – full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own and control.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Using our website building guides, the process will be simple and painless and shouldn’t take you any longer than 2-3 hours to complete.

Recommended: Get started today using our recommended website builder or check out our review of the Best Website Builders.

Step 12: Promote and Market Your Business

Promoting Your North Carolina Business

There are many different methods to promote your business in North Carolina, but the most effective methods are:

- Press Releases

- YouTube

- Google My Business

Press Releases

Press releases are a great way to promote your brand and are one of the most cost-effective strategies as they:

- Provides publicity

- Establish your brand on the web

- Improve your website’s SEO, driving more customers to your website

- Are a one-time cost in terms of effort and money

- Have long-lasting benefits

Recommended: TRUiC has negotiated a 25% discount for you on a service that will write and distribute press releases for you.

A Facebook page is a great, free way to interact with your customers. But, it does require ongoing effort to be successful.

A Facebook page can be used to:

- Establish your local business presence

- Showcase your business products and services

- Communicate with your customers

- Get and share reviews from customers

- Promote your business through ads, though this may not be suitable for your business.

YouTube

With billions of global YouTube users, there is a giant customer base looking for content your business could be producing. A YouTube channel for your business can be used to:

- Improve your SEO by boosting your Google ranking and conversion rate.

- Drive social media engagement and create stronger bonds with your customers.

- Provide detailed explanations about products and services.

Google My Business

Google My Business is a helpful tool that allows businesses to manage how their business appears on Google’s search engine results page (SERP) and Google maps.

Google My Business can be used to:

- Link to important information about your business such as your website, physical address, hours of operation, phone number, and customer reviews.

- Increase brand awareness by improving local SEO and driving traffic to your website.

- Engage with customers and increase credibility.

Get Help From Local Resources

To help you start your business, consider reaching out to city, county, state, and regional resources that can help support you in your entrepreneurial endeavors. This might include SBA district offices, SBDC locations, chambers of commerce, and startup assistance programs.

We’ve compiled a list of resources to check out on our North Carolina Local Resources page.