Do I Need an LLC to Start a Business?

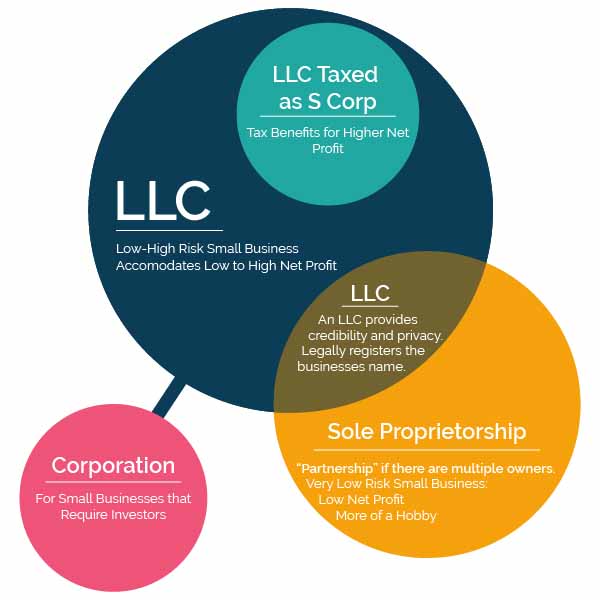

A limited liability company (LLC) is one of the most popular business structures for small businesses. It offers a number of potential advantages over other structures. But, do you really need an LLC to start a business?

Forming an LLC is not required to start a small business, but in most cases, the benefits of starting an LLC are worth the minimal cost and effort.

In this article, we’ll cover some advantages of starting an LLC and other popular business structures to help you decide on the best business structure for you.

If you decide that an LLC is a good fit for your business, you can check out our How to Form an LLC state guides for easy, step-by-step instructions.

What Is an LLC?

An LLC is a business structure that provides its owners (called “members”) the personal liability protection of a corporation with the pass-through taxation of a sole proprietorship or partnership.

Limited liability protection protects a business owner’s personal assets in the event of a lawsuit or unsettled debt.

LLCs can be owned by one or more people. An LLC with one owner is known as a single-member LLC, while an LLC with more than one owner is a multi-member LLC.

Recommended: Check out our What Is a Limited Liability Company guide to learn more.

Find the Right Business Structure For You

Figure out which business structure works best for you — in just a few easy questions.

Answer a few short questions about your business and we’ll recommend the right structure for you — plus show you how to get started.

LLC Benefits

There are a number of potential benefits of starting an LLC, such as:

- Personal liability protection

- Tax options

- Inexpensive to form

- Easy to form

- Less paperwork

- Management flexibility

- Credibility

Personal Liability Protection

One of the most important benefits of an LLC is that it provides personal liability protection to its owners. This means that an owner’s personal financial assets aren’t in danger if the LLC defaults on a debt or is sued. Sole proprietorships and general partnerships do not offer this protection.

However, owners can lose this protection if they do something to pierce the LLC’s corporate veil. This includes things like mixing personal finance accounts with business accounts and committing fraud.

Start an LLC

You can start an LLC yourself using our free guides, or you can hire an LLC formation service for a very small fee.

Tax Options

LLCs are “pass-through entities” by default, meaning they don’t pay any corporate income tax. Instead, profits and losses pass through to each member’s individual tax return and are taxed at the owner’s personal tax rate. This means that the owners can avoid double taxation, which is not the case for owners of corporations.

LLCs also have the option to be taxed as either a C corporation (C corp) or an S corporation (S corp), which may be beneficial, depending on a few factors. Visit our How to Choose a Business Structure guide to learn more.

Save with Freshbooks

Recommended: Find out how much you could be saving today by scheduling a consultation with a business accountant.

Inexpensive to Form

LLCs are generally inexpensive to form and maintain. The main cost of forming a limited liability company (LLC) is the state filing fee, which ranges from $40 to $500, depending on your state.

LLC Costs

Recommended: Visit our LLC Cost guide to learn more about LLC costs in your state.

Easy to Form

LLCs are easier to form than corporations. You should be able to form an LLC on your own without the help of an attorney. The main expense of starting an LLC is usually filing the formation documents with the state government office, which costs between $40 and $500.

If you don’t feel comfortable going through the process yourself and would like professional help, we’ve put together a list of the best LLC services.

Less Paperwork

LLCs are less regulated than corporations and have considerably less paperwork. LLCs aren’t required to have a board of directors, keep meeting minutes, or hold shareholder meetings. This means much less time and money spent on keeping records and filing compliance-related documents.

Management Flexibility

LLCs can choose to be either member-managed or manager-managed. Member managed means that the members are actively involved in managing the company’s operations. In a manager-managed LLC, the members give the responsibility of managing the company to a manager, who may or may not be a member. In this case, some, or all, members may act more like passive investors. LLCs aren’t required to have a board of directors which allows management to be more independent.

Credibility

Forming an LLC is a step up in credibility from a sole proprietorship or partnership. Customers and other businesses will find an LLC more credible.

Form an LLC

Start an LLC yourself using our free Form an LLC guides or hire an LLC formation service for a very small fee.

When to Form an LLC

Most small businesses start as LLCs. An LLC is most likely the best structure for your business if it has any of the following characteristics:

- A potentially large customer base

- Potential for immediate and sustainable profit

- Above minimal risk of liability or loss

- Would benefit from unique tax options

Additionally, you should form an LLC if:

- You don’t need to attract investors

- You plan to invest most of your profit back into the business each year

- You would benefit most from an easy-to-maintain business structure

When to Use an S Corp As an LLC

If you anticipate earning a substantial profit each year and don’t need to attract investors, then forming an LLC and electing to be taxed as an S corporation (S corp) could make the most sense for your business. Under an S corp, business owner(s) can save about 17% on the distribution portion of their income if the following statements are true:

- The business meets S corp restrictions

- The business earns enough in net profit to pay a “reasonable salary” and at least $10,000 in distributions annually

- The addition of payroll and accounting costs don’t outweigh tax advantages

Learn more in our LLC vs S Corp guide.

How to Form an LLC

Forming an LLC is easy. There are two options for forming your LLC:

- You can hire a professional LLC formation service to set up your LLC (for a small fee).

- Or, you can use our free state-by-state Form an LLC guide to do it yourself.

Form an LLC with ZenBusiness

Recommended: Have ZenBusiness form an LLC for you.

Step 1: Select Your State

For most new business owners, the best option is to form your LLC in the state where you live and where you plan to conduct your business.

Visit our Best State to Form an LLC guide to learn more.

- Alabama LLC

- Alaska LLC

- Arizona LLC

- Arkansas LLC

- California LLC

- Colorado LLC

- Connecticut LLC

- Delaware LLC

- Florida LLC

- Georgia LLC

- Hawaii LLC

- Idaho LLC

- Illinois LLC

- Indiana LLC

- Iowa LLC

- Kansas LLC

- Kentucky LLC

- Louisiana LLC

- Maine LLC

- Maryland LLC

- Massachusetts LLC

- Michigan LLC

- Minnesota LLC

- Mississippi LLC

- Missouri LLC

- Montana LLC

- Nebraska LLC

- Nevada LLC

- New Hampshire LLC

- New Jersey LLC

- New Mexico LLC

- New York LLC

- North Carolina LLC

- North Dakota LLC

- Ohio LLC

- Oklahoma LLC

- Oregon LLC

- Pennsylvania LLC

- Rhode Island LLC

- South Carolina LLC

- South Dakota LLC

- Tennessee LLC

- Texas LLC

- Utah LLC

- Vermont LLC

- Virginia LLC

- Washington LLC

- Washington D.C. LLC

- West Virginia LLC

- Wisconsin LLC

- Wyoming LLC

Step 2: Name Your LLC

You’ll need to provide your state with a unique name that is distinguishable from all registered names when you file your LLC’s formation documents.

Our Business Name Generator and our How to Name a Business guide are free tools available to entrepreneurs that need help naming their business.

Step 3: Choose an LLC Registered Agent

Your LLC registered agent will accept legal documents and tax notices on your LLC’s behalf. You will list your registered agent when you file your LLC’s Articles of Organization.

Free First Year Registered Agent Service

Recommended: ZenBusiness provides the first year of registered agent service free with LLC formation.

Step 4: File Your LLC’s Articles of Organization

The Articles of Organization, also known as a Certificate of Formation or a Certificate of Organization in some states, is the document you will file to officially register an LLC with the state.

Step 5: Create an LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your LLC.

Step 6: Get an EIN

An Employer Identification Number (EIN) is a number that is used by the US Internal Revenue Service (IRS) to identify and tax businesses. It is essentially a Social Security number for a business.

EINs are free when you apply directly on the IRS website.

Other Types of Business Structures

In addition to LLCs, there are several other common business structures, including:

- Sole proprietorship

- Partnership

- Corporation

- Nonprofit

Sole Proprietorship

A sole proprietorship is a type of informal business structure. It is a business owned by an individual who files taxes under his or her own name. There is no legal separation between the owner and the business, so the owner is personally liable for any actions taken against the business.

Generally, a sole proprietorship should only be considered an option if all the following are true about the business:

- It must be very low risk (low chance of liability or financial loss)

- It has a smaller customer base — often friends, family, and neighbors

Sole proprietorships sometimes start as hobbies like photography, blogging, or video streaming before turning into businesses.

Partnership

A general partnership is a type of informal business structure. It is a business owned by more than one individual where taxes are filed under the owners’ names. There is no legal separation between the owners and the business, so the owners are personally liable for any actions taken against the business.

Corporation

A corporation is a formal legal business structure that is owned by shareholders. A corporation offers personal liability protection and is more complex to maintain than an LLC. Corporations offer their own set of tax benefits and investor opportunities.

If any of the following is true for your business, a corporation might be the right choice:

- You need to attract venture capitalist and investors

- You need to carry significant profit over from tax year to tax year

Nonprofit

A nonprofit is a type of corporation, but it does not have shareholders, and it is not organized to make a profit for its owners. Instead, nonprofits use the money they make to advance a particular cause. A charity organization is a common type of nonprofit. Nonprofits are exempt from paying federal income taxes, but they must meet certain requirements and apply to be approved to receive their tax-free status.

Do I Need an LLC FAQ

Some of the benefits of an LLC are simple formation and maintenance, personal liability protection, potential tax benefits, and management and ownership flexibility.

LLCs are better for taxes for some businesses but not for all. Read our LLC Tax Guide for more information.

You can easily create an LLC yourself by using our free How to Form an LLC guide, or you can use an LLC formation service to register your LLC for you.

LLCs and sole proprietorships have the same default tax structure. However, LLCs are also eligible to elect S corp tax status, which could potentially result in them paying more or less taxes, depending on the situation.

Check out our LLC vs. Sole Proprietorship tax guide for more information.

You don’t need an LLC if self employed, but we recommend forming an LLC over a sole proprietorship because of the advantages that LLCs offer.

The main cost of forming an LLC is the state registration fee, which is between $40 and $500, depending on the state. If you decide to use a professional service to help with the formation, there will be added expense.

LLCs are taxed differently depending on what they elect. Taxation depends on if you operate a single-member or multi-member LLC as well as your LLC tax structure.

Read our LLC Tax Guide for more information.

The better business structure depends on your business’s unique circumstances and needs. However, unless your business is low profit and very low risk, an LLC is likely the better option.

Check out our Sole Proprietorship vs. LLC guide for more information.

An S corporation (S corp) is an Internal Revenue Service (IRS) tax classification, not a type of business entity. An LLC may choose to be taxed as an S corp or as a default LLC. Read our What Is the Difference Between an LLC and an S Corp article for more information.

Your business’s unique situation and needs will determine whether it’s better to form an LLC or a DBA company. Read our DBA vs LLC article for more information.

Yes, you can start a sole proprietorship without registering it. However, a sole proprietorship is generally not recommended unless the business is low profit, low risk, and has a limited customer base.

Related Articles

Article Sources

IRS Business Structures Overview:

https://www.irs.gov/businesses/small-businesses-self-employed/business-structures

IRS LLC Overview:

https://www.irs.gov/businesses/small-businesses-self-employed/limited-liability-company-llc

SBA Licenses and Permits Guide:

https://www.sba.gov/business-guide/launch-your-business/apply-licenses-permits

SBA’s Business Structure Comparison:

https://www.sba.gov/business-guide/launch-your-business/choose-business-structure